India’s 2025 start-up IPO wave saw valuations collide with profit reality

Investors prioritised repeatable earnings, transparent unit economics, and credible paths to profitability, punishing companies leaning on one-off gains or inflated projections

For 2026, the message is clear: scale may attract attention, but only sustainable profits will secure lasting investor confidence

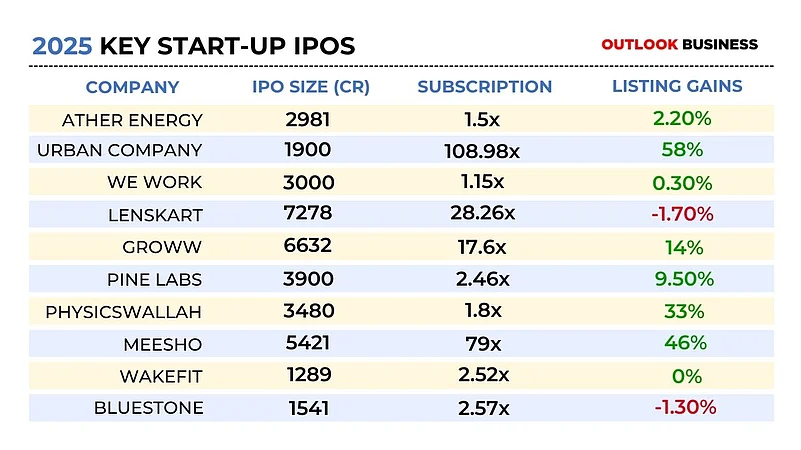

Lenskart, PhysicsWallah, Groww, WeWork, PineLabs, Meesho, Wakefit, and many more! These new-age tech businesses had set the tone for India’s start-up IPO narrative in 2025 — lofty valuations, IPO-ready profits, reduced cash burn, and proof of business resilience in tougher market conditions.

For many start-ups, 2025 was not only about chasing the next funding round, but they remained focused more on survival, sustainability, profitability and justifying their worth in a turmoil investment climate. The pendulum, which oscillated between valuations and profitability, finally took homage in latter one by the year-end.

The year has become a turning point for the start-up landscape. As the global liquidity tightened and investors demanded discipline, inflated valuations had a very hard mathematics for the bottomline in balance sheets.

And funding was no longer driven by promise or optimism alone. The change clearly showed up in how the start-ups approached the stock market. Listings were scrutinised quarter by quarter, roadshows revolved around contribution margins rather than gross merchandise value, and management conversations focused less on market share and more on cash flows.

While valuations and listing volumes grabbed attention, profitability quietly emerged as the real gatekeeper to the public markets.

Why Profitability Took Centre Stage

In 2025, profitability moved from being a future aspiration to an immediate requirement for start-ups tapping Dalal Street. The shift was visible in the numbers as well as investor behaviour. This year, as many as 18 start-up IPOs hit the markets, the highest ever in a single year, collectively raising around ₹41,000 crore – a significant climb from the previous year’s ₹29,000 crore.

But unlike earlier cycles, capital was not chasing scale alone. “Merchant bankers and promoters have realised that the Street is now looking to invest in profitable businesses from a long-term perspective. Showing a clear path to profitability and reasonable valuations has become essential for an IPO to succeed,” said Sunny Agrawal, Head of Fundamental Research at SBI Securities.

Looking at past experiences, whether it was Paytm, which was the first new-age company to get listed and was then hammered post its inability to deliver numbers, or other businesses like Ola Electric, where there was no clear visibility on profitability, Agrawal believes that the promoters and investors have learnt the lesson.

The consequence of those hard-learnt lessons became evident once companies hit the IPO roadshow circuit. Start-ups that demonstrated improving unit economics and narrowing losses saw stronger demand during roadshows and book-building, while companies with weaker earnings visibility faced valuation pushback or muted post-listing performance.

As per data, nearly half of the capital raised through start-up IPOs came via offer-for-sale components, which signals that public markets are increasingly being used as exit routes, but only at prices investors deemed justified.

Stock prices are ultimately driven by earnings. There may be euphoria before listing, but post-listing, Kranthi Bathini, Director of Research at WealthMills Securities, says that how consistently companies deliver on profitability and cash flows decides valuation sustainability.

As Ratiraj Tibrewal, Director at Choice Capital, puts it, “Investors want to see that profits are coming from core operations, not one-off adjustments. Sustainable earnings are now the anchor for valuation”.

In the pre-IPO phase, Agrawal says that it is not cost reduction which drives profitability, rather, it is initiatives that support stronger revenue growth and improved operating leverage, ultimately leading to better and more sustainable profitability in future.

With earnings under sharper scrutiny, public markets began questioning whether private-market price tags could still hold up.

How Public Markets Reset Start-ups Valuation

The focus on profitability also unfolded a conversation around valuations in 2025. As companies lined up for public listings, the gap between private-market pricing and public-market reality became harder to ignore. For instance, Peyush Bansal’s Lenskart looked for a valuation worth ₹70,000 crore in IPO.

Similarly, Groww’s valuation, at ₹61,735 crore based on the upper IPO price band of ₹100, means roughly 16 times revenue and about 31 times earnings. On the surface, it appears reasonable against an industry average P/E of around 40. But the comparison becomes less flattering when stacked against listed peers — Motilal Oswal trades at about 24 times earnings, while Angel One is closer to 19.

These eye-popping valuations were justified in the past few years. But in 2025, they faced their toughest test yet as public markets demanded proof that price tags could be backed by profits and cash flows.

Even in many cases, valuation expectations were cut during roadshows as institutional investors questioned the quality of earnings, sustainability of margins and the credibility of management guidance.

For example, Meesho went to the market at a valuation of about $5.8 billion, a sharp markdown from the $7-8 billion range earlier discussed for its IPO, though it still represents a roughly 16% premium over its 2021 peak private valuation of $5 billion.

This shows that valuation frameworks underwent a rethink for investors. Instead of headline price-to-sales multiples, they increasingly dissected what lay beneath the profit and loss statement.

“We normalise earnings by stripping out one-offs such as fair-value gains or tax credits. Ideally, close to 90% of PAT should come from core operations. Anything else does not justify a premium valuation,” said Tibrewal.

For start-ups that turned profitable just ahead of listing, scrutiny was even sharper. “Almost every start-up shows profits before an IPO, but many of those profits don’t come from core operations. Investors discount such earnings, and that directly reflects in lower valuations,” said Amit Khurana, Head of Institutional Equities at Dolat Capital.

The message from the markets was unambiguous: scale without earnings no longer commands automatic respect. Businesses with recurring revenues, visible cash flows and operating leverage were rewarded with stronger demand and valuation stability. Those leaning on aggressive assumptions, accounting adjustments or temporary cost cuts found the market far less forgiving.

How IPO Investors Evaluate Start-ups in Tighter Market

While the specific metrics depend on the nature of the business, the most critical unit economics benchmarks investors focus on are cash burn, contribution margins, payback period, and customer acquisition cost. These indicators help them assess whether the business can scale efficiently and sustain growth over the long term.

“We focus on whether margin improvement is coming from genuine operating leverage, cost efficiencies, and stable customer behaviour — not temporary cuts to marketing or product spends before an IPO. Only multi-quarter consistency indicates structural, sustainable improvement rather than pre-IPO window dressing,” said Tibrewal.

For companies with uneven profitability, the Choice Capital director says that he relies on a mix of EV (enterprise value)/Revenue, adjusted EV/EBITDA, and growth-adjusted multiples. According to him, the focus should be on cash-flow break-even visibility, the quality and stability of revenue, and the strength of unit economics rather than headline PAT.

Post listing, he says that companies must pursue growth with disciplined capital allocation and a clear path to stronger EBITDA and cash flows because public investors value consistency over high-burn expansion.

On the other hand, Prashanth Tapse, senior research analyst, Mehta Equities says that start-ups preparing for IPOs must prioritise contribution-margin expansion, target to reduce cost structures, and sustainable customer acquisition strategies well before listing.

“We have seen companies that demonstrate predictable revenue streams, efficient working-capital cycles, and asset-light operating models are seeing stronger investor confidence pre and post-listing,” says Tapsee, while citing examples of Delhivery, PB Fintech, CarTrade and Lenskart that currently stand out among listed Indian start-ups as their financials started showing a tilt toward positive cash flows.

And when any start-up swings to profit just before its IPO, Tapsee examines margin trends, customer acquisition costs, and reduction in operating expenses. These parameters reveal whether the profitability is being earned structurally or cosmetically engineered.

Besides these metrics, market experts also analyse working capital movements and one-off income to assess the quality and sustainability of the reported profit.

What the Market Will Demand in 2026

If 2025 was the year when public markets forced start-ups to confront profitability, 2026 is going to be the year when execution will be relentlessly audited. The tolerance for narratives, adjustments and optimistic timelines has narrowed sharply.

For companies lining up to go public, simply reaching breakeven will no longer be enough. The Street will want proof that profits are repeatable, scalable and resilient across cycles.

According to market experts, the biggest filter in 2026 will be “credibility”. “The real risk is not just weak profitability, but the credibility of the path to profitability and management’s ability to deliver on it,” said Agrawal. In a hyper-competitive environment, where start-ups often sacrifice margins to protect market share, any deviation from stated guidance could invite swift punishment in the secondary market.

Valuations, too, are expected to remain tightly tethered to earnings quality rather than growth projections. Tibrewal says investors will continue to strip out one-off gains and accounting adjustments to assess true performance.

“Sustainable earnings are now non-negotiable. If profits don’t come from core operations, valuations will be discounted,” he said, adding that businesses with uneven margins will struggle to command premium multiples.

Another clear demand from public investors will be “capital discipline post listing”. Bathini notes that listing-day enthusiasm can fade quickly if companies fail to convert growth into cash flows. “There may be excitement before listing, but over time, earnings consistency is what anchors valuation,” he said.

The outlook for IPOs in 2026 remains constructive, supported by strong domestic liquidity and a growing pool of listed start-up benchmarks. But the bar has undeniably moved higher. Khurana points out that investors are far better equipped today to identify cosmetic profitability. “If earnings are driven by deferred costs or one-time items, the market will see through it, and price the stock accordingly,” he said.

“Scale can open doors, but only sustainable profits will keep them open”, this is what Dalal Street conveys to start-ups preparing to get listed on the bourses.