If India aspires to break into the world’s top two economies, it must gamble on its future again, for capital put at risk is what turns ideas into innovation and nations into powers

- COVER STORY

- Editor's Note

If India aspires to break into the world’s top two economies, it must gamble on its future again, for capital put at risk is what turns ideas into innovation and nations into powers

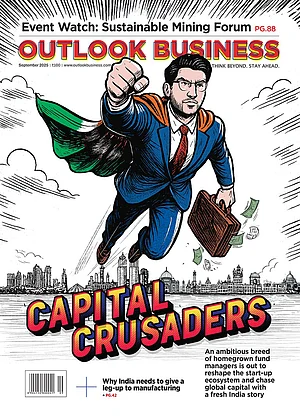

Weekend Read from OB ArchiveAs the foreign PEs/VCs that once fuelled India’s start-up boom are beating a quiet retreat, an ambitious breed of homegrown fund managers is out to reclaim the cap tables, chase global capital with a fresh India story and anchor the country’s economic ambitions

Even amid global uncertainties and market fluctuations, India’s private equity and venture capital landscape continued to demonstrate resilience in 2024

Sanjay Nayar, president of Assocham and founder of venture-capital (VC) firm Sorin Investments, tells Deepsekhar Choudhury and Tarunya Sanjay that while India has seen an explosion of early-stage VC firms, the country continues to lack a deep pool of domestic capital. Edited excerpts

Gopal Jain, managing director and chief executive of Gaja Capital, talks to Deepsekhar Choudhury and Tarunya Sanjay on the evolution of India’s private-equity landscape and what’s holding it back. Edited excerpts

Siblings Pranav and Siddarth Pai, who founded 3One4 Capital in 2015 to invest in early-stage start-ups, talk to Deepsekhar Choudhury about the rise of domestic venture funds and regulatory roadblocks that hinder their growth. Edited excerpts

India must re-energise its Make in India campaign to take on global trade headwinds. Otherwise, it will continue to suffer from bullying by superpowers

As EV disruption accelerates, Uno Minda’s next big challenge is maintaining its competitiveness in a global auto industry undergoing rapid technological change

AI’s rapid rise is wiping out start-ups that once seemed promising. Investors now demand business moats and metrics that can withstand AI disruption

In India’s fast-fashion economy, the price tag may read ₹299 but the real bill is paid in a mounting trail of textile waste no one wants to own

India lacks the intention to protect its green cover, relying on misleading definitions, excluding forest communities and exercising poor oversight of conservation funds

For decades, India Inc grew by leveraging cost arbitrage globally and scale domestically. But this formula has peaked

In an email interview, Union Heavy Industries and Steel Minister HD Kumaraswamy tells Rakshit Kumar about the government’s strategy to make India a leader in EV manufacturing. Edited excerpts

With over 1,700 GCCs employing nearly two million professionals across the country, these centres are now pivotal in enabling India’s leap into advanced technologies

Hemant Mohapatra, partner at Lightspeed India, tells Deepsekhar Choudhury and Tarunya Sanjay why India’s start-ups are seeing a surge in scientific ambition. Edited excerpts

A socialist mindset does not encourage brand building since it clashes with the government’s ability to decide what’s right for consumers

A marine-robotics start-up in Kochi is building underwater drones for inspection, rescue and defence missions in harsh environments

Research shows that when policy volatility deepens, only the social pillar of the ESG framework shields hospitality companies from lasting financial strain

Dr SK Lal in 1949 founded Central Clinical Laboratory and Blood Bank Transfusion Centre. Since then, Dr Lal PathLabs has traversed a long road. The future is fraught as new diseases crop up needing better diagnostics

As the extended income-tax filing deadline of September 15 approaches, last-minute filers are rushing to avoid penalties. While the basics of filing returns remain, filers should note a few changes

The US tariff hike and oil penalty could threaten India’s discounted Russian crude supplies, risking higher fuel costs and sector-wide inflation

The age of AI isn’t about replacement of jobs, it’s about the disruption taking place at the core of modern work, with implications we’re only beginning to understand

The Shawshank Redemption makes it to the top spot in his list of films

The Lok Sabha passes the Online Gaming Act and trade tensions between the US and India intensify

Gujarat revises its textile policy, India gets its 71st Vande Bharat Express and the Lok Sabha clears Manipur's Budget

If India aspires to break into the world’s top two economies, it must gamble on its future again, for capital put at risk is what turns ideas into innovation and nations into powers

As the foreign PEs/VCs that once fuelled India’s start-up boom are beating a quiet retreat, an ambitious breed of homegrown fund managers is out to reclaim the cap tables, chase global capital with a fresh India story and anchor the country’s economic ambitions

Even amid global uncertainties and market fluctuations, India’s private equity and venture capital landscape continued to demonstrate resilience in 2024

Sanjay Nayar, president of Assocham and founder of venture-capital (VC) firm Sorin Investments, tells Deepsekhar Choudhury and Tarunya Sanjay that while India has seen an explosion of early-stage VC firms, the country continues to lack a deep pool of domestic capital. Edited excerpts

Gopal Jain, managing director and chief executive of Gaja Capital, talks to Deepsekhar Choudhury and Tarunya Sanjay on the evolution of India’s private-equity landscape and what’s holding it back. Edited excerpts

Siblings Pranav and Siddarth Pai, who founded 3One4 Capital in 2015 to invest in early-stage start-ups, talk to Deepsekhar Choudhury about the rise of domestic venture funds and regulatory roadblocks that hinder their growth. Edited excerpts

India must re-energise its Make in India campaign to take on global trade headwinds. Otherwise, it will continue to suffer from bullying by superpowers

As EV disruption accelerates, Uno Minda’s next big challenge is maintaining its competitiveness in a global auto industry undergoing rapid technological change

AI’s rapid rise is wiping out start-ups that once seemed promising. Investors now demand business moats and metrics that can withstand AI disruption

In India’s fast-fashion economy, the price tag may read ₹299 but the real bill is paid in a mounting trail of textile waste no one wants to own

India lacks the intention to protect its green cover, relying on misleading definitions, excluding forest communities and exercising poor oversight of conservation funds

For decades, India Inc grew by leveraging cost arbitrage globally and scale domestically. But this formula has peaked

In an email interview, Union Heavy Industries and Steel Minister HD Kumaraswamy tells Rakshit Kumar about the government’s strategy to make India a leader in EV manufacturing. Edited excerpts

With over 1,700 GCCs employing nearly two million professionals across the country, these centres are now pivotal in enabling India’s leap into advanced technologies

Hemant Mohapatra, partner at Lightspeed India, tells Deepsekhar Choudhury and Tarunya Sanjay why India’s start-ups are seeing a surge in scientific ambition. Edited excerpts

A socialist mindset does not encourage brand building since it clashes with the government’s ability to decide what’s right for consumers

A marine-robotics start-up in Kochi is building underwater drones for inspection, rescue and defence missions in harsh environments

Research shows that when policy volatility deepens, only the social pillar of the ESG framework shields hospitality companies from lasting financial strain

Dr SK Lal in 1949 founded Central Clinical Laboratory and Blood Bank Transfusion Centre. Since then, Dr Lal PathLabs has traversed a long road. The future is fraught as new diseases crop up needing better diagnostics

As the extended income-tax filing deadline of September 15 approaches, last-minute filers are rushing to avoid penalties. While the basics of filing returns remain, filers should note a few changes

The US tariff hike and oil penalty could threaten India’s discounted Russian crude supplies, risking higher fuel costs and sector-wide inflation

The age of AI isn’t about replacement of jobs, it’s about the disruption taking place at the core of modern work, with implications we’re only beginning to understand

The Shawshank Redemption makes it to the top spot in his list of films

The Lok Sabha passes the Online Gaming Act and trade tensions between the US and India intensify

Gujarat revises its textile policy, India gets its 71st Vande Bharat Express and the Lok Sabha clears Manipur's Budget