Since 5G’s launch in Oct 2022, Jio and Airtel have spent thousands of crores on rollout, offering unlimited data on most of the plans.

Analysts now expect a 15% tariff hike by end-2025, marking a return to pay-per-use pricing.

The recent withdrawal of 1GB/day entry plans and Jio’s IPO push point to more expected hikes ahead.

Since the rollout of 5G in India in October 2022, top telecom giants Bharti Airtel and Reliance Jio have spent thousands of crore rupees deploying the network across the country. During this period they also offered unlimited data on all postpaid and prepaid plans with daily allowances of 2GB or more.

Now analysts say the companies want to gradually monetise the 5G network with a sharp 15% tariff hike expected by the end of 2025, returning to a pre-Jio tariff structure where users pay according to their usage.

Although a tariff hike was expected, the withdrawal of entry-level 1GB/day plans in August along with Reliance Jio Infocomm’s announcement of a planned initial public offering (IPO) has added weight to the likelihood of higher prices this year.

Notably, it was Jio that introduced the current low-cost all-inclusive data plans in 2016 which led to India having one of the lowest average revenue per user (ARPU) rates at $2.4 per month (₹211) today compared with the global average of $8–10 per month.

Why Hike Tariffs Now?

Analysts at JM Financial Services, the securities brokerage and research arm of JM Financial group, led by Dayanand Mittal, said on September 5 that there is improved visibility of a tariff hike of about 15% in November–December 2025 with regular increases thereafter. This is largely due to Jio’s likely IPO in the first half of the 2026 calendar year.

They added that the hike would be further aided by the government’s intent to ensure a ‘3+1’ player market. The idea was first proposed in 2021 when the industry called for a policy to sustain three private players alongside a fourth operator from the public sector (typically BSNL/MTNL).

“Moreover 5G monetisation is a potential opportunity in the future with Bharti and Jio’s 5G subscriber penetration already at 42%” they said.

Multiple brokerages have said that Mukesh Ambani’s annual general meeting announcement to list Reliance Jio increases the likelihood of a sharp tariff hike. At the current holding structure investors might "apply a holdco [holding company] discount to the embedded stake", meaning Jio’s worth within Reliance’s market capitalisation may be valued lower than its full estimated value.

This is because holding companies often face additional costs, management layers, tax liabilities and reduced transparency making indirect ownership less valuable. To offset this Jio would likely rely on a telecom sector re-rating and a potential market premium.

“An IPO is a positive milestone but as structured it could impose a holdco discount at the Reliance Industries level compared with a cleaner demerger. This would however be more than compensated by a re-rating of the telecom sector and a likely market premium” said Antique Stock Broking, a Mumbai-based broking and research firm, on August 30.

Further tariff hikes are key to achieving the government’s 3+1 market objective by ensuring Vodafone Idea’s (Vi) long-term sustainability wrote JM Financial last week. Since Jio’s entry on September 5, 2016 the Indian telecom market has sharply consolidated.

In early 2010 the sector was highly fragmented with over ten private operators—such as Reliance Communications, Aircel, Telenor, Tata Teleservices, MTS and Videocon—struggling with weak balance sheets, irrational pricing and spectrum liabilities according to Centrum Institutional Research, an equity research firm. Their ARPUs had fallen below ₹100, profitability was under pressure and returns on capital were unsustainable.

Reliance Jio’s entry transformed the sector, offering free voice and ultra-low-cost data and forcing rivals to cut tariffs and triggering consolidation. Vodafone India merged with Idea Cellular, Bharti Airtel absorbed Telenor and Tata Teleservices’ consumer units and smaller operators exited.

By 2018, the market consolidated into three private players plus BSNL/MTNL. State-owned BSNL and MTNL as well as Vi were aided by government reforms in 2021, including adjusted gross revenue (AGR) rationalisation and spectrum charge removal. However, Vi still owes over ₹84,000 crore in old government dues and BSNL is yet to fully launch its 4G and 5G networks.

With banks hesitant to fund Vi’s capital expenditure plans, analysts say multiple rounds of tariff hikes will be required to reach sustainable levels.

By July 2025, India’s 5G penetration in Q1 2025–26 improved to about 42% for both Jio and Airtel with roughly 210mn and 153mn subscribers respectively, aided by improved affordability of 5G smartphones.

“In the absence of killer 5G use cases and due to 5G smartphone affordability constraints, monetisation has been limited so far except via overall tariff hikes, push towards high-ARPU plans, lower cost per GB of data consumed and aggressive rollout of fixed wireless access services,” said JM Financial. They added that rising 5G penetration and users’ adaptation to high-speed data provide opportunities to monetise 5G in the future with premium pricing and potential killer 5G use cases accelerating monetisation.

5G Rollout Costs

According to Research and Markets, a global market research firm, India’s telecom sector in 2024 saw $14bn in capex and $41bn in revenues with a capital intensity above 30% for three consecutive years.

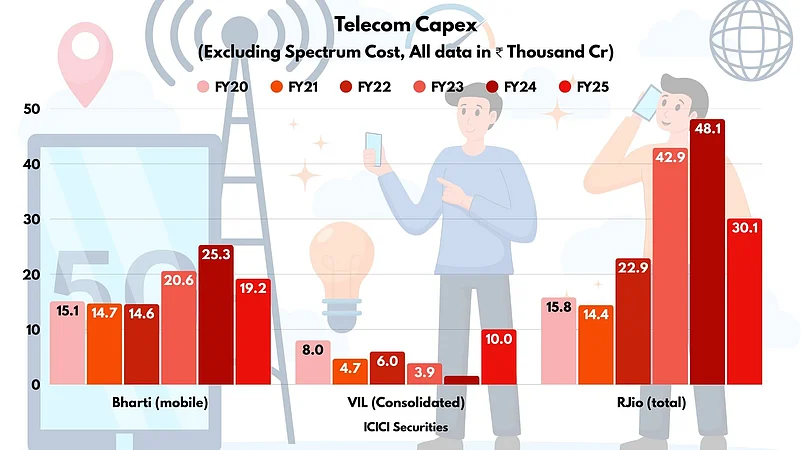

A July report by ICICI Securities noted that during 2020–25 sector revenue grew at a compound annual growth rate (CAGR) of 13.4% while capex rose at 8.8% CAGR. In absolute terms between 2019–20 and 2024–25 industry AGR grew from ₹1.425 lakh crore to ₹2.674 lakh crore.

During the same period Bharti’s mobile capex moved from ₹15,100 crore in 2019–20 to ₹19,200 crore in 2024–25 peaking at ₹25,300 crore in 2023–24. Reliance Jio’s total capex rose from ₹15,800 crore in 2019–20 to ₹48,100 crore in 2023–24 before easing to ₹30,100 crore in 2024–25.

Vi’s consolidated capex fluctuated, falling from ₹8,000 crore in 2019–20 to ₹1,600 crore in 2023–24 before rebounding to ₹10,000 crore in 2024–25 after its follow-up public offering raised ₹18,000 crore in 2023–24.

In aggregate, industry capex grew from ₹38,900 crore in 2019–20 to ₹59,300 crore in 2024–25 largely for 4G and 5G rollout. Notably, this excludes ₹1.71 lakh crore spent on spectrum auctions in 2022 and 2024.

This combined expenditure pushed the industry’s total debt to around ₹6.6 lakh crore as of March 31, 2025 according to Investment Information and Credit Rating Agency (ICRA). Ratings agencies expect capex intensity to slow but predict telecom capex around ₹3 lakh crore over the next four to five years keeping total debt elevated.

What Can Users Expect?

In August, Jio and Bharti Airtel indicated their intention to hike tariffs by removing 1GB/day plans. JM Financial estimates that around 20–25% of Jio’s subscribers are on 1GB/day plans; removing these could increase Jio’s ARPU by ₹11–13/month. Similarly, 18–20% of Bharti’s subscribers are likely on 1GB/day plans potentially raising ARPU by ₹10–11/month. For Vi discontinuing 1GB/day plans could increase ARPU by ₹13–14/month.

Airtel and Jio have consistently referred to such measures as "tariff repair". In the Q1 2025–26 earnings call Bharti management said revenue growth would need to come from higher ARPUs, increased customer volumes and tariff repair. Earlier in Q4 2024–25 they stressed that the "one-size-fits-all" pricing model is broken and unsuitable for upgrades.

Vi in Q4 2024–25 highlighted tariff hikes as necessary for fair returns and future capex noting that heavy data users should pay proportionally. In September 2024 Vi confirmed the next tariff increase of similar size had already been factored in.

JM Financial analysts note that ARPU growth is likely as the industry shifts from one-size-fits-all pricing to a ‘pay-as-you-use’ structure where heavier users pay more. This allows minimal hikes for entry-level tariffs while increasing charges on higher-usage customers.

As the 5G capital expenditure cycle nears its end, telecom companies appear to be passing costs onto users now accustomed to higher data plans. Whether these expected hikes will curb India’s growing appetite for mobile internet remains to be seen.