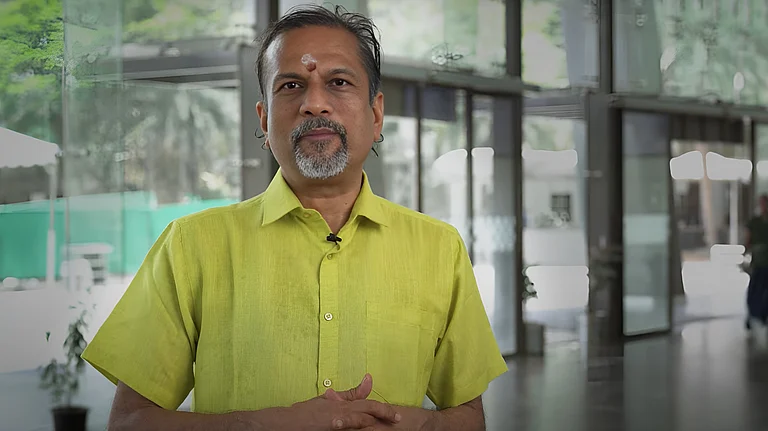

India’s IT industry is long considered a global powerhouse for software services and outsourcing. But now, it is facing headwinds that go beyond the usual suspects of geopolitical tensions or artificial intelligence (AI). While the recent slowdown in earnings has been attributed to disruptive forces like generative AI and Trump tariffs, Zoho founder Sridhar Vembu blames “inefficiencies” in products and services of the software industry.

In a post on X (formerly Twitter), Vembu shared his “operating thesis” in which he clarified that the cyclical downturn in "not just AI related”. “Even without the uncertainty induced by tariffs, there was trouble ahead. The broader software industry has been quite inefficient, both in products and services," his post read.

“These inefficiencies have accumulated over decades of a prolonged asset bubble. Sadly, we adapted to a lot of those inefficiencies in India. Our jobs came to depend on them. The IT industry sucked in talent that may have gone into manufacturing or infrastructure,” the billionaire added.

"We are only in the early stages of a long reckoning," Vembu said. He also warned that the country is at an “inflection point”, asking the IT sector for a fresh thinking and challenge their assumptions.

IT industry leaders have been grappling with the impact of tariff uncertainties, which have led to delays in new orders and project ramp-ups. One of the major consequences has been a hiring freeze in a sector that has traditionally served as a key entry point for lakhs of young graduates eager to join the workforce each year.

Indian IT Majors’ Weak Q4

In India, top IT service providers, including Wipro, Infosys and Tata Consultancy Services (TCS), have reported their fourth-quarter results for FY25 in the last two weeks. Their results revealed mounting challenges for the country’s IT sector amid tariff heat. The companies are now preparing for a potentially challenging FY26 as clients postpone decisions and put transformation projects on hold.

Wipro reported the most concerning outlook as the IT major projected Q1FY26 revenue guidance of -3.5% to 1.5% quarter-on-quarter in constant currency terms. Notably, this is the weakest ever revenue growth projection outside of Covid-19 pandemic and global financial crisis period. And TCS --- India’s largest IT services firm --- saw a 1.7% (YoY) drop in Q4 net profits to Rs 12,224 crore.

On the other hand, Infosys also witnessed an 11.7% drop in its consolidated net profit for the March quarter. However, its revenue increased by 7.9% year-on-year to Rs 40,925 crore. The company also experienced nearly 4.2% of revenue growth, which has fallen short of its previous guidance of 4.5-5%. The company has issued a cautious growth forecast of 0–3% for FY26, taking into account the possibility of further deterioration in the business environment.