Details of Tata Trusts' July 28 board meeting are becoming public. The meeting, which was supposed to discuss Tata Sons' growth prospects, appointment of new board members, and ways to avoid RBI's IPO mandate, seems to have taken a decision on the last of the three.

According to a Mint report, the Tata Trusts board led by Noel Tata passed a resolution asking Tata Sons to remain an unlisted entity. And to do so, hold talks with its largest minority shareholder, the Shapoorji Pallonji Group, for an exit.

Notably, Tata Sons was designated an upper-layer NBFC by the RBI in September 2022, mandating the 156-year-old company to get listed on stock exchanges within three years of the classification. The deadline for the same is set to expire in September this year.

In its annual report for FY25, Tata Sons said that it has asked RBI to remove it from the Upper Layer Core Investment Company (UL-CIC) category. These are considered systemically important core holding companies due to their size, interconnectedness, complexity, and risk profile. The classification brings stricter regulatory oversight, enhanced governance norms, higher capital requirements, and mandatory listing.

What Tata Trusts’ Resolution Says

"The Chairman of Tata Sons is requested to exercise best endeavours to ensure that Tata Sons does not change its current status as an unlisted private company and that Tata Sons fully engages with the Reserve Bank of India in this regard," said the resolution as per Mint. It added, "It was agreed at the Trustees meeting of 28th May to request the Chairman, Tata Sons, to explore all possible avenues for ensuring that there was no change in the status of Tata Sons as it currently stood. This included a dialogue with the minority shareholders, i.e. the SP Group, for providing an exit to them from Tata Sons."

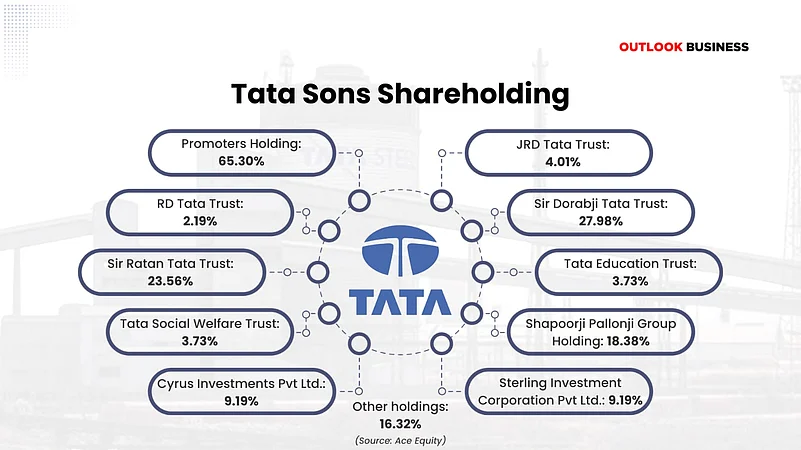

Tata Sons, which has over 323 subsidiaries, 39 associates, and 32 joint ventures, is majority owned by a group of family trusts. They together own 65.30% of the company. A majority of this is held by Sir Dorabji Tata Trust (27.98%) and Sir Ratan Tata Trust (23%).

The Shapoorji Pallonji Group owns 18.38% of Tata Sons via two of its entities—Cyrus Investments Pvt Ltd. (9.19%) and Sterling Investment Corporation Pvt Ltd. (9.19%). The remaining 16.32% is held by other non-institutional investors.

The Shapoorji Pallonji Group has reportedly pledged its shareholding in Tata Sons to service some of its debt. As per the terms of these pledges, lenders to the SP Group will have to offer the first right of refusal to Tata Sons if the pledges are invoked.

As per the company's annual report, Tata Group's total market capitalisation stands at ₹27,84,753 crore, of which ₹14,28,228 crore comes from its listed entities. The group netted ₹15,34,341 crore in revenue in FY25 with a net profit of ₹1,13,011 crore.

SP Group's Debt Problem

Any exit for the SP Group would bring them massive liquidity. The group, which owns companies like Afcons Infrastructure, Forbes & Company Ltd., and Gokak Textiles, was facing about ₹20,000 crore in external debt as of March 31, 2024, according to an ICRA report published in February.

However, it has since secured a $3.4 billion (₹28,322 crore) private financing deal, reportedly the largest of its kind, offering investors a 19.75% yield.

Amid the COVID-19 pandemic, the company’s debt had peaked at ₹37,170 crore in 2020.

The company has reportedly asked RBI to push for a public listing of Tata Sons, arguing that it would benefit all stakeholders.

Other decisions at the Tata Trusts meeting

According to a report by The Economic Times, the Tata Trusts board has approved the initiation of the process to extend N. Chandrasekaran’s term as Chairman of Tata Sons beyond February 2027. His continued leadership is seen as critical to ensuring strategic continuity as Tata Sons accelerates investments in emerging sectors.

The group is also infusing ₹30,000 crore into growth areas such as Tata Digital, Tata Electronics, Air India, as well as its defence and battery ventures—on top of the $120 billion it has already committed in recent years.