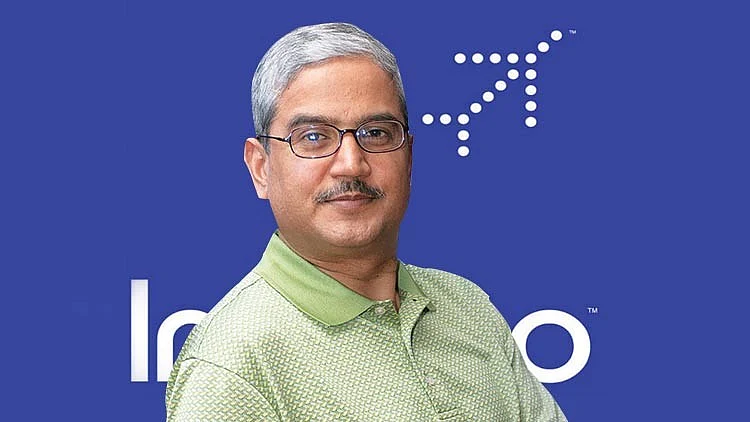

IndiGo co-founder Rakesh Gangwal and his family are reportedly planning to sell a portion of their stake in the airline’s parent company, InterGlobe Aviation, through a block deal. Currently, Gangwal and the Chinkerpoo Family Trust together hold a 13.5% stake in the airline.

According to a report by Moneycontrol, they plan to offload up to a 3.4% stake at a floor price of Rs 5,175 per share. The deal is expected to fetch up to Rs 6,831 crore (approximately $803 million), based on the terms.

The floor price represents a 4.5% discount to IndiGo’s closing price of Rs 5,420 on the NSE as of May 26. Shares of InterGlobe Aviation have risen nearly 20% since the beginning of 2025.

Investment banks Goldman Sachs, Morgan Stanley, and JP Morgan are advising the Gangwal family on the block trade, the report added.

Rakesh Gangwal and his family previously sold significant portions of their IndiGo shares in March and August 2024. According to stock exchange data, they offloaded about 5.2% of their stake in August 2024, raising approximately Rs 9,549 crore. Earlier, in March 2024, Gangwal sold shares worth over Rs 6,783 crore.

These stake sales are part of the Gangwal family’s ongoing plan to gradually reduce their holding in IndiGo. Rakesh Gangwal resigned from the board of directors of InterGlobe Aviation in February 2022, stating his intention to decrease his stake in the airline over five years.

As of 31 March 2025, promoters held 49.27% of IndiGo, while public shareholders held 50.73%.

On 21 May, IndiGo reported a net profit of Rs 3,067.5 crore for the quarter ended 31 March 2025, marking its second consecutive profitable quarter, driven by strong domestic travel demand across India.

The airline had posted a profit of Rs 1,894.8 crore in the same period last year. Revenue from operations rose 24% year-on-year to Rs 22,151.9 crore, up from Rs 17,825.3 crore in the previous fiscal, though slightly below the estimated Rs 22,500 crore.