Reliance Jio is planning a potential IPO this year, aiming to sell about 2.5% stake that could raise over $4 billion and become India’s largest listing.

Valued at around $180 billion by Jefferies, Jio is working with Kotak Mahindra Capital and Morgan Stanley and may file its DRHP with SEBI in coming months.

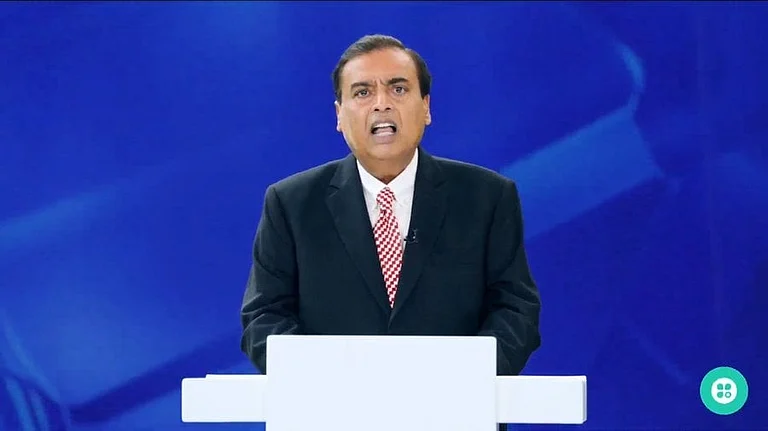

Announced by Mukesh Ambani, the IPO is targeted for the first half of 2026, following Jio’s expansion to over 500 million customers worldwide.

Reliance Jio Platforms is preparing for what could be the biggest initial public offering (IPO) India has ever seen. According to a Reuters report, the company is considering selling about 2.5% of its shares in the IPO expected this year. If this plan goes ahead, the listing could raise more than $4 billion.

The buzz around the IPO comes after investment bank Jefferies valued Jio at around $180 billion in November. At that valuation, selling a 2.5% stake would fetch close to $4.5 billion, making it one of the largest IPOs in the country.

Jio is already working closely with leading investment banks Kotak Mahindra Capital and Morgan Stanley to move the listing process forward, according to a separate report by ET Now. The report had suggested that the company may file its draft red herring prospectus (DRHP) with SEBI within the next two to three months.

Ambani had first officially announced plans for Jio’s IPO at Reliance Industries’ 48th annual general meeting (AGM) held in August 2025.

"Jio is making all arrangements to file for its IPO. We are aiming to list Jio by the first half of 2026, subject to approvals," he had said. "I assure you that this will demonstrate that Jio is capable of creating the same quantum of value as our global counterparts. I am sure that it will be a very attractive opportunity for all investors," Ambani added.

The IPO announcement came after Jio marked an important milestone, the completion of 10 years of operations. Additionally, Jio Chairman and Ambani's son Akash had said that the company crossed 500 million customers, making it one of the largest telecom operators globally.

The same AGM also highlighted Reliance’s growing focus on AI. Google CEO Sundar Pichai joined the meeting virtually to announce a partnership with Reliance to set up a dedicated cloud region in Gujarat's Jamnagar for Reliance’s businesses.

Meta CEO Mark Zuckerberg also revealed a joint venture (JV) with Reliance to build India-focused, enterprise-ready AI solutions. This partnership will combine Meta’s open-source LLaMA models with Reliance’s scale to offer AI tools across industries.