The Winter Session of Parliament begins today, with the government set to table the Central Excise Amendment Bill, 2025 and the Health Security and National Security Cess Bill, 2025.

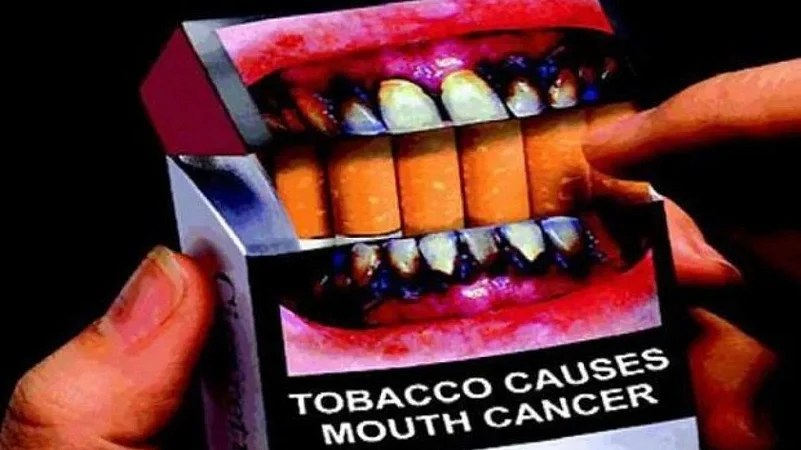

The bills propose replacing the compensation cess with higher excise duty on tobacco products and imposing a new cess on goods like pan masala.

Passage of the bills will help establish a permanent alternative tax structure as the compensation cess ends in 2026.

The Winter Session of Parliament begins today and will continue till December 19, with 15 sittings scheduled across the 19-day period. On Monday, the Centre is expected to introduce two bills in the Lok Sabha, aimed at levying excise duty on tobacco and tobacco products and imposing a new cess on the manufacture of pan masala.

The Central Excise Amendment Bill, 2025

The Central Excise Amendment Bill, 2025, will replace the Goods and Services Tax (GST) compensation cess currently levied on all tobacco products. The new levy is expected to ensure that the overall tax burden on products such as cigarettes, gutkha, pan masala, and others remains unchanged even after the expiry of the GST compensation cess.

As per reports, the Bill proposes increasing excise duty on tobacco products, replacing the compensation cess to maintain revenue neutrality. The objective, according to the statement of objects and reasons cited by PTI, is “to give the government the fiscal space to increase the rate of central excise duty on tobacco and tobacco products so as to protect tax incidence” once the cess ends.

The move follows the GST Council’s decision in September to scrap the compensation cess on all goods except tobacco and shift to a simplified two-rate GST structure.

The Health Security and National Security Cess Bill, 2025

Finance Minister Nirmala Sitharaman will also table the Health Security and National Security Cess Bill, 2025, which seeks to levy a cess on the manufacturing of specified goods such as pan masala, reports said. The Centre may later notify additional items to be included under this cess. Proceeds will be used to augment resources for national security expenditure and public health.

“Sin Goods” May Attract 40% GST

Currently, sin goods such as tobacco and pan masala attract 28% GST plus a compensation cess levied at varied rates — in some cases reaching up to 290% for smoking mixtures. With the 28% rate structure being phased out, these products may now move to the highest slab of 40% GST.

Once the compensation cess ends, the sale of tobacco and related products will attract GST plus excise duty, while pan masala will attract GST and the proposed security cess.

What Is Compensation Cess and Why Is It Ending?

The GST compensation cess was introduced on July 1, 2017, to compensate states for revenue losses following the transition to the GST regime. Initially planned for five years until June 30, 2022, it was later extended by four more years after the Centre borrowed funds to offset pandemic-related revenue shortfalls.

The cess collections are currently being used to repay these loans. Officials have indicated that repayment will be completed by December, after which the compensation cess will cease.

No Change in Tax Burden

With the new Bills, the Centre aims to prevent any reduction in the tax burden on sin goods after the compensation cess ends. The shift from cess to excise duty and a new security-linked levy is designed to protect government revenue without increasing consumer prices.

What Happens If the Bills Pass?

If passed, the existing GST compensation cess on tobacco products such as cigarettes, chewing tobacco, and cigars will be discontinued. The Centre will gain authority to levy and adjust a specific central excise duty on these items under the amended Central Excise Act, 1944. The Bills will establish a permanent alternative tax structure for high-revenue goods as the temporary GST compensation framework expires, a Mint report said.

Other Bills Likely to Be Tabled

Key bills expected this session include:

Insurance Laws (Amendment) Bill, 2025 proposes increasing the FDI limit in insurance from 74% to 100%.

Securities Markets Code Bill, 2025 aims to merge the SEBI Act, Depositories Act, and Securities Contracts (Regulation) Act into a single unified regulatory code.

Jan Vishwas (Amendment of Provisions) Bill, 2025, seeks to decriminalize minor legal offences to support ease of living and doing business.

Amendments to the Insolvency and Bankruptcy Code, the Manipur GST Bill, the National Highways Bill, and the Corporate Laws (Amendment) Bill, 2025.

According to reports, the Opposition is expected to push for a debate on the Special Intensive Revision (SIR) of electoral rolls by the Election Commission of India.