Sterlite Technologies expects its enterprise and data centre segment to contribute nearly 25% of its revenue within 12–18 months.

Currently, 20% of the company’s revenue comes from the enterprise/data centre business.

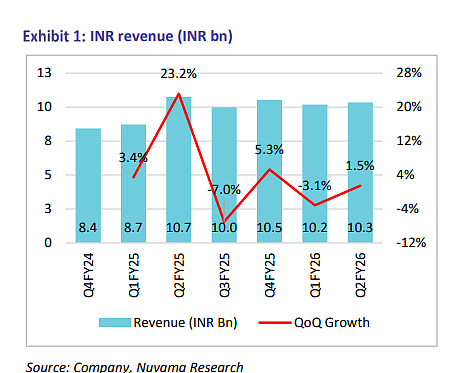

The company reported ₹1,034 crore in revenue in the September quarter.

Vedanta Group-backed optical fibre maker Sterlite Technologies expects its enterprise and data centre business to contribute almost 25% of its revenue in the next 12 to 18 months, as demand from the US and European markets strengthens its order book.

"Almost 20% of the business is now coming from enterprise/data centre (segment)...I personally feel this business will grow to be 23-25% in the next 12 to 18 months," CEO Rahul Puri told Outlook Business in an exclusive interview. The company, which reported ₹1,034 crore in revenue in the September quarter, currently earns about 20% from this segment, with the rest coming from its telecom broadband business.

Sterlite Technologies Ltd (STL) is India’s largest and only fully integrated optical fibre cable manufacturer, with OF and OFC capacity of 50 million and 42 million FKM, respectively. It has manufacturing plants in Aurangabad, Silvassa, China, Brazil (through a JV), Italy and the US. The company, in June this year, announced a new generation of data centre solutions aimed at meeting the growing demands of AI-driven infrastructure. The portfolio was designed for hyperscalers, colocation players, enterprises and telecom operators.

Puri says STL is "at a very strong position to leverage the opportunity which is there from the broadband side, from the telco side, on the data center side, on enterprise side."

Riding Data Centre Boom

On the enterprise and data centre side, he said about 40–50% of the demand is currently coming from the US, with the rest spread across the world. While he did not disclose customer names, he said, "four to five large hyperscalers are deploying a significant number of data centres and are consuming a lot of capacity. We have relationships with some of them and those will continue to grow."

In 2025, a large number of US Big Tech companies announced data centre investment plans across the US and globally. The largest of these is the OpenAI, Oracle and SoftBank-led $500 billion Stargate Project, which aims to build new AI infrastructure for the ChatGPT maker over the next four years. According to one estimate, the global data centre market is expected to exceed $4 trillion by 2030, with optical cable demand for AI-led data centres growing at a 28% CAGR between 2025 and 2030, supported by Big Tech’s data centre capex rising to around $600 billion by 2027.

"The company’s (STL) average realisation in the US market has increased following the easing up of inventory in the US and hyperscale demand for AI-driven data centres in the region. The demand in the US is expected to remain healthy in the medium term with growth coming in from data centres and the upcoming roll-out of the Broadband Equity, Access and Deployment (BEAD) programme," said credit rating agency ICRA in a note on November 12.

The BEAD programme is a US government initiative that provides $42.5 billion to expand high-speed broadband, mainly fibre, to unserved and underserved areas across the country. Over 100 million homes in the US are still awaiting fibre-to-the-home connections, pointing to a multi-year network build cycle. At the same time, 5G adoption is accelerating, with 6.3 billion global 5G subscriptions expected by 2030, accounting for 67% of total mobile subscriptions and carrying 80% of mobile data traffic.

STL is also expected to benefit from the ₹1.39 trillion BharatNet Phase III to connect 1.5 crore rural homes.

Demand Pickup

These major tailwinds come after a period of volatile growth for the company, especially in FY25, when it suffered from muted demand from North America.

"We all saw demand soften after the post-COVID surge, when activity picked up sharply before stabilising, as happens in most industries. Today, we are much better positioned. We now cater not only to telecom operators but also to data centres and other adjacent businesses, which helps mitigate demand-related risks," said the STL CEO.

He added that over the past year, STL has shifted from a single-sector, few-country focus to a multi-sector, globally present organisation, with manufacturing, operations and teams spread worldwide.

"This diversification has strengthened our business and resilience," he added.

When asked about data centre build-out, he said that data centre demand continues to grow, even though estimates vary, from a few trillion dollars over the next five years to a longer 15-year cycle.

"In simple terms, the rate at which data is growing globally is accelerating. Earlier, data volumes doubled every four to five years; now it is happening every two to three years, and this pace will likely increase further. As a result, demand for data storage, processing and fibre infrastructure will remain strong over the long term. While growth will not follow a straight line, history shows that every cycle is larger than the previous one," he said.

"We are starting to see some initial opportunities coming our way," he said, adding that as execution picks up and projects move on the ground, clear opportunities are expected to emerge for STL as well as for other players in the industry.

On the question of the nature of orders in India, he noted that a large part of data centre demand today is still driven by cloud usage, rather than AI training or processing, with another portion going towards traditional storage.

"However, we are now seeing new products and technologies gradually gaining traction. Innovative products are beginning to form a larger share of overall orders and, over time, revenues as well, which reflects a positive trajectory," he said.

According to STL’s second-quarter results, the company has built up an order book of ₹5,188 crore, which analysts say "provides revenue visibility over the medium term."

"There is healthy demand for STL’s products/services, driven by capex by major telcos globally towards 5G rollout and by domestic telcos/corporates to strengthen their network in the light of the increasing digitisation. This apart, large Government projects like BEAD in the US and BharatNet Phase III in India are likely to keep the demand for STL’s products buoyant," said credit rating agency ICRA in a note on November 12.

It added that the expanding portfolio of optical interconnect products will drive revenue and margins over the medium term. The healthy order book and increased demand are expected to drive the company’s revenue growth over the next few years.

"As you know, 85% of our revenues come from overseas markets, and almost all of it, the majority, comes from Europe and the US. Clearly, we are seeing steady demand in both regions. Europe is our largest market and we have a very strong leadership position there, so we continue to grow steadily," said Puri.

Explaining that "there are still many markets (European) that are underpenetrated," he said broadband penetration in the UK is about 50–60%, while in Germany it is still about 35–40%.

"There are also several markets in Eastern Europe that are catching up. Some markets are almost there, but Italy continues to deploy and France continues to deploy as well. There are markets that are still deploying and have plans for the next two to three years. We, obviously, continue to strengthen our partnerships and relationships with existing customers and also continue to onboard new customers," he added.

STL, in its September quarter earnings, revealed that it signed a 2–3-year long-term supply agreement with leading European telecom operators in the UK, Italy and France, without disclosing names.

STL, which was set up after demerging from Anil Agarwal-led Sterlite Industries Ltd (SIL) in 2001, is led by his nephew and managing director Ankit Agarwal.