The central government is reportedly intervening as Tata Sons faces internal conflict among Tata Trusts.

The turbulence coincides with the expiry of the RBI’s mandate requiring Tata Sons to list on the stock market.

Two senior Cabinet ministers are expected to meet Tata Trusts chairman Noel Tata and Tata Sons chairman N Chandrasekaran in New Delhi.

The central government is reportedly stepping in to manage the turbulence faced by India’s most valuable conglomerate, Tata Sons. The company’s majority shareholders, Tata Trusts, are locked in an internal conflict over the nomination of a director to the Tata Sons board. At the same time, the Reserve Bank of India’s (RBI) mandate requiring Tata Sons to list on the stock market has expired.

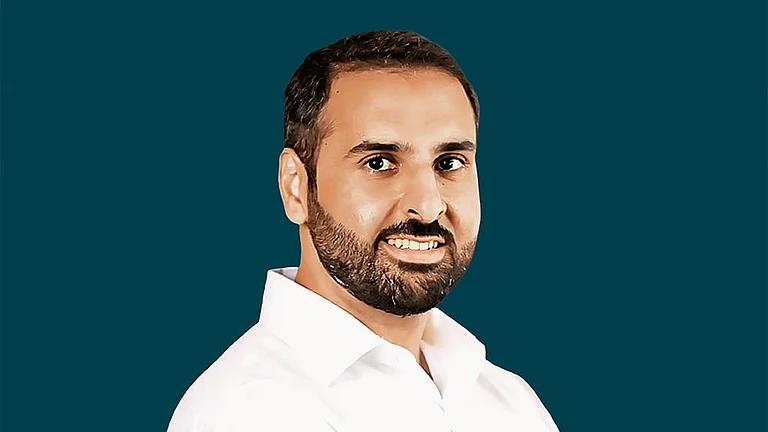

According to The Economic Times (ET), two senior Cabinet ministers are expected to meet key officials of the salt-to-steel conglomerate in New Delhi. Those attending reportedly include Tata Trusts chairman Noel Tata, vice-chairman Venu Srinivasan, Tata Sons chairman N Chandrasekaran, and Tata Trusts trustee Darius Khambata. The meeting is expected to take place early this week.

Tata Trusts’ Infighting

The 156-year-old group, which has interests in power, steel, IT, consumer goods, automobiles, and more, is owned by several Tata family trusts, including the Sir Dorabji Tata Trust and the Sir Ratan Tata Trust. Together, they control 65.30% of Tata Sons. The Mistry family, led by the Shapoorji Pallonji Group, holds 18.38%, while the remaining 16.32% is owned by other non-institutional investors.

The rift between the Tata and Mistry families dates back to the ouster of Cyrus Mistry from the group. However, the recent conflict surfaced earlier this year over the reappointment of Tata Trusts’ nominee Vijay Singh to the Tata Sons board.

Reports stated that four trustees, Mehli Mistry, Pramit Jhaveri, Jehangir HC Jehangir, and Darius Khambata, opposed the move. Those supporting Singh’s reappointment, including Tata Trusts chairman Noel Tata and vice-chairman Venu Srinivasan, both nominee directors on the Trusts’ board, were in the minority. Singh, a former Defence Secretary, subsequently resigned from the Tata Sons board.

According to reports from ET and Mint, the rift within Tata Trusts intensified after Ratan Tata’s death in October 2024 and centres on what four trustees describe as a lack of transparency. The dissenting trustees allege that two classes of trustees now exist, those privy to key decisions made by Tata Sons and those kept in the dark.

They claim information has been redacted, including details related to Article 121A of Tata Sons’ Articles of Association, which requires the Trusts’ prior approval for major transactions exceeding ₹100 crore. The dissenting trustees questioned why the three nominee directors, Noel Tata, Vijay Singh, and Venu Srinivasan, approved the reappointment of independent director Anita Marangoly George without consulting them.

The dispute comes at a time when Tata Trusts need to fill at least three seats on the Tata Sons board, appointments that cannot proceed until the nomination issue is resolved.

Tata Sons IPO Mandate

Meanwhile, the government is reportedly concerned over the expiry of the RBI’s directive for Tata Sons to list its shares on the stock market. The deadline expired on September 30. Tata Sons, registered as an upper-layer Non-Banking Financial Company (NBFC), was asked in 2022 to publicly list its shares within three years.

Before the deadline expired, Tata Sons requested the central bank to withdraw its upper-layer NBFC classification. The RBI is yet to take a decision on the matter.

RBI Governor Sanjay Malhotra told reporters earlier this month, “Any entity which has a registration can continue its business till that registration is cancelled.”

The Mistry family-led Shapoorji Pallonji Group has been pushing for Tata Sons to be listed to access liquidity from its roughly 18% stake. The group, which recently listed its EPC arm Afcons, has been under pressure due to heavy debt, some of which is secured against its Tata Sons holdings.

Tata Sons board has started talks with SP Group to help provide them an exit from the conglomerate.