Google and Accel are jointly launching a dedicated AI cohort to support early-stage Indian and diaspora-led AI ventures

Selected start-ups will get funding, cloud credits and early access to Google’s advanced AI models

The partnership underscores India’s rising importance in global AI development

Venture capital fund Accel has joined hands with tech giant Google to launch the 2026 AI Cohort under Accel’s Atoms program. Under this partnership, the duo has planned to co-invest in early-stage Indian artificial intelligence start-ups.

The initiative, through the Google AI Futures Fund (AIFF) launched in May 2025, will support at least early-stage AI start-ups. It will extend support to diaspora founders building AI products for Indian and global markets. Start-ups chosen for the cohort will receive capital, access to Google Cloud, Gemini and DeepMind resources, as well as mentorship.

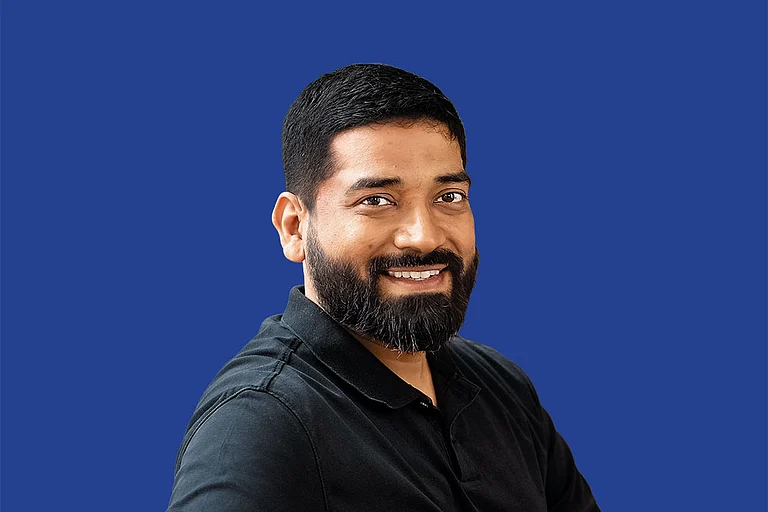

“The initiative is about creating a ready stack of resources to help Indian founders build and scale globally from day one,” said Prayank Swaroop, Partner at Accel. He stated that the homegrown start-ups often work at the intersection of AI and the physical world.

This is the first such collaboration by Google’s AI Futures anywhere across the world. It is pertinent to note that India is at a pivotal point in its AI journey. It can capture a meaningful share of AI-driven value leveraging its strengths and implementing key enablers.

What Google-Accel Partnership Will Offer?

Under this alliance, beginning in 2026, Google’s AI Futures Fund and Accel will invest $2 million each in at least 10 start-ups. Indian-origin founders based overseas who are building products for both India and global markets, will be eligible to apply for the program, Swaroop told media persons.

Each selected start-up will receive $1 million from Accel and Google separately, which will take the total capital to $2 million for one venture. However, Google plans to extend up to $350,000 worth of compute credits through Google Cloud, Gemini, and DeepMind, along with priority access to their latest models, APIs, and experimental tools.

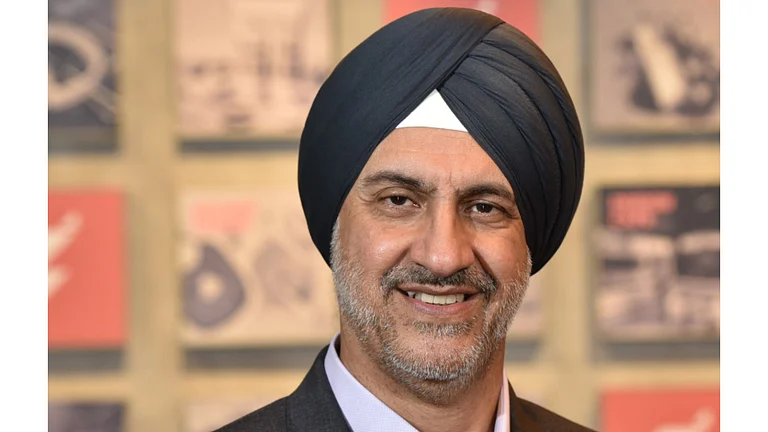

Jonathan Silber of Google DeepMind explained that the start-ups in the cohort will get early exposure to Google’s latest AI technologies like Gemini 3. He explained the fund aims to back entrepreneurs developing solutions across the entire AI stack, i.e., from coding assistants and workplace productivity tools to creative platforms and entertainment tech.

Silber noted that these categories form the core of its investment thesis, but the team is open to betting on other high-potential emerging start-ups.

Accel’s Atoms program has been operational for four years. Since then, it has evolved from supporting a broad mix of sectors to specifically backing AI start-ups. So far, the fund has backed 40 companies through Atoms, and these ventures have collectively raised over $300 million in follow-on funding.

Why Accel, Google Are Teaming Up?

Google on the capital table significantly boosts credibility, particularly for start-ups selling to large enterprises, said Swaroop. “On the enterprise, founders have had a hard time. They build great products, but they do not get as much limelight in the US or certain other international markets because they're from India,” he told the media.

Google helps these founders go to market, he added. “We have seen enterprise customers feel a lot more comfortable when Google is on the cap table since it is such a big brand. Google's name or even the capital gives trust to these enterprise customers”.

In addition, the tech giant has been bullish on Indian market over the past few years. Google has announced a series of investments in India, with the most recent is the $15-billion capital infusion to set up an AI hub in Visakhapatnam, Andhra Pradesh. Notably, it is Google’s biggest investment outside the US so far.

Before this, the company had also announced a $10-billion India Digitisation Fund in 2020, which helps in accelerating Prime Minister Narendra Modi’s vision to digitise Indian economy.

Speaking about the collaboration, Silber clarified that the duo didn’t choose India “at random”, rather made a bet for a “good purpose”. And Swaroop acknowledged that India has an advantage in fields like robotics and healthcare because of its large data pools and clinical testing infrastructure.

“We are partnering with Accel because we know that India is going to be building the next wave of innovation. We want them to be doing that responsibly on Google's most advanced AI models. We have already seen incredible talent from the companies that we have been working with already”.

The firms did not disclose how the ownership structure is split, but both the companies emphasised their commitment to investing in as many promising start-ups as they get with o fixed limit. Besides capital, the program also promises hands-on support. Google and Accel will collaborate closely with each start-up to address its unique challenges and priorities.

Why India Attracts AI Giants?

India is fast emerging as a global AI magnet as the country is drawing deep interest from the US tech majors like Google, Microsoft, and OpenAI due to its unmatched data diversity, massive population scale, and multilingual landscape.

"The volume of people that India has, you won't get access to anywhere else in the world, bar China. Secondly, the amount of languages that India has," said Raja Lahiri, partner and technology industry leader at Grant Thornton Bharat LLP.

He further stated that in India, the quantum of data is so high that models become more intelligent with more access to data and can then give better answers. NITI Aayog, in its recent report, even called India the "data capital" of the world.

"One of India’s biggest strengths is its data, and it has the potential to leverage this advantage. In the digital economy, data will function as currency that powers innovation, drives valuations, and shapes global leadership. India has the potential to lead due to its scale, diversity and digital infrastructure," the report said.

It added that artificial intelligence and its associated opportunities could add $1 to $1.4 trillion to India's Gross Domestic Product (GDP) by 2035, helping the country achieve an aspirational 8% annual growth rate.