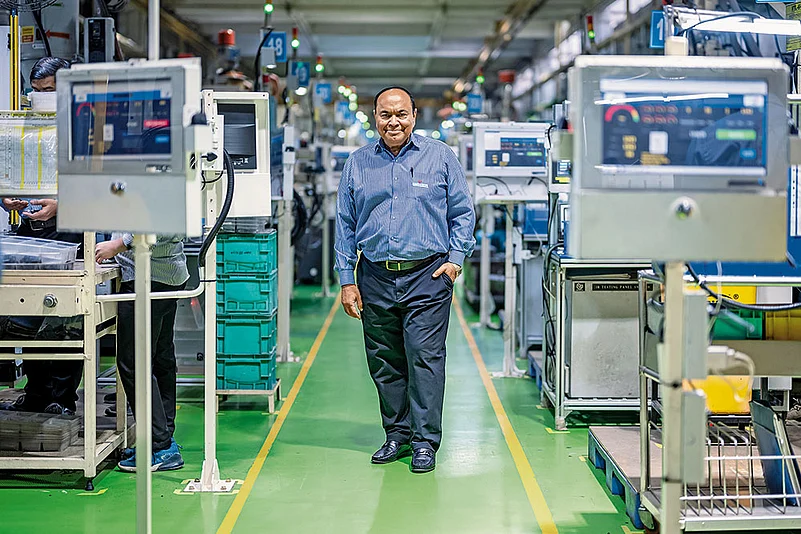

On the flat, dusty edge of Haryana’s Industrial Model Township in Kharkhoda, Uno Minda’s new factory floor hums as molten aluminium spins into shape, cooling to form passenger-vehicle wheels. The ₹542-crore alloy wheel plant, spread across 25 acre and capable of producing 1,20,000 wheels a month, will, when fully complete, be the company’s largest plant.

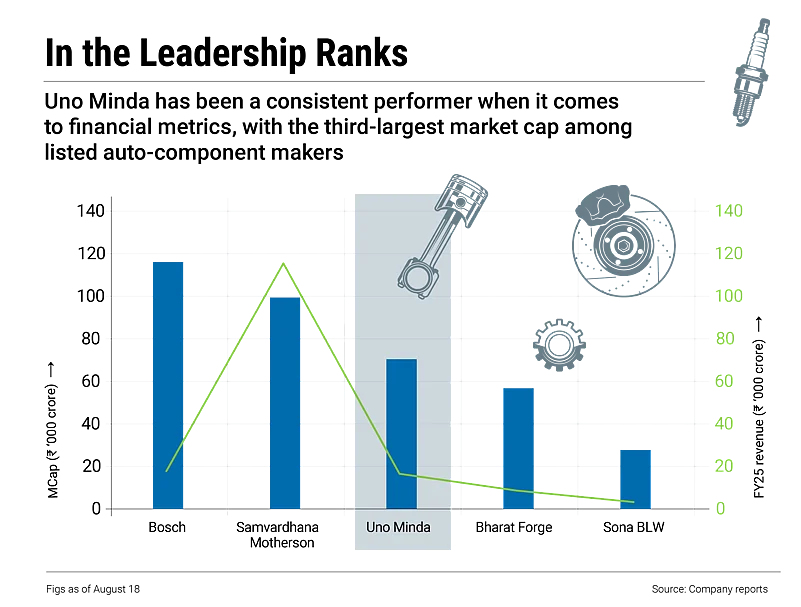

Outside, the steel frames are a far cry from the lanes of Chawri Bazar in Delhi where the company began its journey as a small auto parts trading firm over six decades ago. Since then, the business has shed its metal-and-mechanics image. Today, it runs on software, sensors and electrification and has grown to be one of India’s largest auto-component makers with 76 manufacturing facilities in six countries and a market cap of about ₹70,000 crore.

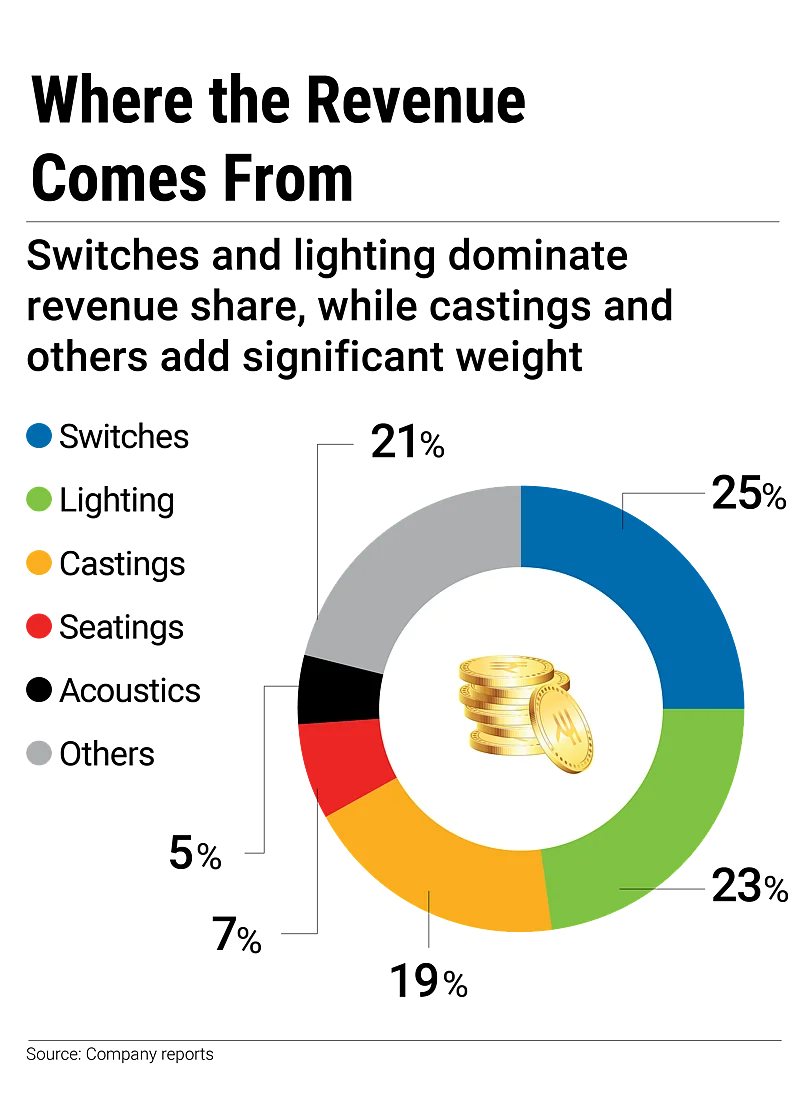

Its numbers are positive. The company reported a consolidated revenue of ₹16,775 crore and profit after tax (PAT) of ₹943 crore in 2024–25 versus a revenue of ₹6,374 crore and PAT of ₹119 crore in 2020–21, with strong performance across all product segments, led by lighting, switches, casting, seatings and other divisions (sensors, motors and controllers).

The target is to grow 1.5 times the pace of the overall industry. In the last 4–5 years, they have expanded at twice the industry rate.

Race Against Time

But the shift to electric vehicles (EVs) and new propulsion systems is rewiring the industry at a pace unmatched in the past decade. For suppliers, this involves navigating turns that demand betting on early-stage tech, high capital costs, retraining their workforce and building resilience against supply chains rattled by geopolitical power plays.

“Today, technology disruption is massive. We’ve moved from mechanical to electronic to software-driven vehicles. Ten years ago, things like electrification, personalisation and connected vehicles were just buzzwords. But now, they are real and just incremental improvements won’t be enough,” says Nirmal Minda, executive chairman at Uno Minda, who has helmed the company for nearly five decades.

“If you look at a car from five years ago, it looks outdated compared to today,” he says.

This is the company’s biggest challenge: staying ahead of change, instead of just reacting to it. EV technology is still in flux and much of this technology sits in China, adding geopolitical risk for Indian suppliers.

For a company whose portfolio is largely EV-agnostic, the transition can be an opportunity to extend its lead. In 2025, Uno Minda announced a ₹423 crore greenfield plant for high-voltage EV powertrain components, a ₹210 crore casting facility in Aurangabad and a ₹195 crore acquisition of the remaining stake in its joint venture, Uno Minda EV Systems, from Germany’s Friwo.

“When it comes to EV-specific components like the DC [direct current]/DC converter, motor and battery pack, Uno Minda has made significant progress. Uno Minda, in line with the industry trend, initially focused on two-wheelers, especially scooters, where EV penetration has been good,” says Sunny Agrawal, head, fundamental research at SBI Securities, SBI’s retail-brokerage arm.

Minda himself sees the shift to new fuel technologies as an opportunity. “Many of our sensors and controllers are now being developed with EV-specific requirements in mind, covering aspects such as energy efficiency, thermal management and compatibility with high-voltage systems,” he says.

Saji John, research analyst at Geojit Investments, an investment-services firm, adds that Uno Minda has emphasised introducing newer products in the export market, aiming for international business to account for 20%, driven by innovation in e-axles, advanced driver assistance systems and charging technologies.

The company acknowledges that deeper technological strength will be critical. It spends about 4% of revenues on R&D. By comparison, auto component majors Bosch invests 3% and Sona Comstar 3.2% of revenues in R&D, according to their 2024–25 annual reports.

Minda underlines the urgency. “If we don’t keep up, we won’t survive. To emulate China’s progress, we have to move towards self-reliance.” A decade ago, the company had just 50–60 engineers. Today, that figure has risen to 1,200, but “I believe we should double or even triple this headcount, aiming for 2,500 to 3,000 engineers in the future,” says Minda.

Lessons From the Past

Technology was once the company’s weak spot. In the 1980s, when Maruti entered the market, Uno Minda lagged behind. That realisation triggered a pivot. The group began investing in technical capability and in 1995, Minda trained in Japan for three months before striking a joint venture with Tokai Rika, which develops automotive-control systems and components.

This gave Uno Minda the ability to meet global OEM standards and marked the shift from a family-run mindset to professional R&D. Since then, the company has built joint ventures with global partners and steadily expanded its product portfolio.

These partnerships have been instrumental in raising kit value. In auto jargon, this is the total worth of components a supplier provides for each car or two-wheeler. The higher the value, the deeper a supplier is embedded with an OEM.

As technology cycles get shorter, Uno Minda is accelerating its pace of adoption. Between financial year 2022 and financial year 2024, it signed five technology licensing agreements and formed three JVs

Over the past four years, Uno Minda has expanded this share. Its kit value has jumped by 41–92% in two-wheelers between 2020–21 and 2024–25, and by 43–154% in four-wheelers in the same period. A recent report by the brokerage ICICI Securities points out that this “EV-agnostic portfolio, proven execution on JVs and rising order book visibility” puts Uno Minda in a strong position to benefit from India’s push towards electrification.

The company is also betting on emerging technologies, states its 2024–25 report. “Our R&D has grown so strong that even our foreign partners co-develop software with us for markets like India and Japan. Now, OEMs conduct PoCs [proof of concept] with us before finalising vehicle designs. This opens doors for joint PoCs and patents,” says Minda.

And as technology cycles get shorter, Uno Minda is accelerating its pace of adoption. Between 2021–22 and 2023–24, it signed five technology licensing agreements (TLAs) and formed three JVs. Compare this with the preceding three years when it had one TLA, one JV and two acquisitions.

Minda underlines the urgency. “Unless India spends more on R&D, we’ll lag. So yes, we must change and we are changing together with our customers. Our R&D spending is rising. We bring in technology, but also develop our own.”

But rapid expansion comes at a cost: the company’s growth strategy is highly capital-intensive. While capex was around ₹1,650 crore in 2024–25, the company has lined up ₹1,300 crore for 2025–26, with roughly ₹500 crore earmarked for sustaining capex—funds to maintain existing plants—and ₹800 crore for growth-oriented projects.

Much of this outlay is backed by customer orders, which should help ramp up capacity quickly, but the heavier financing burden and depreciation are expected to keep margins under pressure and weaken credit-related metrics.

Credit-rating agency Icra notes the company also faces the risk of acceleration in its debt repayments if there is a breach of financial or rating-linked covenants, though its track record of financial discipline provides comfort.

Additionally, the company derives a large share of its revenue from the domestic automotive market, making its earnings vulnerable to industry cyclicality.

“While operational growth is visible, it hasn’t translated into earnings growth and margins are expected to remain rangebound,” says Agrawal. To break out of this cycle, the company will need fresh product bets or large acquisitions, but in the near term, its growth is likely to stay within range given its high costs, capacity limits and tight margins.

Risky Business

But it’s not just the balance sheet under strain. Who Uno Minda partners with and where those technologies come from could be just as critical to sustaining growth. Of its three partnerships for manufacturing EV-related components, two are with China-based EV companies Inovance and StarCharge.

This dependency on China stems from the country’s edge in EV technology. Geojit Investment’s John warns that any move by China, such as restricting rare earth magnets, could disrupt OEM production schedules in India.

The trend is not exclusive to Uno Minda. Sona Comstar has announced a joint venture with China-based Jinnaite Machinery to tap into China’s growing EV ecosystem. The country accounts for two-thirds of the world’s EV sales. For many Indian auto-component makers, breaking into EV tech without Chinese know-how would mean years of development work, investment and lost time.

“Initially, China also took technology from outside. Later they developed it in-house. We will also get to that state. We need to localise everything. The mindset of continuous import will not work,” says Minda.

That localisation effort is already taking shape. For instance, Uno Minda first developed its EV charging gun locally and later upgraded it from 3.5kW to 7.27kW using StarCharge’s technical know-how.

It isn’t only adversaries like China that pose risks. Friction is also growing with the US. In 2024–25, Uno Minda won an order to supply advanced lighting systems for a US technology company. But newly announced tariffs by President Donald Trump threaten to derail those plans in a market where the company has a modest foothold.

Beyond trade headwinds, the bigger test for Uno Minda will be reshaping its business model to keep pace with industry shifts. The road ahead is less about incremental change and more about transformation.

“Challenges will always be there”, says Minda, “but so will opportunities. That’s the role of entrepreneurs to overcome them. Yes, there are challenges, but other countries like China and Japan also faced and overcame them. We will too.”