Shares of tobacco product makers plunged today after reports suggested the government is planning to raise the GST rate on such products to the maximum allowed level.

As of 12:30 PM, shares of FMCG conglomerate ITC fell over 1%, while Four Square-maker Godfrey Phillips dropped 6%, and Charminar manufacturer VST Industries declined 3.8%.

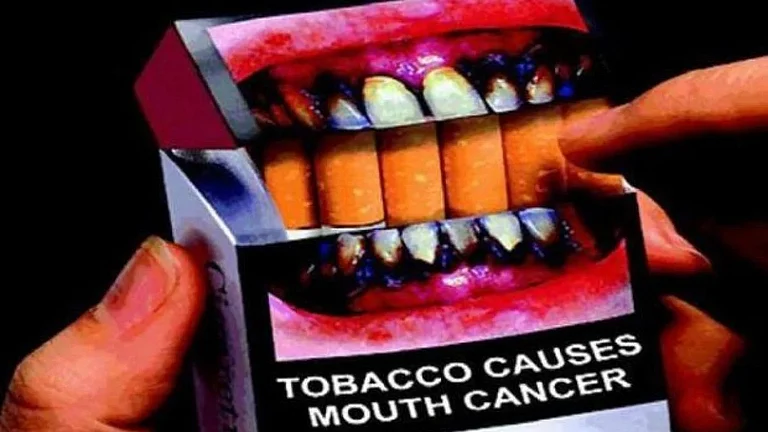

According to The Economic Times (ET), the government is considering raising the GST rate on cigarettes and other tobacco products from the current 28% to the highest permissible 40%. The report also mentions plans to impose additional excise duties on these products, which the government classifies as "sin goods."

Currently, cigarettes and other tobacco products attract a total tax of 53%, which includes 28% GST, a compensation cess, and other levies. However, the compensation cess is set to expire in March 2026.

The compensation cess was introduced under the GST Act to offset states’ revenue losses following GST implementation. Initially meant to last five years, it was extended in June 2024 until March 2026. During the 55th GST Council meeting in December, the panel also decided to extend the timeline for the Group of Ministers (GoM) on GST Compensation restructuring until June 2025.

Why Govt Want to Hike GST on Cigarettes?

The government aims to maintain steady tax revenues from tobacco products as the compensation cess expires. According to ET, officials are exploring alternatives to replacing the cess.

Tobacco-related products generate substantial revenue for the government, contributing Rs 72,788 crore in the financial year 2022-23.

Previously, the GST Council had formed a GoM to examine tobacco taxation. The group, led by Odisha Finance Minister Niranjan Pujari, suggested linking the cess element of GST to the retail price of products rather than the current sales value-based approach. The issue was later referred to a fitment committee and the GoM on rate rationalisation, led by Bihar Deputy Chief Minister Samrat Chaudhary.

According to The Hindu, on December 2, the GoM suggested increasing the tax rate on "sin goods" to 35%.