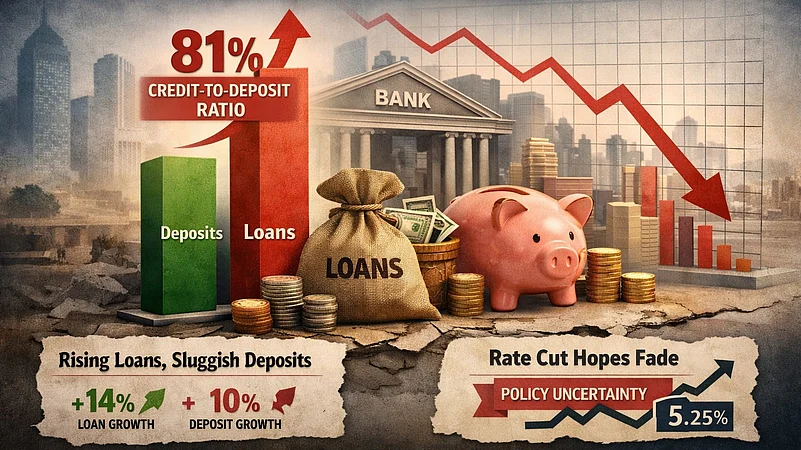

India’s banking system saw its credit-to-deposit ratio rise to a record 81% in the December quarter

Major banks, including HDFC Bank, PNB and Union Bank, reported credit growth outpacing deposits, while some lenders saw outright declines in advances or deposits.

Analysts warn the imbalance could push banks to raise deposit rates and constrain the RBI’s room for further rate cuts.

The bank loan-to-deposit ratio reached an all-time high of 81% in the quarter ended December, highlighting the widening gap between credit growth and deposit mobilisation. HDFC Bank, the country’s largest private-sector lender, reported loan growth of 12% year-on-year in the December quarter, while deposits rose by 11.5%, slowing from a 16% increase in the June quarter, reports said.

The broader banking system also recorded faster credit growth than deposit mobilisation. According to data provided by Bank of Baroda, global advances rose 14.57% year-on-year, while global deposits increased by only 10.25%, The Economic Times reported. State-owned Punjab National Bank reported an 8.5% rise in global deposits, while global credit grew 11%. Union Bank of India’s global advances rose 7.13%, while deposits increased 3.4%, the report said.

The broader banking system also recorded faster credit growth than deposit mobilisation. According to data provided by Bank of Baroda, global advances rose 14.57% year-on-year, while global deposits increased by only 10.25%, The Economic Times reported. State-owned Punjab National Bank reported an 8.5% rise in global deposits, while global credit grew 11%. Union Bank of India’s global advances rose 7.13%, while deposits increased 3.4%, the report said.

Axis Bank reported a 14.1% year-on-year rise in gross advances, while deposits grew 15%. Kotak Mahindra Bank recorded a 16% growth in advances, with deposit growth at 14.6%. Yes Bank and RBL Bank reported deposit growth of 5.5% and 12%, respectively, while loan growth stood at 5.2% and 13%. IndusInd Bank’s net advances declined by 13.1%, while deposits fell 3.8%.

Among non-banking financial companies (NBFCs), Bajaj Finance reported loan growth of 15% in the October–December quarter, with assets under management (AUM) rising 22% year-on-year. Deposits stood at ₹7,100 crore as of December 31.

With the credit-to-deposit ratio at an all-time high, analysts flag that the imbalance could force banks to raise deposit rates or limit the Reserve Bank of India’s Monetary Policy Committee’s room to cut policy rates. The MPC cumulatively reduced rates by 125 basis points in 2025, bringing the benchmark repo rate down to 5.25% from 6.50% in December 2024.

The MPC is scheduled to meet next from February 4–6, with market participants divided on the policy outlook. While most economists expect a status quo, some traders are factoring in a 25-basis-point rate cut.