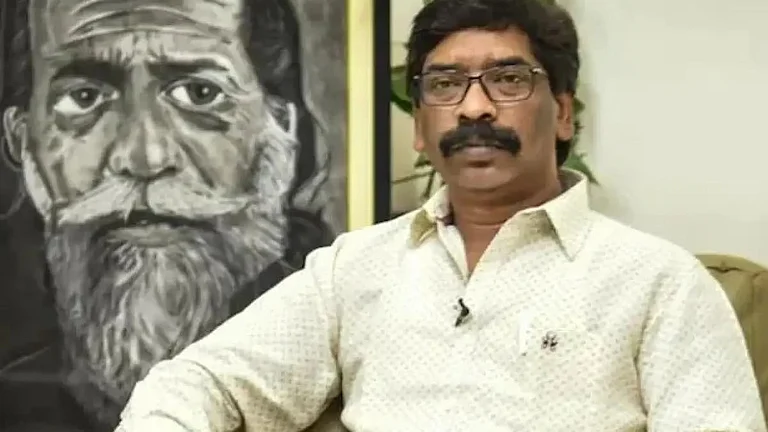

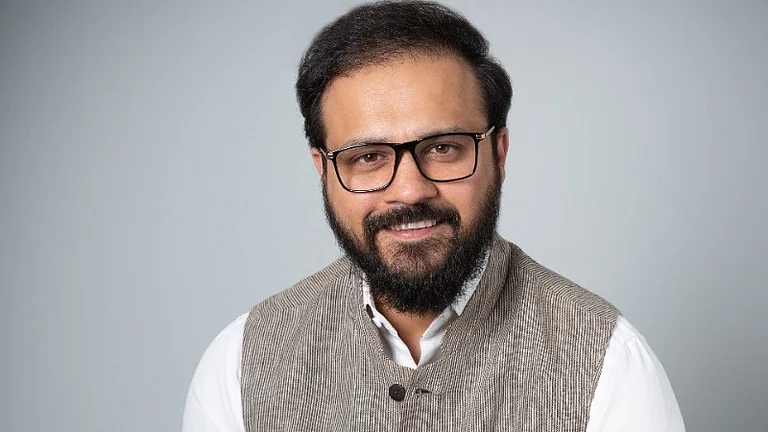

KPMG India’s Head of Consulting, Hemant Jhajhria, expects consulting and IT firms to see steady, long-term growth from AI.

He said the AI boom resembles an “arms race,” with heavy investments flowing into infrastructure, data, and related areas.

Jhajhria added that the transformation will unfold gradually, marking “a period of steady, high growth over a longer duration.”

KPMG in India’s Head of Consulting, Hemant Jhajhria, believes consulting and IT firms will experience steady, high growth over a longer period, rather than the sharp revenue and profit surges currently being reported by AI chipmakers and hyperscaler giants.

“There were a lot of expectations for the future, with multiple companies racing to jump into AI. It’s almost like an arms race. So, you’ll see heavy investments, especially in infrastructure, data, and related areas. Over the next two to three years, consulting and IT firms will certainly be part of that. But it’s not going to be an overnight boom,” said Jhajhria in an exclusive interview with Outlook Business.

He added that it’s more likely to be “a period of steady, high growth over a longer duration.”

“You have to realise that much of the work involves adoption, change management, and deriving real value from AI, and that’s a slower process than just building infrastructure. You can build a highway in a year, but teaching people how to drive on it takes longer. It’s the same with AI; we’re still learning how to drive on those highways,” he further explained.

In recent quarters, several IT firms have started disclosing what portion of their revenue comes from generative and advanced AI projects. Dublin-based Accenture — the first global firm to separately report its AI earnings — recorded about $900 million in generative AI bookings in the reported quarter. Analysts later noted that “the majority of Accenture’s generative AI bookings are in consulting.”

TCS also secured $100 million in AI deals, with clients increasingly demanding “AI-infused productivity” in large contracts. HCLTech reported $100 million in “advanced AI” revenue in Q2 FY26, accounting for nearly 3% of its overall revenue. Happiest Minds Technologies said its generative AI business generated about $4 million in the first half of the year and projected that to double by year-end, from a base of 1.6% of revenue in FY25.

However, KPMG India’s Head of Consulting says it would be difficult to quantify how much AI-driven productivity has been integrated into the consulting business.

“That’s only 20% of the problem,” he said, explaining that the remaining 80% lies in people, processes, and adoption.

“It’s not like you build a cool model and everyone immediately jumps on it. No technology works that way. You might build a great model with strong ROI potential, but it still has to go through a process of integration within firms and businesses,” Jhajhria added.

He further noted that the ROI from those business cases will take time, as “middle managers” who actually run organisations take longer to adapt.

“This isn’t the first time we’re going through such a technological shift, electricity did it 100 years ago, the internet 30 years ago, and IT, digitalisation, and cloud computing in the early 2010s,” he said.

Trade Uncertainty Adding to Challenges

For many businesses, this technological transformation has arrived at a pivotal moment. In the US, companies are also dealing with uncertainty caused by tariffs and other trade disruptions under the new Trump administration , a concern Jhajhria acknowledges.

“AI transformation is probably easier because there’s now a clear understanding of where it’s headed , how to leverage and extract value from agentic AI and, eventually, autonomous agents. The roadmap is visible. What creates challenges, however, is unpredictability, deciding whether to invest in one sector over another when tariffs, supply chains, and global conditions remain uncertain,” he said.

He added that we are living through an unprecedented period. “The world has seen multiple crises this year, but it will come through them. There’s volatility from an investment perspective, but when it comes to AI, there’s actually a lot of clarity. In fact, if you look at the numbers, investments in AI are significant,” he added.

Much of this investment, Jhajhria noted, is going into training AI, building models, data centres, and infrastructure, rather than deploying AI in enterprise systems. The full impact of enterprise-level adoption isn’t visible yet, but it will be.