AVT Natural Products has at various points in time popped up on the radar of value investors as well as tipsters. For the most part, the company has been seen as one with great potential given the addressable market for food and feed ingredients. However, that potential has not entirely come to fruition. Part of the Rs 30 billion AVT Group, promoter Ajit Thomas also controls flagship AV Thomas and Co, AVT McCormick Ingredients, AVT Leather and Allied, and AVT Gavia among others. These private entities are not subsidiaries of the listed company.

Through its processing facilities at Vazhakulam (Kerala), Tiptur (Karnataka) and Sathyamangalam (Tamil Nadu), AVT Natural supplies marigold extracts for eye care, food colouring and poultry pigmentation, spice oleoresin and oils for food colouring and flavouring, value-added tea — decaffeinated and instant, and has recently entered animal nutrition products.

Less than 5% of the company’s revenue comes from the domestic market. It did try to grow its India revenue by launching health supplements under the Optim Health brand but nothing much came out of it. It was launched in December 2013 with a lot of fanfare but now only a few of their products seem available

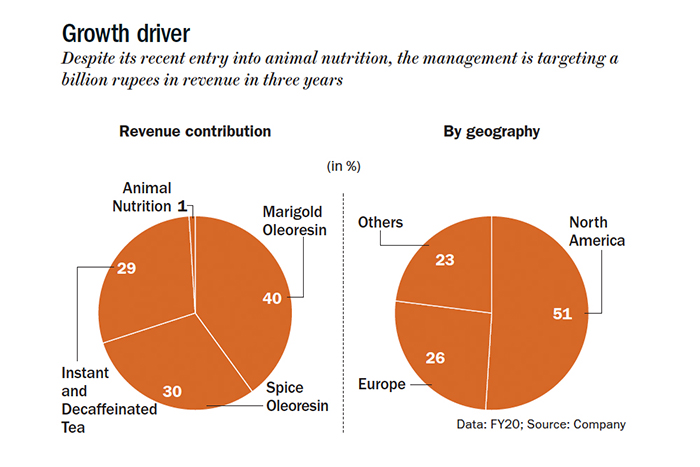

Though the company is a leader in food-grade marigold oleoresin, it hasn’t really reflected in the numbers. In fact, over the years, the contribution of marigold oleoresin to overall revenue has been decreasing. In FY20, it stood at 40% compared with 60% in FY14 (See: Growth driver). Total revenue has increased from Rs 2.93 billion to Rs 3.96 billion during the same period.

Though the company is a leader in food-grade marigold oleoresin, it hasn’t really reflected in the numbers. In fact, over the years, the contribution of marigold oleoresin to overall revenue has been decreasing. In FY20, it stood at 40% compared with 60% in FY14 (See: Growth driver). Total revenue has increased from Rs 2.93 billion to Rs 3.96 billion during the same period.

“AVT Natural’s operating margins and return on capital employed remained at moderate levels in the recent fiscals (except in FY20) owing to the rising revenue contribution from the lower-margin spices and beverage segments and reduction in contribution levels from the marigold segment since FY15. Post the improvement seen in FY20, the operating margins are expected to reduce to the earlier steady-state levels (12-13%) with the withdrawal of the Merchandise Export Incentive Scheme post-December 2020,” state ICRA analysts Jayanta Roy and Balaji M in their latest rating update.

Buyer of first resort

“Even in marigold oleoresins, they are the supplier to user industry, making them a B2B player. In a fragmented sector, most B2B players do not have pricing power,” points out independent investor Ambareesh Baliga. Given that the company does not provide a detailed breakup of its various businesses, it is not clear what margins they have, either on the B2B side or the B2C side of the business and how much of the company’s natural ingredients are consumed in-house. What’s clear though is the core business is characterised by high working capital requirement, driven by the need to stock up raw material and intense competition which restricts pricing power.

In marigold oleoresin, it competes with Chinese companies and in spice oleoresin, the competition comprises of Indian companies such as Synthite and Plant Lipids. Synthite has more than 30% share in the global oleoresin market, having made its start in 1972. For food-grade marigold oleoresin, AVT Natural’s biggest customer is Kemin Industries and for feedgrade, it is Kemin and multiple other customers spread over Mexico and Spain.

Having been inked in November 2008, the Kemin partnership goes back more than a decade and has now been extended till May 2028. The Iowa-based Kemin itself does nearly a billion dollars in revenue but along with marigold and rosemary extracts, it also supplies ingredients extracted from oregano, spearmint, and potatoes, not to mention its other divisions such as pet food, aquaculture, textile, biofuels, and animal vaccines.

This long partnership notwithstanding, customer concentration seems glaringly high. In FY20, AVT Natural’s top five customers contributed 55% of revenue of which Kemin’s share was 30%. While the existing offtake agreement helps, Kemin Health operates in a strongly regulated market and any untoward development would equally affect AVT Natural. The FY20 annual report states — “two customers accounted for 32.5% of revenue and three customers accounted for 38.06% of the receivables.” Is this level of customer concentration a cause for concern? “The customer concentration is on the higher side but if the history of relationship is long, it’s also a strength,” says Baliga.

In Kemin we trust

For now, in oleoresins, except the Kemin supply agreement, there is nothing that differentiates AVT Natural from market leader Synthite or a relative newcomer such as OmniActive Health Technologies. It is this relationship that the management is banking on to expand its product portfolio and margins in oleoresins. Post FY17, operating margin has consistently headed south but for the uptick in FY20 due to supply disruption in China. The management mentioned in the FY20 annual report, “Increasing Chinese competition resulted in subdued price levels for the product in the global market for the most part of the year. But the prices firmed up substantially in the last quarter owing to uncertainties posed by the COVID-19 situation in China, which allowed the company to reap benefits.”

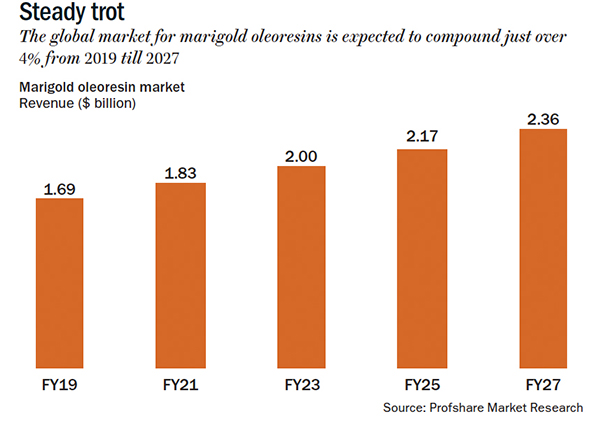

According to Zion Market Research, the global market for oleoresins is expected to grow from $1.22 billion in 2018 to $1.94 billion in 2026, at CAGR of 6%. Within that, the market for marigold oleoresin is expected to compound just over 4% (See: Steady trot). While the margin in marigold oleoresins is reportedly twice that in spice oleoresins, nutraceuticals is where the big action is, and Mordor Intelligence expects the global market to grow from $379 billion in 2017 to $671 billion in 2024. But where there is an opportunity, so are the Chinese. They already dominate feed-grade oleoresins, are making a play for foodgrade oleoresins and flexing their muscles in spice extraction.

According to Zion Market Research, the global market for oleoresins is expected to grow from $1.22 billion in 2018 to $1.94 billion in 2026, at CAGR of 6%. Within that, the market for marigold oleoresin is expected to compound just over 4% (See: Steady trot). While the margin in marigold oleoresins is reportedly twice that in spice oleoresins, nutraceuticals is where the big action is, and Mordor Intelligence expects the global market to grow from $379 billion in 2017 to $671 billion in 2024. But where there is an opportunity, so are the Chinese. They already dominate feed-grade oleoresins, are making a play for foodgrade oleoresins and flexing their muscles in spice extraction.

Hence, AVT Natural has stepped up its R&D spend. In FY20, the company spent Rs 106.31 million compared to Rs44.33 million in FY18. The move towards hybrid marigold seeds is to counter seasonal dependence on raw material and lower working capital requirement. The company also wants to transition from “being a supplier of ingredients to provide more formulation-based applications to move up the value chain and capture greater margin and stickiness.”

While the FY20 annual report had mentioned: “Our efforts have resulted in new complementary product lines with nutritional applications, new spice extract offerings, and new functional ingredients with various cross-division applications,” the company did not respond to a detailed questionnaire sent by Outlook Business. Baliga says, “The company seems to have focus on R&D but because of the management’s non-communication, it is unclear how many new ideas incubated are converted to commercial opportunities.”

Even as FY21 turned out to be another blockbuster year, to supplement marigold oleoresins, the company has turned to rosemary-based extracts. “We have entered into a strategic five-year agreement with Kemin, one of the largest players in the antioxidant space, to service their requirement for this product,” stated the FY20 annual report. The management has projected the rosemary extracts potential at 600 MT and contribution from Kemin in the first year is estimated to be Rs 720 million. The global rosemary extract market is expected to grow from $244 million in 2019 to $314 million in 2025, at CAGR of 4.28%, according to Industry Research.

Steady cash flow

Post the recent Tiptur expansion, the strategy is to use that plant exclusively for marigold and rosemary oleoresin and the other two facilities for value-added tea and animal nutrition on which the management is majorly bullish. For tea, the management had targeted a volume of 1,000 MT in FY21. “The company has worked closely with key multinationals to meet their specific requirements through consistent innovation and product development. This focused approach has yielded positive results and continues to consolidate the company’s position in the value-added tea market,” stated the FY20 annual report.

In spice oleoresins, the focus continues to be on specialty products to protect margins. “While its revenues in FY20 were driven by growth in the marigold segment, its performance in FY21 has been supported by improved revenues from the spices and beverage segments, driven by continuous focus on new products and customer additions,” mentions the ICRA report.

The company has set up a 100% owned subsidiary in Mexico for marketing animal nutrition products in the South American market. Another 100% subsidiary in the UK is the marketing arm for decaffeinated tea and instant tea. While the Mexico arm logged FY20 sales of Rs 21.7 million and loss of Rs 33.3 million, the UK arm had sales of Rs 590 million and profit of Rs 11.5 million for FY20. Though it recently entered the animal nutrition products market, the management is targeting top-line of Rs 1 billion in three years.

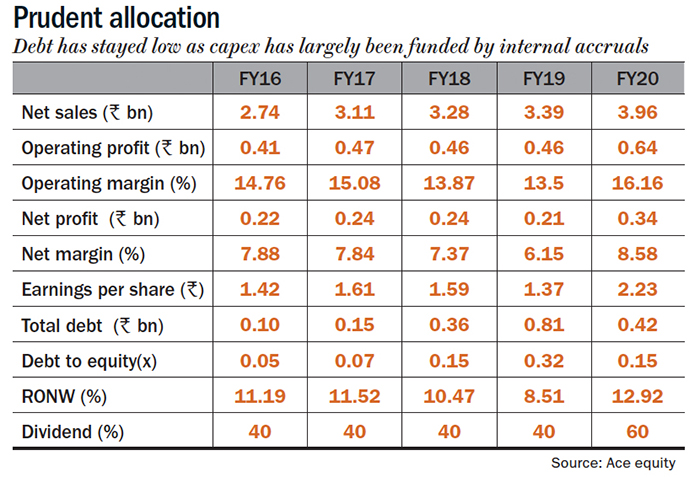

After the high capex in the past two years, the management has no capex planned for the next two years unless for capacity addition in instant tea where it caters to buyers like Unilever and Nestle. “Despite the high working capital funding requirements in the business, stable accruals have limited dependence on external debt over the years. Key credit metrics including total debt to operating profit and operating profit to interest and finance charges stood at around 1.1x and 20x, respectively in H1FY21,” states the ICRA report (See: Prudent allocation).

Tight-lipped

Despite being a major player in marigold oleoresin, the stock has hardly any analyst coverage. That apart, AVT Natural does tick a lot of boxes on a prospective investor’s list — established business model, high promoter holding, low debt, regular dividend, high on compliance, 100% holding in subsidiaries. But the risk is that nothing changes over the next few years and the management’s new initiatives do not work out.

While family-owned companies tend to hold their cards close to their chest, it can be discomforting for institutional investors. In the FY20 annual meeting, to a shareholder question on management’s efforts to improve the company image through investor relations exercise like concall, quarterly presentations and meeting investors, CFO Ramadas replied, “We don’t have any plans at present.”

Baliga says there is a difference between investing in a business and buying a stock for a short pop. “As a long-term investor, you want to know how the business will shape up in the next two to five years. If the management continues to be non-communicative, why would analysts or investors be interested when there is enough choice in the market,” he asks.

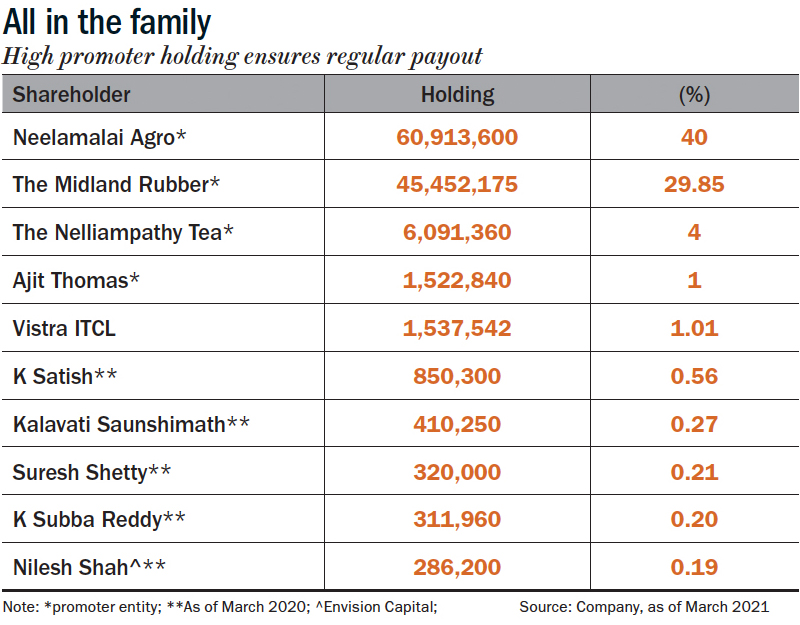

Conventionally, high promoter holding is a source of comfort (See: All in the family). But if the promoter holds 75% and much of the non-promoter holding is spread among investors holding less than 2,000 shares each, there is no guarantee that going forward the promoter won’t take the company private. That applies equally to MNCs as well as Indian promoters when the company finally moves into a higher growth orbit. “Currently, the only trigger for the stock is management buying out the remaining public holding. If they want to take it private, it will have to be at a premium to the prevailing price. If the promoters are holding 75% stake and do not want to communicate, they might as well delist,” says Baliga.

Interestingly, Neelamalai Agro which is listed on the BSE holds 40% in AVT Natural. Its market cap is about Rs 1 billion, an effective holding company discount of 70% compared to AVT Natural’s market cap. While the discount does seem on the higher side, it might also be discounting the abysmal liquidity in the holding company. Neelamalai recently did a buyback at Rs 1,600/share and the promoters increased their holding from 67.45% to 68.02%.

The flipside to low liquidity — if the company starts performing exceptionally well, then that low float also pushes up price rapidly. Despite the low free float in AVT Natural, daily trading volume regularly tops 100,000 shares on the NSE. Delivery volume has consistently averaged 55% over the past three months as the stock retraced 20% from its then 52-week high in January. That was on the back of financial performance for nine months ended December 2020, as the company notched up revenue of Rs 3.6 billion and net profit of Rs 335 million. Much of that bump up was in Q1FY21 after the windfall in Q4FY20.

“While the company can be compared in terms of business to SH Kelkar, a closer comparison with respect to P/E multiple, given its size, would be food colour companies such as Vidhi Specialty, Dynemic Products or antioxidants company Camlin Fine Sciences, which is trading at one-year forward multiple of 15x,” points out Baliga. At its current price of Rs 63, AVT Natural trades at a trailing-twelve-month multiple of 23x. According to Value Research data, having hit a high of 40x in 2017, the stock has a 10- year median P/E of 17x. The stock has a history of going ballistic, correcting 50% and bottoming out at P/E of 10x.

“Growing revenue contribution from the higher-margin marigold segment in the recent quarters, better contribution levels generated in the new products launches and improving operating efficiencies aided by the recent manufacturing facility established in Karnataka are likely to support margin expansion for AVT Natural in the coming fiscals,” state the ICRA analysts. If the company manages to stay on the growth track, existing investors could soon be jiving to Genda Phool.