Nvidia reported record Q3 revenue of $57 billion, up 62% year-over-year

CEO Jensen Huang dismissed AI Bubble fears, citing three massive platform shifts

Data Center revenue reached $51.2 billion, increasing 66% from the previous year

The company forecasts strong Q4 revenue of approximately $65 billion, fueling the AI Revolution

Nvidia CEO Jensen Huang acknowledged the “AI Bubble” debate circulating in tech and investor circles after announcing the financial results for the third quarter of fiscal 2026. During the chip giant’s post-results conference call, Huang stated that there has been a lot of talk about an AI bubble. However, from Nvidia’s vantage point, the company sees something very different.

He noted that unlike any other accelerator, Nvidia excels at “every phase of AI from pre-training and post-training to inference”. He added that, with the company’s two-decade investment in CUDA X acceleration libraries, Nvidia is also exceptional at scientific and engineering simulations, computer graphics, structured data processing, and classical machine learning.

Nvidia Enables Global Tech Transition

Huang remarked that the world is undergoing three major platform shifts simultaneously and Nvidia is a key enabler of all three.

He explained that for the first time since Moore’s Law began, the industry is shifting from CPU-based general-purpose computing to GPU-accelerated computing.

Moore's law is the observation that the number of transistors on an integrated circuit (IC) doubles approximately every two years, leading to a corresponding increase in computing power, smaller devices, and lower costs.

With Moore’s Law slowing, large amounts of software used in data processing, science and engineering now need to be optimised for accelerated computing. As a result, many applications that once ran only on CPUs are rapidly migrating to CUDA GPUs, which have reached a key tipping point.

Second, he noted that AI has reached its own tipping point, with generative AI rapidly replacing traditional machine-learning models in areas like search ranking, recommendations, ad targeting, click-through prediction and content moderation. He highlighted Meta’s Gem model, trained on large GPU clusters as a clear example of this shift.

In Q2, Gem delivered over a 5% increase in Instagram ad conversions and a 3% increase in Facebook Feed conversions, showing how generative AI is now directly driving revenue growth for hyperscalers.

Third, he said a new wave of agentic AI is emerging, systems capable of reasoning, planning, and using tools. This includes coding assistants like Cursor and Replit, radiology tools like iDoc, legal AI platforms such as Harvey, and autonomous driving systems like Tesla FSD and Waymo. Leading companies including OpenAI, Anthropic, xAI, Google, Cognition AI, and Tesla are driving this next stage of AI development.

He summarised the three platform shifts by saying that accelerated computing is now essential in a post-Moore’s Law world, generative AI is transforming existing applications and business models, and agentic and physical AI will be revolutionary, enabling entirely new industries and services. He also stressed that Nvidia’s unified architecture is designed to support all three transitions across every stage and form of AI.

Nvidia’s Monster Quarter

Nvidia reported record revenue of $57 billion for the October quarter, up 22% from the previous quarter and up 62% from a year earlier. Data Center revenue also hit a record, reaching $51.2 billion, a 25% increase from Q2 and a 66% rise year-over-year.

For the quarter, GAAP and non-GAAP gross margins were 73.4% and 73.6%, respectively. GAAP and non-GAAP diluted earnings per share were both $1.30.

Huang said, “Blackwell sales are off the charts, and cloud GPUs are sold out…. Compute demand keeps accelerating and compounding across training and inference — each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

During the first nine months of fiscal 2026, Nvidia returned $37.0 billion to shareholders through share repurchases and cash dividends. At the end of the third quarter, the company had $62.2 billion remaining under its share repurchase authorisation.

Q4 Outlook

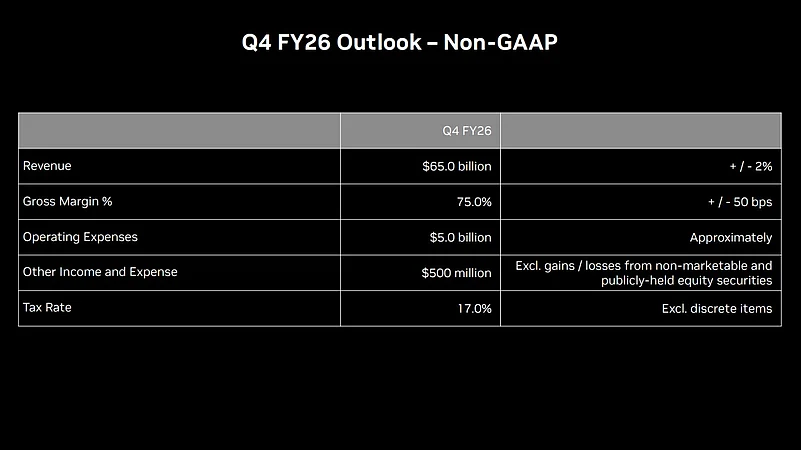

Nvidia expects fourth-quarter fiscal 2026 revenue to come in around $65 billion, with a possible variance of about 2%. The company anticipates GAAP and non-GAAP gross margins of roughly 74.8% and 75%, respectively, each with a margin of error of 50 basis points.

Operating expenses are projected to reach approximately $6.7 billion on a GAAP basis and $5.0 billion on a non-GAAP basis.

Nvidia also expects both GAAP and non-GAAP other income and expenses to reflect about $500 million in income, not including gains or losses tied to non-marketable or publicly traded equity investments. Finally, the company forecasts GAAP and non-GAAP tax rates of about 17%, with a 1% range on either side, excluding any discrete tax items.

Reacting to the optimistic projections for Nvidia’s financials, US brokerage firm Wedbush said the estimate represents an eye-popping guidance raise that will serve as a major positive catalyst for Nvidia and for the bullish AI Revolution thesis.

Addressing concerns about an AI bubble, the firm said, “Fears of an AI Bubble are way overstated in our view... this is another validation point for the AI Revolution and our view we are in the Top of the 3rd inning of this AI game. This will be a foundational bullish data point for hyperscale names Microsoft, Google, Amazon, Oracle and software plays such as Palantir and Oracle. The semi trade around AMD, TSMC, ASML among others is well underway and we would expect a bright green day for tech stocks tomorrow.”