US President Trump’s executive order imposing a $100,000 fee on new H-1B visa applications has upended the traditional model of Indian IT giants.

Experts say the move could hit IT firms’ margins by 15–50 bps in FY26, leading to fewer onsite jobs and more local hiring in the US.

Some roles may shift to Canada and Mexico as firms seek alternatives for onsite delivery.

An executive order of US President Donald Trump has shaken the traditional service delivery model of Indian IT giants. The order introduced a $1,00,000 fee for new H-1B visa applications.

After initial confusion and panic over how the fee for high-skilled visas would be applied, experts now say the new rules will impact anywhere between 15 to 50 basis points (bps) of margins of IT services firms in the financial year 2025–26. They also expect a sharp decline in onsite jobs, more local hiring and a shift of some jobs to neighbouring countries like Canada and Mexico.

On September 20, Trump signed an executive order aimed at protecting the interests of American workers. He said H-1B visa programmes used by companies to bring high-skilled workers to the US over the years had severely harmed the US economy “and national security demands an immediate response”.

Standing beside the President, US Commerce secretary Howard Lutnick said companies would need to pay $1,00,000 per year for each H-1B worker. This led to panic among visa holders and companies prompting them to call back their workers to the US before the rules kicked in.

Initial Panic, White House Clarifications

Initial reports of the executive order said the rules might apply to H-1B visa holders who were outside the US. This led to companies like Amazon, JP Morgan and others asking employees on vacation or outside the US to come back before the September 20, 12:01 EDT deadline. A video surfaced on social media showing passengers, especially those of Indian origin, panicking to disembark from a San Francisco-bound flight.

Later, news agency Reuters reported that an Emirates flight from San Francisco to Dubai was delayed for more than three hours, as several Indian passengers demanded to deplane after receiving memos from employers about President Trump’s sudden $1,00,000 H-1B visa fee order. At least five were eventually allowed off, according to the report. In another incident, one woman in New York abandoned her trip to France after her company’s lawyers warned employees overseas to return immediately. She asked the captain of her United Airlines flight, which had already begun taxiing, to return to the gate so she could get off.

Back in India, a software professional who has lived in the US for 11 years had travelled to Nagpur for the anniversary of his father’s death, as per a BBC report. Fearing he might not be able to return before the fee took effect, he spent more than $8,000 booking and rebooking flights in just eight hours to make it back in time.

Even on Chinese social media app Rednote, posts of H-1B visa holders rushing back to the US were trending all weekend. India and China are two of the largest beneficiaries of the H-1B visa programme.

Amid the panic, the White House clarified the next day that the $1,00,000 fee was a one-time charge for new applicants only.

White House Press secretary Karoline Leavitt posted on X, “Those who already hold H-1B visas and are currently outside of the country right now will not be charged $1,00,000 to re-enter. H-1B visa holders can leave and re-enter the country to the same extent as they normally would.”

She added that the new fee would only apply to “new visas, not renewals and not current visa holders”.

New H-1B Visa Rules

The H-1B programme allows US employers to hire highly skilled foreign professionals, typically in specialised fields. Nearly 400,000 H-1B visas were approved in 2024 of which 260,000 were renewals according to an analysis by Pew Research Centre, a policy and social research think tank. Most recipients of the visa took computer-related jobs according to government data. Indian nationals made up 71% of approvals with Chinese workers accounting for 11.7% of these visas in 2024.

Currently the annual H-1B visa application fee is about $1,000 with some other nominal charges. The executive order raises the overall H-1B fee to $1,00,000 per applicant. This represents 100 times jump and applies to new applications.

The programme’s mechanics remain the same otherwise meaning it is the employers who sponsor the foreign workers for roles requiring specialised skills but now at a sharply higher cost.

The White House clarified that the new visa fee will only apply once for new applications and not to existing visa holders, renewals or those re-entering the US. Current H-1B workers can travel as usual without being charged the fee.

The order also directs agencies to tighten verification, raise wage standards and prioritise higher-skilled applicants.

“Since H-1B lotteries and petitions are typically run in Q4–Q1, the first impact would likely be seen in 2026–27 petitions,” says Motilal Oswal Financial Services.

More importantly, the individual visa petition and approval would be valid for 3+3 years before the individual falls into the lottery cycle again and the visa fee becomes due. Hence, the one-time visa fee would be capitalised over six years.

The proclamation has certain exemptions in case the secretary of Homeland Security Kristi Noem finds that the hiring of foreigners to be employed as H-1B speciality occupation workers is in “the national interest and does not pose a threat to the security or welfare of the United States”.

How Dependent are IT Firms on H-1B Visas?

Experts earlier told Outlook Business that IT services firms work on an 80-20 onshore-offshore workforce ratio. Under this, 80% of the required workforce on a project is deployed in low-cost regions while 20% is onsite near the client. This ratio has over the years shifted more in favour of offshore locations especially after the pandemic showed remote project execution is possible. In the last few quarters, companies were already reducing the use of H-1B visas with focus on offshoring to increase profit margins as growth slowed down.

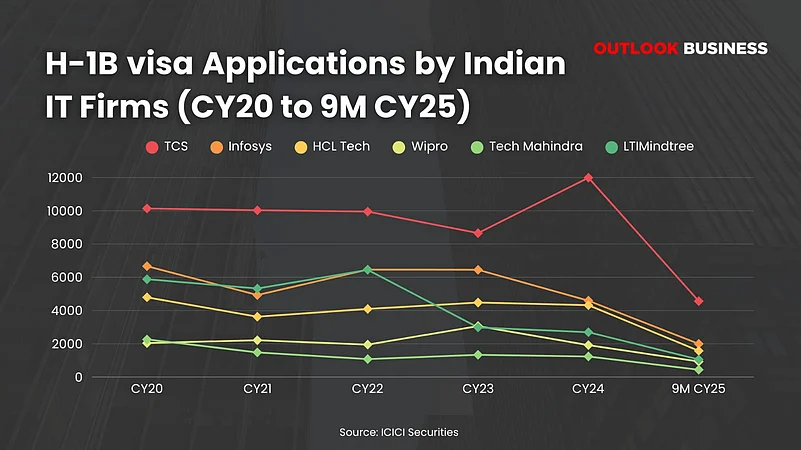

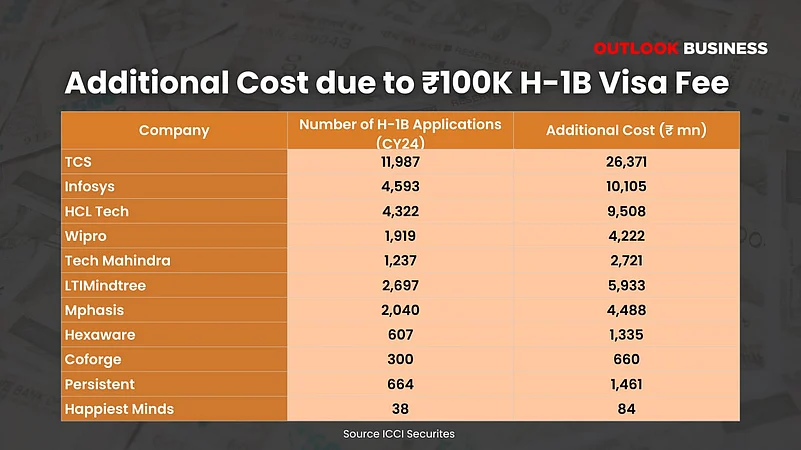

Data compiled by ICICI Securities shows how IT services companies have reduced their demand for the skilled visa programme. It analysed labour condition application (LCA) filings by Indian IT services companies which have fluctuated over the past five years. Infosys’ filings peaked at 6,666 in 2020, fell in 2021 and then stabilised with 4,593 in 2024 and 1,996 so far in 2025. HCL Technologies maintained steady volumes filing 4,322 in 2024 and 1,575 in 2025 to date. Wipro’s filings dropped from 3,064 in 2023 to 1,919 in 2024 while Tech Mahindra’s also fell to 1,237 in 2024 and 442 in 2025 so far. LTIMindtree, saw filings decline sharply from 6,448 in 2022 to 2,697 in 2024.

Tata Consultancy Services (TCS) recorded the highest numbers of LCAs though it has grown just modestly from about 10,137 in 2020 to 11,987 in 2024 with 4,566 already filed in the first nine months of 2025.

Among mid-tier firms, Mphasis filed 2,040 in 2024 and 1,030 this year, Coforge filed 300 in 2024 and 154 so far this year and Hexaware Technologies filed 607 in 2024 and just 20 so far in 2025. Persistent Systems filings rose steadily reaching 664 in 2024 and 238 in 2025. Happiest Minds had relatively low volumes with 38 filings in 2024 and 18 this year so far.

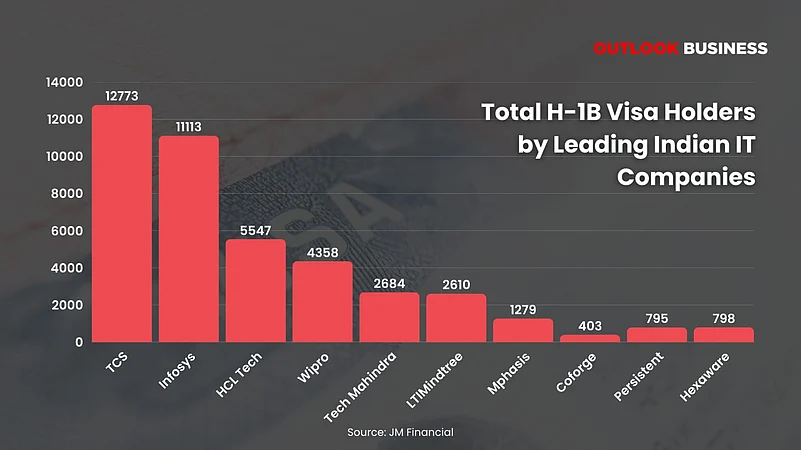

According to JM Financial, a leading investment banking and advisory firm, the top 10 IT services players have 1.2 to 4.1% of their total employee base on H-1B visas. The brokerage’s data shows TCS has 12,773 visa holders, Infosys 11,113, HCL Technologies 5,547, Wipro 4,358, Tech Mahindra 2,684, LTIMindtree 2,610, Mphasis 1,279, Coforge 403, Persistent Systems 795 and Hexaware Technologies 798.

New Rules’ Impact on Hiring, Earnings

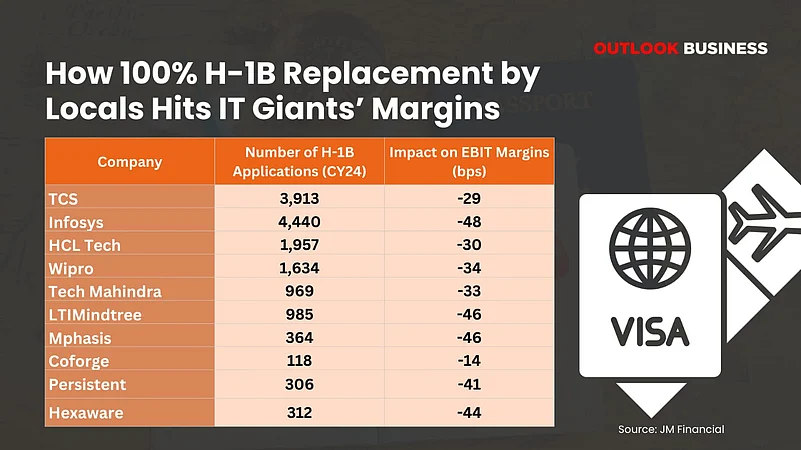

The brokerage says that in a scenario of increased local hiring without offsets, companies’ margin impact could be 15–50 bps. It says if all H-1B visa holders at Indian IT firms were gradually replaced by local hires over six years along with new petitions also being substituted by locals, TCS would need to hire around 3,913 employees, Infosys about 4,440, HCL Technologies 1,957, Wipro 1,634, Tech Mahindra 969, LTIMindtree 985, Mphasis 364, Coforge 118, Persistent Systems 306 and Hexaware Technologies 312.

This shift would likely reduce their earnings before interest and taxes margins by 15–50 bps with the biggest impact seen at Infosys (about 48 bps) and the lowest at Persistent Systems (about 14 bps) though companies could partly offset this through higher offshoring.

JM Financial adds that in a more likely scenario of higher offshoring the above impact could be completely negated.

“Financially therefore this is neutral in our view. Importantly with one of the biggest regulatory overhangs now behind this event is net positive in our view,” they said.

Another brokerage firm, PL Capital, expects no major near-term impact from the new H-1B visa fee until about March 2026 but says medium-term earnings could be affected from 2026–27 by about 2.6% across the IT sector. LTIMindtree is expected to be the most affected with earnings per share falling by about 7.5% and margins by about 5%. Large IT companies such as TCS, Infosys, HCL Technologies, Wipro and Tech Mahindra may see modest pressure with margins falling by 30–60 bps and earnings by 1–4% while LTIMindtree could face a much sharper impact due to its higher reliance on visas.

Overall, the brokerage says the additional $1,00,000 fee on new H-1B approvals could lead to a margin hit of about 40 bps and an earnings decline of about 200 bps on average in 2026–27.

Data from ICICI Securities gives a more relative picture. In calendar year 2024, TCS filed about 11,987 LCAs. At this level, the brokerage estimates that the additional cost from the new H-1B visa fee would be ₹26,371mn, equal to about 1% of revenue and 4.1% of profit.

Infosys filed 4,593 LCAs potentially bearing ₹10,105mn or about 0.6% of revenue and 2.7% of profit in cost. HCL Technologies had 4,322 filings with an additional cost of ₹9,508mn from new visa rules or about 0.8% of revenue and 4.1% of profit. Wipro filed 1,919 LCAs leading to ₹4,222mn in extra cost about 0.5% of revenue and 2.4% of profit. Tech Mahindra filed 1,237 LCAs facing ₹2,721mn in costs or about 0.5% of revenue and 4.8% of profit. LTIMindtree filed 2,697 LCAs with the highest relative impact at ₹5,933mn equal to about 1.6% of revenue and 9.5% of profit.

Among mid-tier firms, Mphasis filed 2,040 LCAs with a steep impact of ₹4,488mn about 3.2% of revenue and 19.7% of profit. Hexaware filed 607 LCAs with a cost of ₹1,335mn or about 1.1% of revenue and 2.6% of profit. Coforge filed 300 LCAs incurring ₹660mn in cost or about 0.5% of revenue and 6% of profit. Persistent Systems filed 664 LCAs with ₹1,461mn in added cost equal to about 1.2% of revenue and 8% of profit. Happiest Minds had 38 filings with ₹84mn in cost or about 0.4% of revenue and 3.2% of profit.

Motilal Oswal says if an IT company were to apply for 5,000 H-1Bs in 2026–27 the annual fee alone would amount to $500mn (5,000 × $100k).

“Given the magnitude of this fee it is likely that Indian IT companies will avoid new H-1B filings altogether opting instead to expand offshore delivery or increase local hiring,” the brokerage noted.

According to Phil Fersht, founder of HFS Research, a global business research consultancy, leading services organisations with deep dependencies on the H-1B model are staring at both a massive challenge to protect their existing book of business and a unique opportunity to transform their entire delivery model.

“You now have the perfect excuse to get away from the quarterly reporting grind and make those changes you have wanted to make for a very long time. While Indian-centric IT services bosses will argue they have reduced dependence on H-1Bs in recent years you can clearly see that H-1B hiring was still rampant until this year’s industry slowdown,” he wrote in a blog on September 21.

He argues that both large and mid-sized providers must rebalance toward nearshore (from Canada or Mexico) and remote delivery but survival will hinge on converting spend into US talent pipelines and embedding AI into productised services.

“The IT services giants will swallow much of the cost for platform-critical roles but mid-tiers simply cannot and urgently need to evolve their delivery models. Writing seven-figure checks for visa entries is not a strategy; it is a slow bleed,” Fersht noted.

He added that those who accelerate Services-as-Software with Agentic AI, LLMs and Vibe Coding will protect margins and differentiate while those who do not will end up stuck in a broken rotation model that enterprise clients no longer want to pay for.

According to Emkay Global, a financial services company, increased scrutiny, risks of further protectionist measures and H-1B incremental fee imposition could potentially prolong sales cycles as clients might reassess resource plans, evaluate onshore/offshore workforce mix and negotiate cost-sharing for roles exposed to the fee.

What About Big Tech Firms?

While it is often portrayed that IT firms are major users of H-1B visas, in recent years Big Tech companies like Google, Amazon, Microsoft and Meta account for a larger share of fresh applications than Indian IT.

Motilal Oswal Financial Services in an analysis shows that in 2021–22 Big Tech firms made up about 43% of approved H-1B petitions compared with 29% for Indian IT and 15% for global IT firms. By 2023–24 Big Tech’s share was slightly lower at 40% but still ahead of Indian IT’s 26% and global IT’s 17%. Financial institutions also accounted for around 12–13% across both years while the remaining share went to other sectors.

“For IT vendors localisation and subcontracting are already baked into their delivery models making them relatively better placed to adjust,” the brokerage said.

Emkay Global says to reduce reliance on visa-dependent talent, companies might consider expanding US-based hiring through direct employment or contracting. While this approach could help mitigate immigration risks, it may lead to higher costs due to supply-demand workforce imbalance in the US.

“The US produced about 1,00,000 computer and information science graduates in 2024 well below demand thus creating talent scarcity,” the brokerage said in a note.

In such cases, experts have told Outlook Business that the demand for Global Capability Centres (GCCs) especially those in India, might rise. So far India has over 1,760 companies setting up GCCs and as per ANSR, a global consulting firm that helps multinational corporations build and manage high-performing GCCs, this is expected to rise to over 2,400 by 2030 with more Fortune 500 companies setting up advanced services centres in India.

The GCC establishment and management firm ANSR has told Outlook Business that the new visa fee will only boost the strategic importance of delivery centres in India making them more innovation centric.

So, it seems while the latest White House order might create near-term headwinds for India, in the longer term it is expected to reinforce the importance of the skilled workforce provided by the region.