Covid-19 accelerated fitness adoption: 156% surge in app downloads

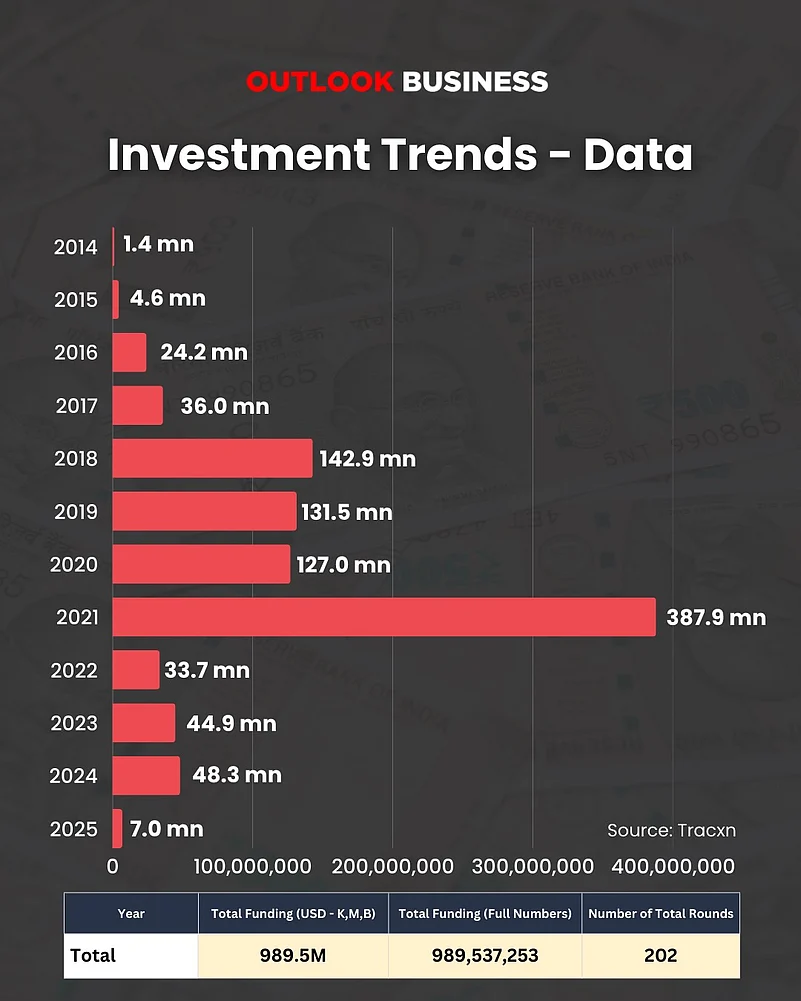

Funding peak in 2021: $387.9 million; 2025 funding so far: $7 million

Investors now prioritise retention, measurable impact, and profitability over scale

Over 600 active fitness tech startups in India; only 96 have received funding

When Covid-19 hit, gyms closed but fitness didn’t stop in India. Industry insiders revealed that the fitness app downloads surged by 156%, adding 58 million new users almost overnight. The message was clear: it was no longer a luxury; it had become a daily necessity. Yet, the money in fitness tech start-ups isn’t being fuelled at the same pace.

In 2021, Indian fitness tech start-ups hit their funding peak, with over $387.9 million funding across 36 rounds. The year was majorly driven by Cult.fit’s landmark $180 million Series F round. However, VC funding has been cooling down sharply since then. These start-ups only raised $7 million in 2025 till date, according to data shared by Traxcn. Even in 2024, the investment in this sector was only $48.3 million.

The irony is hard to digest – the market is booming, demand is surging, and platforms are going tech-savvy to innovate; but the venture capital has slowed down post-pandemic peak. On top of that, Deloitte, in its recent report, stated that the country’s fitness economy is expected to reach $16 billion by 2027.

What this means is tech adoption is now baked into consumer behavior — apps, wearables, and remote coaching aren’t a niche anymore, they’re mainstream, said Jitendra Chouksey, founder and CEO of FITTR, which has recently raised $3 million as investors look for community-driven, and outcome-based models.

The funding slowdown doesn’t mean the fitness tech sector has lost its steam, it rather signals a shift in investors’ focus.

Investors Want Proof, Not Hype

Over the years, investor expectations have evolved significantly. Previously, their primary focus was on scale at any cost, with a heavy emphasis on rapid expansion and market share. However, Akshay Verma, founder of FITPASS, believes that the focus has shifted to profitability, sustainability, and backing strong operators with long-term value.

“Given the constraints investor face—whether it’s cheque size, desired ownership stake, or fund life—the focus is on backing those who have already proven themselves capable of managing the evolving market,” said Verma.

Chouksey also argues that while demand for fitness is stronger than ever, capital is flowing selectively. “It’s not about vanity metrics anymore; it’s about showing that the product delivers real, measurable change in people’s lives”.

“The benchmark has shifted from ‘how many users a start-up can acquire’ to ‘how long it can keep them’. In fitness, flashy adoption numbers don’t guarantee long-term engagement. What matters now is retention and outcomes. As investors, we want to see stickiness, not spikes,” said Archana Jahagirdar, managing partner at Rukam Capital.

As per data, 69% of fitness apps are abandoned within 90 days across the world, which is worse than the average of 52% for all app categories. In India, Investors are now particularly drawn to models that combine tech, science, and community, said Ankita Vashistha, founder and managing partner of Arise Ventures.

Tech start-ups must show they can hold users for months, not just weeks. With over 600 active fitness tech start-ups and 96 funded in India, experts say that only those demonstrating high retention and real user impact get serious investment.

There are more than 100 VCs who have backed India’s fitness tech sector till 2025 till date. Of these, the most active are Chiratae Ventures, Blume Ventures, and Kalaari Capital. Other notable investors include Accel, Pratithi Investments, and Rainmatter, supporting companies such as Fitbudd, AyuRythm, and FITTR.

Potential Hidden in Missed Opportunities

While most investors are pressing founders to prove sustainability and retention, Vashistha is looking at the horizon. She believes that the most promising bets will come from adjacent categories like women’s health, mental wellness, nutrition & metabolic health, and eldertech.

Experts even highlight that there are some sectors in fitness tech which remain unexplored. For instance, women’s health is still heavily underrepresented. Most products focus narrowly on weight loss, while broader areas such as hormone health, postpartum strength, fitness, and menopause only get little innovation.

In addition, chronic disease management is another open highway. Chouksey says that almost one in three adults in urban India live with conditions like diabetes and hypertension, but few solutions use tech for ongoing lifestyle support. Longevity and preventive health also offer headroom as younger consumers seek lasting results rather than one-time fixes.

Though spotting unexplored categories isn’t enough, Vashistha cautions that the sector still faces deeper structural hurdles like sustained engagement, personalisation, and affordability at scale.

“Most products focus on activity tracking, but integration across fitness, nutrition, sleep, and mental wellness is limited. Another gap is accessibility beyond tier 1 cities—how do we make fitness tech inclusive for middle-class and rural populations? That’s a massive billion dollar opportunity,” she adds.

These challenges are also compounded by structural barriers like customers’ low willingness to pay, high drop-off after 3–6 months; regulatory clarity on health data, cross-border digital services, insurance integration; and patchy fitness infrastructure outside metros and inconsistent internet access.

Booming Against the Odds

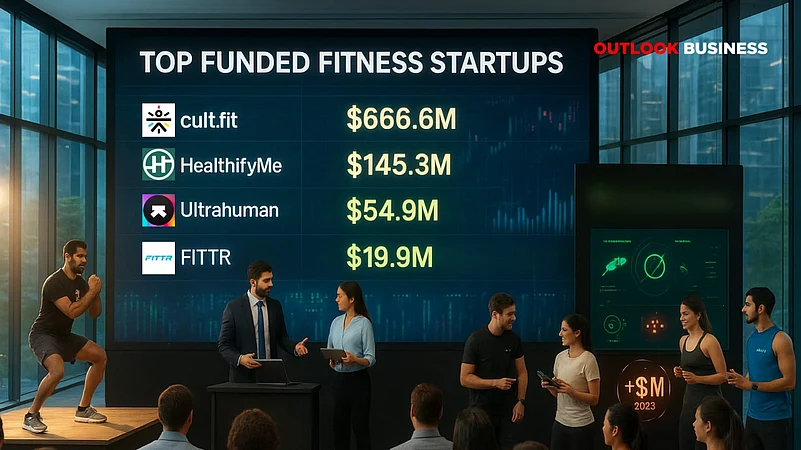

Despite funding slowdown, some Indian start-ups have witnessed remarkable growth in fitness tech sector. It has recorded four mega funding rounds of over $100 million to date, all raised by Cult.fit. These include a $180 million Series F in 2021, a $110.5 million Series D in 2020, a $120 million Series D in 2019, and a $120 million Series C in 2018.

In total, Cult has raised $666.6 million funding till date. It has even turned unicorn in 2021. The start-up is followed by HealthifyMe with $145.3 million, while Ultrahuman has secured $54.9 million to scale its biomarker-led health platform. Additionally, FITTR also raised $19.9 million funding. In 2025 till date, the start-up secured $3 million in a Series A round from Rainmatter.

This resilience is even evident in the performance of another fitness tech start-up like FITPASS, which reported a 205% year-on-year growth in FY25. It achieved annual recurring revenue (ARR) of ₹174 crore in the same fiscal year.

Verma says that start-ups are also leaning on strategic partnerships, regulatory engagement, and consumer-driven demand to scale sustainably. FITPASS has also collaborated with IRDAI (Insurance Regulatory and Development Authority of India) to integrate fitness into health insurance and working with policymakers to reduce GST on wellness services.

“These partnerships with the Government of India and IRDAI have opened up opportunities like tax-saving benefits for individuals investing in their health, further mainstreaming fitness as part of financial and healthcare planning. It also offers more flexibility and profitability compared to relying on venture capital to cover burn rates,” Verma added.

The reality is that “tight funding conditions” are only felt by players who rely heavily on VC money. About a decade ago, investors placed large bets on a single fitness player, hoping to dominate the market. But the picture has changed now. Today, healthy competition fosters growth. When multiple companies compete for consumer trust, the entire sector flourishes—and both consumers and operators benefit.

The right kind of VC backing is still critical to scale, but it’s about more than just capital—it’s about partnering with operators who understand unit economics and share a longevity vision for India’s health.

Afterall, the real measure of success lies in retention. Even the best-funded initiatives falter if users don’t stay engaged—motivation wanes fast, and sustaining it is the ultimate challenge for the sector.