Nvidia may invest up to $100 billion to build OpenAI data-centre and chips

Staged funding ties tranches to each gigawatt deployed, targeting at least 10 GW

Initial $10 billion upfront; subsequent tranches released per gigawatt achieved

Plan uses millions of Nvidia AI chips, deepens vendor-investor entanglement concerns

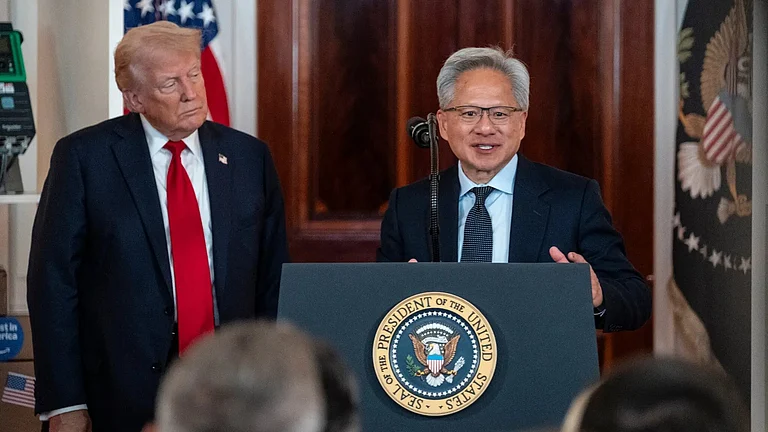

Nvidia and OpenAI said on Monday they have signed a letter of intent under which Nvidia may invest as much as $100 billion to support new data centres and related AI infrastructure for the maker of ChatGPT.

The multibillion-dollar arrangement, structured as staged investments tied to deployed computing capacity, would support the construction of at least 10 gigawatts of data-centre power and make Nvidia both a supplier and a major financial backer of one of the industry’s most important AI firms.

An initial $10 billion will be provided upon signing, with subsequent tranches released as each gigawatt of deployment is achieved. This phased approach ties the flow of funds directly to the pace of infrastructure expansion.

Deal Details

At its core, the partnership is designed to supercharge computing power. It plans on deploying the equivalent of four–five million Nvidia AI chips across the new facilities, with deliveries expected to begin as early as late 2026 on Nvidia’s next-generation platform.

This massive rollout positions Nvidia as the backbone of OpenAI’s data and compute needs in the coming years.

The scale of the project is staggering. The 10 gigawatts of planned data-centre capacity is comparable to the peak electricity demand of a major city, underscoring just how energy-intensive large-scale AI infrastructure has become. If completed as planned, it would mark one of the largest single compute expansions in the history of the tech industry.

On the commercial side, the arrangement balances investment with equity. Nvidia will receive a stake in OpenAI as part of the transaction, while OpenAI will channel the capital back into purchasing Nvidia’s systems. Both companies have said that definitive terms of the deal will be finalised in the coming weeks.

Strategic & Market Impact

The pact aims to secure the vast amounts of specialised hardware and power OpenAI needs to train and run ever-larger AI models. For Nvidia, the arrangement locks in demand for its accelerators and deepens commercial ties with a marquee AI customer.

At the same time, the transaction amplifies concerns about concentration of compute and commercial entanglement in the AI stack.

Critics say the deal may reinforce Nvidia’s market power in AI accelerators and blur the line between vendor and investor, a “circular” dynamic in which Nvidia funds customers who then buy more Nvidia chips. That combination could raise competitive and regulatory scrutiny.

OpenAI already has major partnerships to secure capacity, notably with Microsoft and a global Stargate initiative involving Oracle and SoftBank, and has been exploring additional compute avenues, including bespoke chip efforts. The new Nvidia arrangement complements but does not replace those moves, industry insiders say.

Other cloud builders and hyperscalers are also rapidly expanding AI capacity. Microsoft, Oracle and Meta have disclosed multibillion-dollar commitments to data-centre buildouts this year. Analysts note the collective spending to scale AI infrastructure now runs into the hundreds of billions globally.

Broader Implications

Deploying 10 GW of compute will carry significant energy and infrastructure implications, from site selection and power procurement to cooling and grid impact. It also highlights the bottleneck in specialised AI chips and the race among large AI players to secure long-term supply, capacity and favourable commercial terms.

For rivals, chipmakers, cloud providers and AI model makers, the deal raises the stakes: access to scale compute may determine who can train and operate the most advanced models.

OpenAI, now one of the world’s most valuable private tech firms, has been raising capital and reshaping partnerships to support faster product rollout and larger models.

Microsoft remains a major strategic investor and cloud partner, while Oracle and SoftBank are part of broad infrastructure projects. The new Nvidia investment would mark a further shift toward deep, capital-intensive infrastructure commitments across the AI ecosystem.