InStoried once looked like a sure bet. Founded in 2019, the content-marketing start-up raised $20.7mn over 14 funding rounds and was backed by early-stage venture-capital funds such as 9Unicorns and Venture Catalysts. Its promise was blending emotional intelligence with AI-driven content recommendations.

Then came OpenAI.

By late 2023, nearly a year after ChatGPT’s public debut, InStoried cofounder Shamin Ali had to admit the uncomfortable truth. “AI has leapfrogged more in one year than it had in the previous decade.”

What had been a niche platform was suddenly competing with a free and widely accessible tool. InStoried tried innovating, layering emotional analysis and other features on top of their AI, but the gap only widened.

When Abhi (name changed), a veteran teacher on a major ed-tech platform, launched his own start-up offering small-batch classes and competitive exam prep, it began with a bang. Students were eager to join, parents trusted him and his YouTube channel hit 14,000 subscribers in no time.

But engagement plateaued after AI chatbots entered the picture. Suddenly, investors weren’t interested in talking about funding anymore. The foundation of his model, human-delivered long-form lessons, was “obsolete”, they said.

As AI lowers the incremental cost of content production to nearly zero and seemingly erases barriers to entry, start-ups in sectors where content is the backbone are the first to take the hit. Investors aren’t looking to back companies or double down on existing portfolio start-ups in areas like edtech, storytelling platforms or marketing.

“You don’t even need physical studios or expensive set-ups anymore. It’s becoming cheaper and more accessible, which means anyone can create content at scale,” says Anirudh Damani, founder, Artha Ventures, a micro-venture-capital (VC) fund.

But this reluctance is not limited to a few sectors anymore. It’s a pattern playing out across the start-up landscape from e-commerce to fintech.

In 2023, the year after ChatGPT’s debut, 15,921 tech start-ups shut down in India, up from 2,101 the year before. The number was 12,717 last year.

Legacies Under Siege

Every big tech shift creates two types of companies, explains Asish Kumar, partner at Fundamentum, a growth-stage VC fund. “Those who take advantage of that trend and grow and those who may not ride the wave, but are resilient enough not to get disrupted by it.”

With AI, the change is faster than ever. What once took years now happens in months as AI-native start-ups hit $10mn in annual recurring revenue (ARR) within 12–18 months.

Late last year, Perplexity, the AI search start-up positioning itself as an alternative to Google, expanded into online retail.

Unlike Amazon, Perplexity says it does not rank products through sponsored listings. Instead, its system generates AI-curated product cards with pros, cons and live pricing. In July, Microsoft-backed OpenAI launched an AI agent that could help users buy groceries or clothes without going to an e-commerce platform.

While these features haven’t been launched in India yet, investors say that such agents highlight a broader shift: if users start searching, comparing and buying entirely inside AI platforms, traditional e-commerce platforms risk losing their grasp on discovery.

“The whole discovery experience may move from keywords to something outcome-driven and that could change everything,” says Abhishek Srivastava, general partner at Kae Capital, an early-stage VC fund.

Disruption is sweeping through fintech as well. Wealth management offers an example as distribution-led or traditional advisory models without robust data and workflow systems fall out of favour.

“In contrast, tech-first wealth platforms that use AI to personalise portfolios, handle taxes smartly, ensure compliance, and help advisors manage and retain more clients can be very successful if they demonstrate real improvements in client retention, customer value, advice quality, and adviser efficiency,” says Udayan Pandey, assistant vice-president at Blume Ventures, an early-stage venture fund.

As AI lowered the incremental cost of production and erased barriers to entry, start-ups in sectors where content is the backbone took the hit

The Biggest Victim

Take for instance software-as-a-service (SaaS), which is being upended as AI automates core processes once done manually. In the past, one had to manually enter names, emails, addresses and order information into different on‑screen forms.

Now, this is changing. AI can capture and process information automatically, making many pre-AI workflow systems feel clunky and outdated. Unlike static SaaS dashboards that require human interpretation, AI can analyse patterns and recommend specific actions, such as identifying customers at risk of churn and suggest outreach strategies.

Sateesh Andra, partner at Endiya, an early-stage VC fund, warns that AI is transforming robotic process automation, call-centre operations and customer-support analytics with faster, cheaper and more intuitive solutions. "This disruption is reshaping the industry, pushing traditional vendors to adapt or face obsolescence," he adds.

For investors in India, it’s getting tougher to back the older style of software companies. Many of these tools were built to make office routines smoother and not offer something new. They focused on task management or system integrations. Today, AI can handle much of this.

The market already reflects this shift. SaaS majors Airtable, Gusto and HashiCorp have lost more than half their market capitalisation since 2021, showing that even strong players aren’t immune as investors gravitate toward AI-first businesses.

Even start-ups like Qoruz, a creator intelligence and collaboration platform that recently raised $1mn in pre-Series A funding, is feeling the heat. During its fundraise, investors questioned how the company would remain relevant in a world where AI influencers could potentially replace human creators.

“And if they don’t understand how fundamentally different our tech stack is from a typical content tool, they’ll default to thinking it’s not defensible. They’d rather wait six months or a year than take that bet now,” says Praanesh Bhuvaneswar, co-founder and chief executive, Qoruz.

Microsoft chief executive Satya Nadella has called AI “the new platform for software innovation”, warning that “companies that succeed will be those that embed AI into their products and reimagine their business models. Legacy SaaS companies need to accelerate or risk losing market relevance and investment.”

Investors are clear: traditional SaaS companies without a strong AI story will struggle to raise funding. The rare exceptions are in industries slow to embrace AI, such as oil and gas or traditional manufacturing, where older SaaS models may still be relevant.

Beyond the AI Label

With the AI boom accelerating, investors are spotting a rise in “AI whitewashing”, that is, start-ups that use the term in pitches just to get in the door. But flashy demos and slick interfaces are no longer enough. Product evaluation now goes beyond financials, with investors meeting chief technology officers and AI engineers to examine how deeply AI is built into a start-up’s core.

Founders face tougher questions: How are you enriching your models beyond what ChatGPT or other large models already offer? To stand out, start-ups must develop specialised AI tools trained for specific tasks.

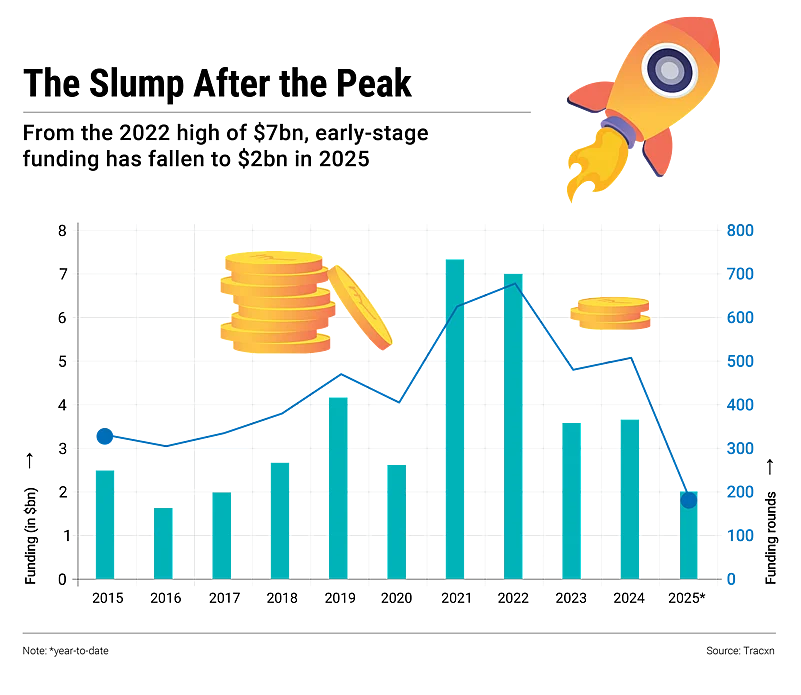

The funding climate reflects this caution. Numbers from data platform Tracxn show Series A and B funding plunging from $7.3bn in 2021 to $3.6bn in 2023, while the average time to raise these rounds stretched from 27 to 37 months.

Another key metric is revenue per employee (RPE), a measure of operational efficiency to gauge if start-ups can do more with less or are merely riding the AI hype. For instance, Apple has had the highest RPE among Silicon Valley giants over the years. But its RPE has stagnated around $2.4mn since 2021, whereas the metric has grown more for its peers like Meta and Alphabet. This demonstrates how well the tech giants are faring in the AI race, compared to each other, according to industry insiders.

Similarly, a start-up with a low RPE, say $200k per employee and generating $2mn ARR with 10 employees looks lean; with 80 employees, it looks bloated. “If they have domain knowledge, real customer insight and the ability to embed evolving AI into defensible workflows, that’s who we bet on,” says Pranav Pai of 3one4 Capital, a VC fund.

Even then, certainty is elusive. “You can be right early and still be proven wrong in nine to 12 months. That’s the cadence now. That’s the new normal,” Pai adds.

In a podcast, OpenAI chief executive Sam Altman pointed out that there were two ways to build in the AI era: the first assumes that technology won’t radically improve, the second bets that giants like OpenAI will keep advancing rapidly.

“It seems to me that 95% of the world should be in the latter, but many start-ups are in the former. And then when we just do our job, make the model better, you get the ‘OpenAI killed my start-up’ meme,” he said.

As AI moves at a breathless pace, there will be casualties and there will be champions. Yet in the uncertainty, investors, founders and the wider ecosystem share one conviction: if they don’t move fast enough to usher in the new, a rival will.