Syria Civil War: Oil prices inched slightly higher on Monday after the Syrian Civil War, which initially started in 2011, took a dramatic turn over the weekend. It took less than two weeks for the main rebel group to overthrow Syrian President Bashar al-Assad and take over the capital Damascus.

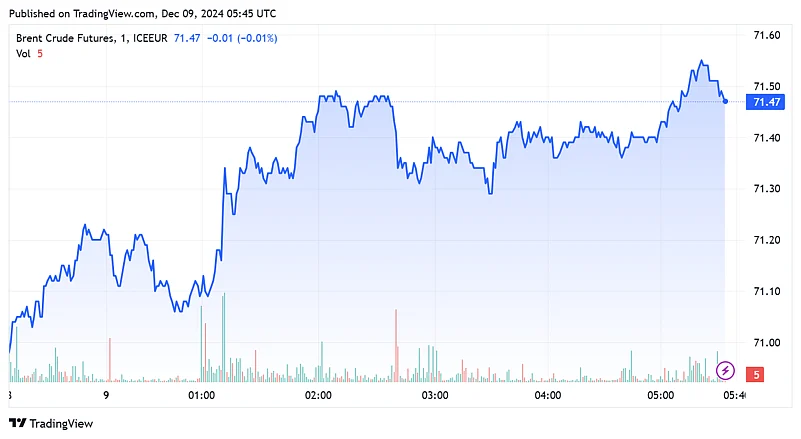

The WTI crude oil index (benchmark for the US oil market) was trading at nearly $67.50 price level. In the last 2 weeks, Brent crude futures have surged by more than a per cent.

While the Middle-East turbulence seems to have only a marginal impact on the price levels of oil, the larger resistance is coming from weaker demand levels.

This has already pushed OPEC (Organization of the Petroleum Exporting Countries) nations to extend supply cuts to next year. The world's largest exporter of crude oil, Aramco announced that it has cut its January 2025 prices for Asian buyers to their lowest point since early 2021, as per a Bloomberg report.

The faltering demand picture is majorly arising because of two reasons, first is the rising oil output from the US and second is the economic drawdown being witnessed by China, which is the largest importer of oil.

However, tensions are still well-present around the price levels of the commodity as any escalation in the Middle East conflict can result in heightened volatility.

Will crude oil prices rise?

It's difficult to say so. As the commodity is facing both demand and supply pressures concurrently. On one side, tensions in Syria are already causing mayhem in the price levels. Any kind of advancements in the Israel-Iran war can further put pressure on supply levels resulting in surging costs.

On the other side, China's decreasing demand picture and Trump's return to the white house, are altogether putting pressure on the demand levels of the commodity. The new president-elect's stance on oil was quite visible in his manifesto.

"We will drill, baby, drill and we will become energy independent, and even dominant again," the official documents from Trump's manifesto read.

The number of oil and natural gas rigs is steadily rising in the US, indicating an increasing oil output in the country. This might also have been the reason why prices remained only marginally up even after the rebel group took down the Syrian President last week. According to multiple media reports, the ousted President Bashar al-Assad has fled to Moscow.

As of now, the situation inclines slightly towards the supply side. The extension of production cuts suggests that OPEC nations remain cautious about the ongoing weakness in demand.

The price of the commodity will remain in focus this week, as we enter the last month of 2024, a year that has been largely upsetting for the oil market.