Bernstein warns US AI firms (OpenAI, Google, Perplexity) threaten India’s tech sovereignty

Massive funding gap undermines domestic foundational models and long-term AI competitiveness

Bernstein urges policy intervention: data localisation, sovereign procurement, and ownership mandates

Reliance on foreign foundation models risks commoditisation of India’s AI application ecosystem

India is facing a strategic tech crisis.

US AI firms like OpenAI, Google AI and Perplexity are entering India with aggressive, India-specific pricing and partnerships, risking capture of India’s AI market and loss of tech sovereignty. Brokerage firm Bernstein believes how several AI firms are pushing to penetrate the Indian market, while the policymakers fail to curb the rising dominance.

In its recent report, Bernstein calls this a “wake-up call” requiring urgent policy intervention. “The reality is stark. Every major digital platform powering India, be it search, messaging, social media, and commerce, is already under US control,” it said.

The AI firms’ India push comes at a time when US president Donald Trump has unleashed a punitive 50% tariff on Indian exports. The report called India’s tech policy as broken, remarking that after the Tik Tok ban when no Indian social media app could fill the gap and Meta’s Instagram eventually reaped millions through its reels feature.

American AI Firms’ India Push

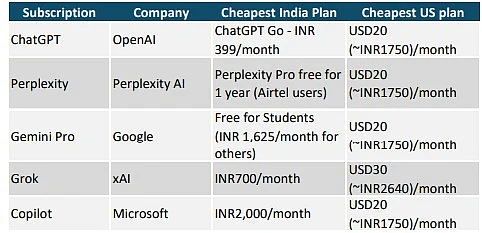

Perplexity’s strategic tie-up with Airtel, giving Airtel customers a complimentary 12-month Perplexity Pro subscription, seeds a large user base and accelerates mainstream familiarity with a premium assistant.

Similarly, OpenAI’s India-first pricing (ChatGPT Go at ₹399 per month) sharply lowers the consumer price point and makes high-quality models accessible to price-sensitive segments, speeding adoption across students and casual users.

Google’s Gemini is also pursuing a two-pronged India strategy: a paid Pro tier (around ₹1,950 per month) to monetise power users and deep enterprise integrations across Gmail, Docs and Search, plus targeted programmes (for example, free Pro access for students) to build long-term user habits and lock in usage.

Collectively, these moves compress the window for domestic incumbents to build foundation models or capture user attention, turning trial, pricing and platform integration into fast paths for market entrenchment.

India’s Foundational Problem

Bernstein shows private AI investment from 2013 to 2024 at about $471 billion in the US, about $119 billion in China and about $11.29 billion in India. The report also notes the Indian government’s earmark for a homegrown LLM, about ₹100 billion (about $1.2 billion), is tiny compared with the war chests global winners had (OpenAI had raised about $13 billion by the time ChatGPT launched).

Those raw numbers matter because leading-edge models need sustained capital for data, compute (GPUs/TPUs), research teams and repeated retraining, costs that routinely run into the tens or hundreds of millions.

Domestic groups can rarely finance model development at the scale or cadence required to compete. Talent flows to better-funded labs, the supply chain (specialised hardware, cloud credits) is expensive, and even one-time investments are insufficient: continual scale and iteration win.

Bernstein argues this funding delta therefore makes it unlikely India will produce world-beating foundation models without much larger, sustained capital and policy support.

India’s start-ups are mainly building application layers on top of foreign foundation models, not competing at the model or foundational level. They are packaging foreign foundation models into sector-specific products (health, finance, HR, enterprise workflows).

That strategy is pragmatic and fast to market, but it creates two systemic risks. Firstly, it commoditises the stack: as base models improve, vertical add-ons become easier to replicate and compete on price. Secondly, dependence in value capture (data, monetisation, model IP) accrues to the foundation-model providers, not the application layer.

The report cites experiments where generalist models, given sector data and prompts, rivalled specialist models, showing how a dominant foundation model can displace vertical incumbents.

Problem With Indian Market

Indian regulators tightly police domestic start-ups, particularly in fintech through licensing, compliance and capital rules that raise costs and slow product launches, while gateways and digital infrastructure (platforms, APIs, cloud/LLM access) face lighter oversight.

This asymmetry raises barriers for local entrepreneurs but leaves multinational models and gateway providers freer to scale, tilting the competitive field toward foreign incumbents who capture users and data.

Similarly, easing tensions with China could let Chinese tech re-enter India, intensifying competition and further shrinking space for Indian champions; combined with predatory capital, this threatens India’s remaining digital sovereignty.

The report argues the AI market will trend toward a small number of dominant global models, leaving little room for many homegrown foundational models. Exhibit data show the bulk of large foundational models originate in the US and China, while India has very few.

Policy Prescription

Bernstein urges decisive policy measures to preserve India’s strategic stake in AI.

Recommendations include ring-fencing critical AI development and procurement for domestic entities, enforcing data localisation and on-shore data-centre requirements, and mandating minimum 51% Indian public ownership or broadly held equity in certain AI operations to ensure value capture.

The report argues that short-term access to cheap foreign models should not trump building sovereign capabilities; rather, incentives, capital pools, preferential procurement and regulatory conditioning are needed to help domestic foundational models scale. Without such structural levers, India risks ceding control of its AI stack and economic rents to foreign firms.