ITC and Godfrey Phillips' stocks fell in early trade after the Centre announced a new tax on cigarettes, effective February 1.

ITC hit a 52-week low, falling up to 5% on Friday, while Godfrey Phillips dropped 2.5%, extending their steep losses from the previous session.

Cigarettes will face higher taxes, with a new excise duty of ₹2,050-₹8,500 per 1,000 sticks imposed on top of the existing 40% GST.

Shares of the major tobacco companies, ITC and Godfrey Phillips, slumped on Friday's early trade after the Centre notified that a new excise duty will be imposed on cigarettes and other tobacco products, starting February 1, in addition to the existing GST tax.

ITC shares plummeted as low as 5% during the morning trade on Friday, reaching a 52-week low of ₹345.35. Meanwhile, the shares of Godfrey Philips tanked as low as 2.5%. Notably, ITC and Godfrey's stock declined almost 10% and 17%, respectively in the previous session.

The new excise duty, as notified by the Finance Ministry on December 31, say that cigarettes will now attract a duty in the range of ₹2,050 to ₹8,500 per 1,000 sticks, depending on cigarette length. The new levy will be imposed in addition to the existing 40% GST applicable on cigarettes, tobacco and similar products.

In a statement, JM Financial said, "We see this as significant negative for ITC as sharp duty hike will: (a) negatively impact volumes and meaningfully impact Cigarette EBIT, (b) mix could see deterioration and (c) concerns on illicit cigarette will also re-emerge."

"For ITC, which was seeing resilient cigarette volume growth in past few quarters, this levy has the effect of pushing possible catalysts further out," it added.

According to a report by The Economic Times, domestic brokerages have estimated the increase in additional levies to be 50%. The have reportedly said the prices of tobacco products could rise by anywhere between 20% and 25% in response to the duty increase.

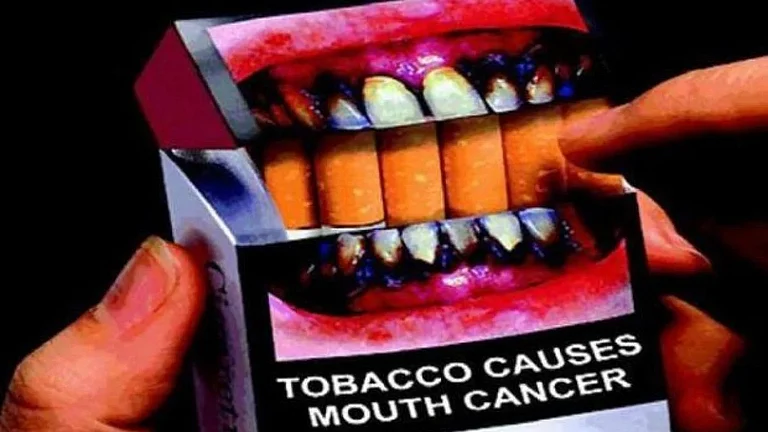

Taxes on cigarettes are complicated because they are charged in several layers.

Until now, the total tax on cigarettes had four main parts. First was a basic excise duty, which was a small fixed amount per 1,000 cigarettes. Second was the National Calamity Contingent Duty (NCCD), another fixed tax that varied depending on the type of cigarette. Third was GST, charged at 28%. Finally, there was a compensation cess, which itself had two parts, one charged as a percentage of the price and another charged as a fixed amount per 1,000 cigarettes.

In general, cigarettes with filters and longer length were taxed more heavily, while cigars and similar products faced the highest taxes.

From February 1, the compensation cess will be removed. To make up for this, the government has increased GST to 40% and sharply raised excise duty to between ₹2,050 and ₹8,500 per 1,000 cigarettes. The NCCD will continue unchanged.

According to Finance Ministry officials, cigarettes have become either equally affordable or even more affordable over the past ten years. This means their prices have not risen as fast as people’s incomes. This goes against global public health advice, which says tobacco should become less affordable over time.

The Ministry added that globally, more than 80 countries increase tobacco taxes every year, often linking them to inflation or setting tax hikes in advance for several years.