ASML will cut 1,700 management roles (3.8% of its workforce) to streamline innovation

Record Q4 bookings of €13.2 billion ($15.8 billion) more than doubled previous analyst forecasts

Net profit reached €9.6 billion in 2025, driven by surging demand for AI infrastructure

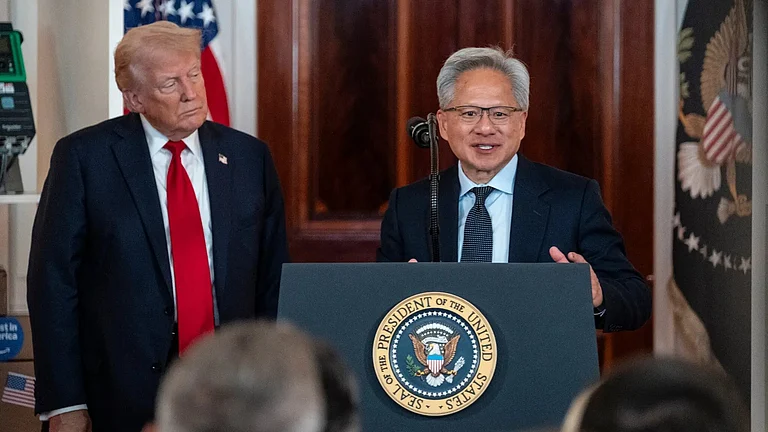

Advanced Semiconductor Materials Lithography (ASML) on Wednesday announced to cut 1,700 management jobs (around 3.8% of its staff) to focus on engineering, Reuters reported. The announcement comes after the Dutch company boosted its 2026 outlook after reporting record orders in the fourth quarter amid rising demand from AI chip makers like Nvidia.

The chip equipment maker recorded beyond expected orders as the global chip market is looking to boost production capacity to support rising AI and data centers demand. ASML’s precision machines put it at the center as it dominates the process for printing AI chips.

ASML reported a sharp surge in fourth-quarter orders with bookings jumping to a record €13.2 billion ($15.8 billion) from €7.1 billion a year earlier. The figure far exceeded Visible Alpha analysts’ expectations of €6.32 billion, underscoring strong demand for the chipmaking equipment maker.

Chief executive Christophe Fouquet reportedly said the rise in orders reflects production-capacity expansions by major customers including Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics and Micron Technology.

Looking ahead, Fouquet said ASML plans to significantly strengthen its engineering and innovation capabilities. He acknowledged that as the organisation has grown more complex, engineers are spending less time on innovation, and said the company wants to streamline operations so its technical teams can refocus on developing next-generation technologies.

ASML Financials 2025

ASML reportedly posted a record net profit of €9.6 billion ($11.5 billion) in 2025, driven by AI-led demand, on total sales of €32.7 billion. The strong performance came even as the Dutch government imposed restrictions on exports of advanced chipmaking equipment that could be used in weapons systems.

ASML also raised its 2026 sales guidance to a range of €34 billion to €39 billion, above analysts’ expectations of about €35 billion, according to LSEG data as quoted by Reuters. Earlier, the company had guided for sales in 2026 to be flat to higher compared with €32.7 billion reported in 2025.

The report stated that these restrictions, which were first announced in 2023 and later expanded, are widely seen as aligned with US efforts to limit China’s access to sensitive semiconductor technologies. Despite these constraints, ASML said it expects 2026 to be “another growth year” for its business, with demand led by continued sales of its extreme ultraviolet (EUV) lithography systems.

No More Quarterly Data

ASML reportedly said that moving forward, it will stop posting quarterly orders data, despite it being one of the most closely watched metrics in the semiconductor industry, arguing that the data creates unnecessary volatility in its share price.

“It will be the last time that ASML reports quarterly order intake, and the company is going out with a bang,” ING analyst Marc Hesselink said as quoted by Reuters.