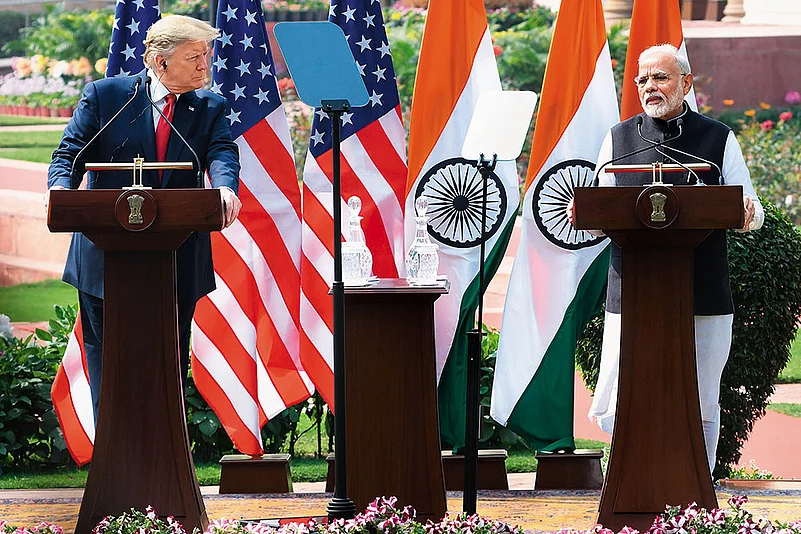

The Narendra Modi-Donald Trump bromance has hit the pause button. The year, however, started off well with Modi's visit to the US in February bolstering ties in a number of critical areas. Ties between the two countries were bolstered following Vice-President JD Vance’s India visit in April.

However, from the middle of the year bilateral ties have been spiralling down. India is one of the few countries to have been battered by Trump’s tariff blitzkrieg.

Unhappy over India's decision to maintain its energy ties with Russia, Trump imposed a 25% additional 'penalty' on August 6, bringing tariffs on some Indian exports to the US to 50%. A planned August visit by US trade negotiators was abruptly called off, delaying talks on a much-anticipated bilateral trade agreement (BTA) further.

The question for India is how to turn this fraught situation into an opportunity—to reform and reinforce its economy so that it can deal with global superpowers from a position of strength.

Home Truths

For India to face up to Trump’s (or any other country’s) bullying it must confront some economic realities at home. Despite recent record growth, India's manufacturing goal of raising manufacturing to 25% of GDP by 2025 missed the deadline. The share of manufacturing value added in India’s GDP has fallen to under 14% after a decade of launching the Make in India campaign.

As a result, India runs trade deficits for the very industrial supplies it aspires to produce. India's trade deficit with China reached an all-time high of $99.2bn in 2024–25, which experts flag as alarming.

This underperformance in manufacturing comes at a cost. “There are relatively few bargaining chips that India has against the US. But none of these lends itself to Donald Trump style threats and bullying,” says Ajay Shah, senior research fellow and co-founder of research organisation XKDR Forum and a former consultant with the Department of Economic Affairs, Ministry of Finance.

The Make in India initiative marked the government's first strategy towards building India as a global manufacturing hub. It aimed at more than 25 sectors, offering incentives such as tax concessions and simplified land acquisition to both domestic and foreign investors.

Over the past 10 years, numerous reforms, incentives and campaigns have been implemented to boost the industry. But structural bottlenecks and uneven sectoral performance kept manufacturing from becoming the growth engine it was intended to be.

Manufacturing’s share of GDP remained stuck at around 16%. Job creation in the sector also lagged, with only about 11.4% of the workforce employed in manufacturing by 2023–24.

The government adopted the production-linked incentive (PLI) policy in 2021–22. The aim was to scale up industries to a level where they could compete globally. Over the four years to March 2025, PLI schemes across 14 sectors to boost manufacturing have attracted investments to the tune of ₹1.61 lakh crore, accounting for just over half of the ₹3 lakh crore pledged over five years.

However, only ₹21,534 crore, or just 11% of the ₹1.95 lakh crore earmarked as incentives tied to investment, has been disbursed under PLI schemes for 12 sectors by March 2025.

Moreover, PLI schemes also did not translate as expected. For example, electronics was a flagship focus of the Make in India programme but much of this growth came from final assembly of products like mobile phones, with limited local value addition in components or design. India remains a net importer of electronics, accounting to $102.6bn compared to its $40.9bn export in 2024-25.

Likewise, under the PLI scheme for automobiles and auto components, only one-fifth of the participating companies have been qualified for incentive payouts under the ₹25,938-crore programme even after two years of launch. According to a Business Standard report, just 16 out of 84 approved firms managed to meet the scheme’s strict domestic value addition criteria as of July 31, 2025.

Enter the Dragon

In Trump's tariff wars, China has emerged as one of the few countries which has forced the US to stop, rethink and reconsider its tariff blitz. China’s nearly five-decade push to dominate rare earth elements (REEs) and finished magnets have emerged as its most potent weapon in the global trade war. By curbing supplies of seven critical REEs, Beijing has thrown global defence and high-tech manufacturers into disarray.

Beijing is a bigger supplier and manufacturing force than the US. In fact today, China is the manufacturing powerhouse, contributing nearly one-third of global manufacturing output. “All advanced economies in the world are dependent on Chinese imports, across value chains. They have greater countervailing power on the US than the US has on them,” says former Union commerce secretary Anup Wadhawan.

China surpassed the US in manufacturing in 2008 and since then it has more than doubled its world share. To understand China's dominance better, its production capacity now exceeds that of the next nine largest manufacturers combined.

The Road Ahead

So, should India borrow a copy of the China playbook?

"The Chinese way will not work for India because we do not have a critical supply chain. What we need to do is to be smarter on the geo-strategic negotiations. Trade is just collateral damage," says Arpita Mukherjee, professor, Indian Council for Research on International Economic Relations (ICRIER).

India-US trade talks entered turbulence when Washington, DC wanted greater market access for its farm products. India resisted the move, citing “sensitivity of the sector”. India has been protective about its dairy and farm sector for long even though it has caused higher food inflation. Modi also used his Independence Day address to affirm he “stands as a wall” against policies hurting farmers and small producers.

Mukherjee believes that this was not the right approach while negotiating a trade deal. “At one stage, even the US announced they were close to signing [a deal with India]. Issues like dairy involved only two or three products out of 30. It is a wrong approach to treat the whole sector as untouchable,” she says.

Agriculture and its allied areas, such as dairy, contribute only 16% to India's $3.9trn economy, but sustain nearly half of the country's 1.4bn population. Hence, this sector holds immense political significance.

In such case, strategists believe two options lie ahead. One is de-prioritising from the US and another one is to leverage this opportunity in a smarter way. Explaining India's potential to tapping new markets, Shah of XKDR Forum says that the world economy can be roughly broken up into four groups with prosperous democracies at about 32% of world GDP; the US at about 27%; followed by Russia, China, Iran, North Korea and Hong Kong at about 20%; and others including India at about 22%.

"The right strategy for India is to focus on the 32%," he says.

Boosting Domestic Demand

A commerce ministry official says that while India is expanding its focus from 20 countries of significance to top 50 importing countries which accounts over 90% of India’s export share. Meanwhile, the free trade pact with the European Free Trade Association, which includes Iceland, Liechtenstein, Norway and Switzerland, is set to take effect from October 1, with an expectation to give cushion to some of the Indian exporters.

However, Mukherjee of ICRIER points out a challenge with diversification, saying that the goods India exports to the US may not find equal acceptance in other markets.

It is not that India does not understand the current global trend. While the world is leaning towards protectionist measure, the Economic Survey highlighted that India’s strongest strategy is to reinforce domestic growth by generating around 8mn jobs each year, raising manufacturing’s contribution to GDP, embedding Indian firms more deeply into global value chains and strengthening the MSME sector.

“Trade policy is linked to economic welfare of a country. The key concerns for India are supply chain resilience and domestic value addition,” says Sabyasachi Saha, an associate professor at the Research and Information System for Developing Countries.

Wadhawan also emphasises improving the investment environment and business climate, which will give India manufacturing strength and countervailing power. "We should look inwards and put our domestic house in order for businesses to function competitively," he says.

Echoing the same sentiment to boost domestic demand through reforms, Ajay Srivastava, founder, Global Trade Research Initiative, says, “India must focus on reducing manufacturing costs through fundamental reforms, starting with lowering input costs. High import duties on materials like steel and textile intermediates need review to make the industrial value chain globally competitive.”

Other reforms could include providing capital subsidies, as well as addressing core issues such as ensuring reliable and uninterrupted power supply, he says.