Indian and global IT companies stepped up mergers and acquisitions in 2025 to pursue inorganic expansion.

Analysts say these acquisitions are critical for survival in an AI-first market, as the sector grapples with two years of revenue deceleration.

Indian IT firms recorded a 33% rise in M&A activity in 2025, completing 29 deals worth about $743 million by December 23.

In the face of continued slow growth, Indian and global IT companies flocked to the market in 2025 to look for inorganic expansion opportunities. From Tata Consultancy Services, Infosys and HCLTech to global players like Accenture, Capgemini and others, companies made a series of mergers and acquisitions in 2025.

Some of these deals, analysts say, will be critical for their survival in an “AI-first market,” especially after the last two years of revenue deceleration the IT sector has seen. The issue has been compounded by the deflationary effects of artificial intelligence (AI) on the sector, as well as geopolitical turmoil and tariff pressure hitting their largest market, the United States.

According to Biswajeet Mahapatra, Principal Analyst, Forrester, Indian IT firms saw a 33% rise in M&A activity in 2025, with 29 deals totalling about $743 million as of December 23, 2025. The deals were driven by the need to build AI capabilities for 2026.

“Major players including TCS, Infosys, Wipro, HCLTech, and Tech Mahindra focused on acquiring AI, cloud, and automation expertise to strengthen their portfolios. These moves are expected to define leadership in the AI services race and help the sector emerge from its recent slow growth phase by unlocking new revenue streams and accelerating innovation,” Mahapatra said.

The surge in deal activity was especially visible in the past couple of weeks as India’s third-largest IT services firm HCLTech announced three back-to-back acquisitions in the second half of December, including the buyout of the Telco Solutions business of Hewlett Packard Enterprise (HPE) for $160 million.

It was followed by Coforge’s $2.35 billion takeover of US-based Encora, making it the largest takeover by an Indian IT company in the engineering research and development (ER&D) segment.

M&A has always been part of the playbook for large IT services firms, but what we are seeing now is a clear uptick in urgency, according to Phil Fersht, Founder of global analyst and advisory firm HFS Research.

“The difference is that acquisitions are no longer just about adding scale. They are being used to plug very specific capability gaps in AI, cloud, cybersecurity, and digital engineering. The pressure to stay relevant in an AI-first market is accelerating deal-making,” he told Outlook Business in September this year.

Key IT Deals of 2025

Similar to 2024, Dublin-based IT and consultancy giant Accenture led the sector in M&A deals with six acquisitions in just the last quarter. The company plans to spend $374 million on M&A during the year, which would contribute 150 basis points (bps) to FY26 revenue growth. Its takeover spree started with IQT Group (an Italian engineering firm specialising in infrastructure) in February. It was followed by Halfspace, Ascendient Learning, Maryville Consulting Group, NeuraFlash, Orlade Group and RANGR Data.

According to an analysis by Saurabh Gupta, President, HFS Research, these deals were aimed at enhancing engineering delivery capacity, applied AI talent, reskilling for AI execution, and platform-native, agentic AI capabilities in ecosystem-led stacks.

Accenture’s rival Capgemini followed suit with a $3.3 billion takeover of agentic AI-led BPO operator WNS. The French firm, while announcing the closure of the deal in October, claimed that the merger creates a global leader in Intelligent Operations to capture clients’ investment in agentic AI to transform their end-to-end business processes, a large part of the IT services business.

India’s ailing IT giant TCS also came out all guns blazing in the M&A market after five years with two key deals in the later part of the year. It first bought Salesforce consultancy ListEngage to expand its Salesforce and AI-led digital transformation practice and then acquired Salesforce consulting partner Coastal Cloud to deepen Salesforce advisory capabilities. These were the Tata Group company’s first acquisitions after the Postbank Systems AG (German IT service provider) deal from Deutsche Bank in late 2020.

This came at a time when TCS has been going through a major restructuring amid slowing growth. The company, in late July, announced plans to lay off about 12,000 employees, around 2% of its global workforce.

Its Bengaluru-based rival Infosys made two key strategic acquisitions in 2025 to strengthen its AI execution capabilities. In August, it acquired a 75% stake in Versent for about $153 million, underscoring the importance of regional cloud density and delivery scale in establishing credibility for large-scale AI execution. Earlier in April, Infosys acquired MRE Consulting, signalling a focus on profitability through deep domain expertise that enables more differentiated, outcome-oriented AI transformations.

Nasdaq-listed Cognizant bought 3Cloud in November in a push towards power and execution, highlighting that hyperscaler-aligned data and AI delivery capabilities have become a must-have for services firms competing in AI-led transformation programmes. Meanwhile, Wipro completed the acquisition of HARMAN DTS in December for around $375 million, reinforcing the view that engineering depth and product development scale remain critical as AI moves closer to embedded products and real-world applications.

These deals are just some of the key announcements that made headlines this year. However, EY data from its Tech Services: Deal Insight Series for Q3 FY25 show that globally, in the September quarter alone, there were 225 mergers and acquisitions in the technology sector, with deal value climbing to $8.2 billion. It shows that till the September quarter, the sector has seen more deals in absolute numbers compared to last year. In the first three quarters, the larger technology sector saw 681 deals, compared to 659 deals in corresponding periods in 2024.

“IT services providers reported robust order book growth for the quarter, upwards of 20%, driven by large contracts and disciplined dealmaking from clients. Incumbents continued to strengthen their AI narratives, highlighting AI-led strategies and revenue streams as the industry embraces the AI and GenAI evolution amid questions on ‘AI promise vs. reality,’” the report noted.

Adding that there is a resurgence of large deals worth over $250 million, with more than 10 transactions led by both strategic buyers and private equity firms, reflecting strong demand for data, AI and cloud capabilities.

Why Go for Inorganic Growth

According to Piyush Jha, Group Vice President & Managing Director, APAC, GlobalLogic, enterprises were no longer pursuing scale for efficiency alone; they were investing in deep engineering capabilities, domain IP and AI-first platforms that deliver differentiated products and measurable business outcomes.

“2025 surely marked a shift in the IT industry from cost arbitrage to product and value arbitrage,” he added. Japanese industrial conglomerate Hitachi-owned GlobalLogic, in September 2025, announced the acquisition of German data and AI services firm Synvert in a move aimed at accelerating the development and deployment of agentic AI and physical AI across its global business.

“We firmly believe that M&A and alliances succeed only when they translate into tangible engineering outcomes, shorter time-to-market, higher automation across the SDLC, and scalable, domain-specific AI solutions,” Jha told Outlook Business.

The sentiment towards this inorganic growth seems to be stronger among sector leaders. According to KPMG’s 2025 Technology and Telecommunications CEO Outlook, M&A remains firmly on the table for CEOs “not just to acquire customers, but increasingly, to access AI talent and infrastructure.”

A CEO survey shows that 43% display a “high” appetite for “transformative” M&A, along with 40% of them hoping for a “robust” rise (2.5–5%) in earnings growth in 2026, compared to just 29% of CEOs who shared that view in 2024.

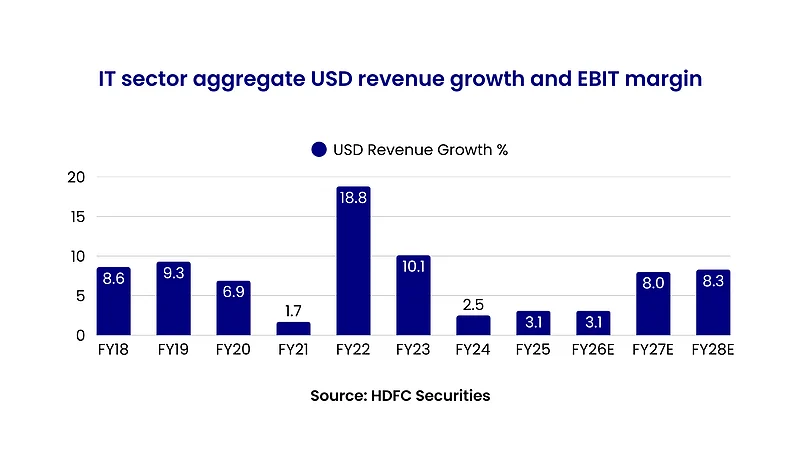

This hope is coming on the back of a long growth drought for companies. Just look at the data of Indian listed IT companies. As per an analysis by HDFC Securities, since FY22, aggregate revenue growth of the Indian IT sector has sharply moderated from a multi-year peak of 18.8% in FY22 to 10.1% in FY23, 2.5% in FY24 and just 3.1% in FY25.

The brokerage, in a note on December 8, forecast that in FY26 this aggregate revenue growth would remain flat at 3.1% before recovering to 8.0% in FY27 and 8.3% in FY28.

Recovery Hopes Bound to AI

This recovery expectation is on the back of this year’s contract wins by companies, which were led by AI technologies such as generative AI, agentic AI, machine learning and AI-driven automation platforms.

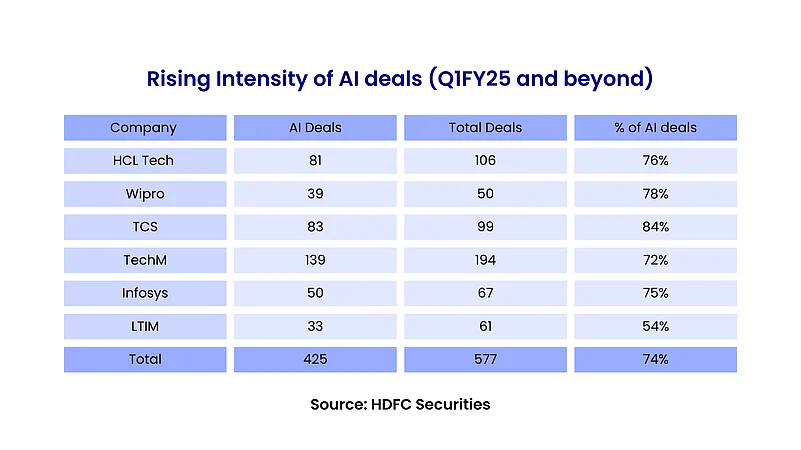

The brokerage analysed deals over the last six quarters of leading IT firms and found that HCLTech led in volume, with 139 AI-focused deals out of 194, reflecting its strength in AI-led transformations and engineering. TCS followed with 81 AI deals out of 106, highlighting its investments in AI platforms and operational modernisation, while Wipro showed the highest relative emphasis on AI, with 83 AI-themed deals out of 99, underscoring its commitment to AI-driven delivery and digital transformation.

“Infosys, LTIMindtree and Tech Mahindra also reflect a significant proportion of AI deals, with AI constituting the majority of their recent contract wins, demonstrating the widespread adoption of AI as a strategic imperative across major Indian IT services firms,” the brokerage claimed.

Motilal Oswal Financial Services also holds a similar view. The brokerage, in a note last month, said that AI spending has so far been focused on infrastructure, mainly data centre buildout. This was phase one. The second phase, where enterprises move from experimentation to deployment, begins when the incremental benefit of more hardware starts to flatten.

“Over the last 14–16 months, GenAI has moved from early experimentation to meaningful ecosystem formation. We believe the GenAI stack spanning core models, vector databases, orchestration frameworks, guardrails and cost-optimised inference infrastructure is now built to a large extent. This stack sits natively on the cloud ecosystem, making hyperscaler alignment a critical differentiator for IT services vendors,” the note added.

The brokerage believes the industry is approaching the early stages of the GenAI inflection point.

“While productivity gains may put pressure on low-value coding and BPO revenue pools, the scale of GenAI-driven modernisation should more than offset these headwinds for IT services, in our view,” it claimed.

According to HDFC Securities, in the bull case, global GDP is expected to rise from $114 trillion in 2025 to $132 trillion by 2030, with global IT spend growing at a 7% CAGR to $2.1 trillion, lifting the Indian IT sector from $300 billion to $470 billion at a 9% CAGR.

Some of this spending is also expected to come from India. As per the latest forecast by Gartner, Inc., IT spending in India is expected to reach $176.3 billion in 2026, an increase of 10.6% from 2025.

“Enterprises in India are accelerating their adoption of cloud and digital technologies, which will drive sustained, robust growth in IT spending in 2026. As the uncertainty pause that began earlier this year eases, rising demand for AI infrastructure will fuel new investment in data centres in India,” said DD Mishra, VP Analyst at Gartner.

He added that local CIOs will continue to prioritise investments in cybersecurity, AI/ML and data analytics.

“Their ongoing commitment to modernising applications, strengthening connectivity, implementing hyper-automation and enhancing both customer experience and operational efficiency will be key factors propelling IT spending growth in the region,” Mishra added.