The Indian rupee is the worst-performing Asian currency in 2025, falling to a record low of 89.95 per dollar amid Trump’s tariff shocks, foreign outflows, and uncertainty around the India–US trade deal.

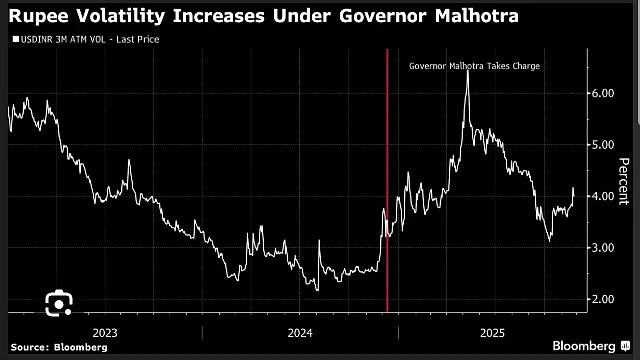

RBI’s shift toward a more hands-off intervention strategy under Governor Sanjay Malhotra has increased volatility.

Markets are split on the rupee’s path ahead, with traders seeing potential downside toward 94–95 if RBI steps back further.

The Indian Rupee has had a turbulent 2025. While there were several factors impacting the domestic currency, Donald Trump’s re-election as the US President has wreaked the most havoc.

The domino effect of Trump 2.0 is clear with his oscillating trade and tariff policies sending waves of panic across markets, especially shaking the emerging market economies.

From falling exports, the fee hike in highly-coveted H-1B visas to the jittery investor sentiment across the globe, the year was not kind to the rupee, which has fared the worst among its Asian peers.

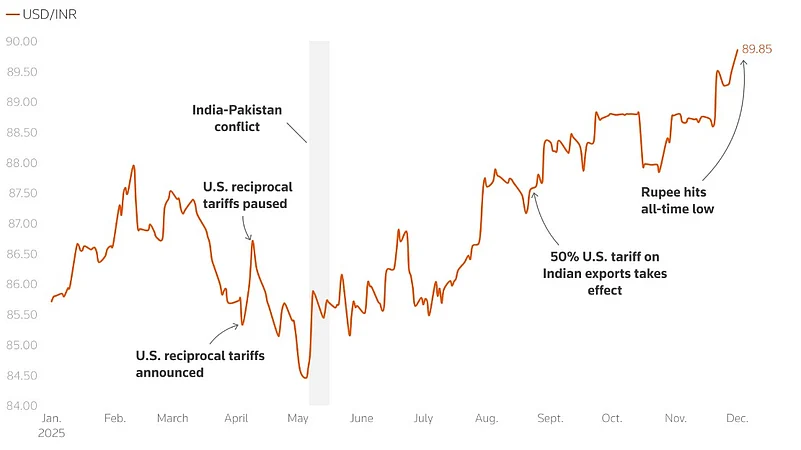

In fact, the rupee is on its way to its steepest annual decline since 2022, when the Russia-Ukraine war sent the oil prices soaring, which in turn weighed on India’s import bill. The rupee fell to an all-time low of 89.95 on December 2, just shy of the psychologically-crucial level of ₹90 per dollar.

How Tariffs Triggered Rupee's Slide

The rupee slipped for the first time in the first week of January as the dollar index, which measures the strength of the dollar against six major currencies, strengthened. On January 10, the rupee fell to 85.97 a dollar.

There were some signs of recovery in May as the rupee erased the losses and traded at 83.75 as investors remained sanguine about the India-US trade deal. What also helped was the Reserve Bank of India actively protecting the domestic currency through dollar sales in both the offshore non-deliverable forwards market and the onshore spot market. Foreign fund inflows on hopes of lower tariffs on India also fuelled companies to seek alternative markets such as India over China, a Bloomberg report said.

However, come July, Trump announced reciprocal tariffs and threatened to impose additional duties on Indian goods, stemming from New Delhi’s purchase of Russian energy, triggering the rupee’s worst monthly loss in nearly 3 years.

In August, Trump’s higher-than-expected 25% reciprocal tariff along with a 25% punitive tariff pushed the total India obligation to a sweeping 50%. This drove the rupee to a series of record lows, and consequently, a free fall to the crucial level of 88 per dollar.

The rupee weakened further in September as Trump urged his western allies and the European Union to impose similar punitive tariffs on India imports to pressurise New Delhi to curb its purchase of Russian oil. Further, the Trump administration’s plan to raise the H-1B visa fee roiled the market.

The exodus of foreign investors put the rupee under constant pressure through most of 2025. According to a Bloomberg report, foreign investors withdrew funds worth $16.3 billion from the Indian markets, further weakening the rupee.

The continuous foreign fund outflows were driven by the tariff policy uncertainty, a delayed US-India trade deal, high stock valuations and concerns about economic growth amid slowed exports owing to the tariffs.

The rupee was able to limit the pace of its depreciation as the RBI actively intervened in the foreign exchange market to curb the excessive volatility. RBI Governor Sanjay Malhotra repeatedly stressed that the central bank does not target any specific value against the dollar.

Under Malhotra, who took charge in December 2024, the rupee has seen the most volatility in recent times, as the central bank is now taking a more “hands-off approach”.

Traders say that the rupee quickly falls to record lows when the central bank is not aggressively selling the dollars to protect the rupee. “What we read from the RBI’s less aggressive intervention lately is that the central bank is now recalibrating its intervention approach,” a senior FX official at a US-based bank said. “They must have been rethinking it as the liquidity drainage and consistent depletion of the foreign exchange assets may not be sustainable in the long run,” he added.

The domestic currency has depreciated over 4% against the greenback this year. What makes the rupee’s fall this stark is the fact that the dollar index has not strengthened sharply and still remains below the key mark of 100. Moreover, other major Asian currencies, including the Thai baht, the Malaysian ringgit and the South Korean won, have all strengthened against the greenback broadly.

The key driver for the rupee’s decline is India staring at an aggressively high export duty, as per reports by Bloomberg. A widening current account deficit – more imports over exports – also dragged the rupee to a lifetime low as other emerging countries like South Korea and Thailand export more. As per a HSBC report, the country’s CAD is projected to widen to 1.4% of GDP in FY26 from 0.6% last year.

IMF Reclassifies RBI’s FX Strategy

The International Monetary Fund (IMF) reclassified India’s de facto exchange rate regime to a “crawling peg” last week, two years after classifying it as “stabilised” from a “floating” system. The “crawl-like arrangement” involves small and gradual adjustments to a currency to reflect differences in inflation between a country and its trading partner. In an interview with Bloomberg, Malhotra downplayed the rupee's fall, saying it is expected given the inflation between India and advanced economies.

A crawl-like arrangement is when the exchange rate remains within “narrow margin of 2% relative to statistically identified trend for six months or more, and the exchange rate arrangement cannot be considered as floating”, the IMF says.

"While the exchange rate has exhibited an increasing two-way movement this year, there remains room for an additional exchange rate flexibility," the IMF said. The global body added that the reclassification will allow for a greater exchange rate flexibility that would help absorb external shocks and reduce the need for costly reserve accumulation, and encourage market development. The rupee's 1-year realised volatility has jumped above 5% compared to below 2% before Malhotra became RBI’s governor, a Reuters report said.

The IMF directors see space for RBI’s Monetary Policy Committee to cut rates further owing to low inflation and recommend caution over the impact of tariffs on the consolidation of fiscal plan. Market participants remain divided over the policy outcome as the RBI rate-setting panel meets from December 3-5 for the last monetary policy review of the year. Most economists expect a status quo owing to the consistent GDP growth over the last two quarters, while others expect a 25 basis points reduction in the repo rate.

Rupee’s Road Ahead

Currently, the market sentiment around the rupee is mixed and there is a possibility of it rebounding in the medium term, said the FX official at the foreign bank. Earlier in the week, reports from Wall Street suggested that the Indian markets are poised for a rebound in 2026, with the rupee being one of the currencies with the biggest potential to bounce back.

“The demand (for dollars) has been overwhelming, which is putting pressure on the rupee, especially with our widening trade data,” he said. “The rupee’s pace of depreciation and trajectory is now completely based on the RBI, if it (RBI) lets the rupee fall, it can fall as low as 94-95 a dollar, or if they intervene, it may trade around 89-90 by year end.”

Market participants are now eyeing the policy decision and a forward guidance, and any comments on exchange rate policy by RBI’s MPC members. All eyes are also on an India-US trade deal, which has entered its final stage. Traders are also expecting the dollar to weaken in 2026 as the likelihood of more interest rate cuts by the US Federal Open Market Committee under a Trump-preferred chair will negatively impact the dollar, thereby supporting the rupee. US Federal Reserve chair Jerome Powell’s tenure will end in May 2026.

On Tuesday, the rupee posted its fifth consecutive fall, dropping to a low of 89.9475 before settling at 89.87 a dollar.