A US senator has proposed the HIRE Act, introducing a 25% tax on outsourcing to “protect American workers.”

The bill, led by Republican Bernie Moreno, could disproportionately affect Indian IT majors.

While experts believe the bill is unlikely to pass, but backing from Trump adviser Peter Navarro increases its perceived risk.

It comes amid worsening India-US trade ties, with 50% tariffs on Indian goods, though services exports remain exempted.

A US senator from Ohio last week introduced a new bill to impose a 25% tax on outsourcing in an effort to "protect American workers". The Halting International Relocation of Employment Act (HIRE Act), introduced by Republican Senator Bernie Moreno, is expected to disproportionately impact Indian IT services providers like Infosys, TCS, Wipro and others if it goes through.

While experts covering the industry say the bill is unlikely to move forward in the US Congress, the support by President Donald Trump's advisor Peter Navarro has added to the risk it poses. Experts say the uncertainty caused by the bill is more problematic than the impact of the tax it proposes.

It comes at a time when India-US trade relations have sharply deteriorated, with President Trump imposing a 50% tariff on all goods imports from New Delhi. But so far, India's lucrative services exports to the country, which to the US were $41.6 billion in 2024, have been exempted from these tariffs.

What Does the HIRE Act Propose?

The HIRE Act, introduced on September 5, proposes to amend the Internal Revenue Code to impose a 25% excise tax on any payments made by US persons to foreign persons for labour or services. These “outsourcing payments,” including fees, royalties, service charges, and similar transfers, would be taxed proportionally if they benefit both US and non-US consumers, as per the bill.

It also calls for the establishment of a Domestic Workforce Fund to use the tax revenue for workforce development, retraining, apprenticeships, and state grants in areas affected by job displacement.

In addition, it proposes to remove any tax deductions for outsourcing payments, calls for detailed reporting and certifications by corporations making such payments, and imposes heightened penalties for failure to comply.

Senator Moreno claimed that outsourcing had led to fewer jobs for American college graduates and said, "If companies want to hire foreign workers instead of Americans, my bill will hit them where it hurts: their pocketbooks."

Since the bill would hurt US companies that use this outsourcing for lower labour costs, experts say it would require major lobbying and support to move forward. Further, in a newsletter on September 7, Phil Fersht, Founder of HFS Research, said, "Taxing digital labour is technically far harder than taxing goods, and the US economy would bear the brunt of the disruption."

Earlier, an X post in support of the bill was retweeted by Navarro, which called for a "tariff" on "the foreign remote workers."

"All outsourcing should be tariffed. Countries must pay for the privilege of providing services remotely to the US the same way as goods. Apply across industries, levelled as necessary per country," said the post by a user called Jack Poso on September 1.

Pareekh Jain, founder of EIIR Trend, told Outlook Business that if the bill goes through in "the near term it would hurt US companies but in the longer term would hit Indian services providers as clients start asking for changes in deal terms."

He also noted that the IT sector will face more headwinds, which is already under stress going back to post-pandemic years.

More 'Uncertainty' for Indian IT Cos

Indian IT companies since the fourth quarter of FY25 have been warning about the impact of the "uncertainty" over tariffs and other geopolitical tussles. Outlook Business has reported how US companies might further slow down their discretionary spend on IT services as they bear the cost of trade tariffs.

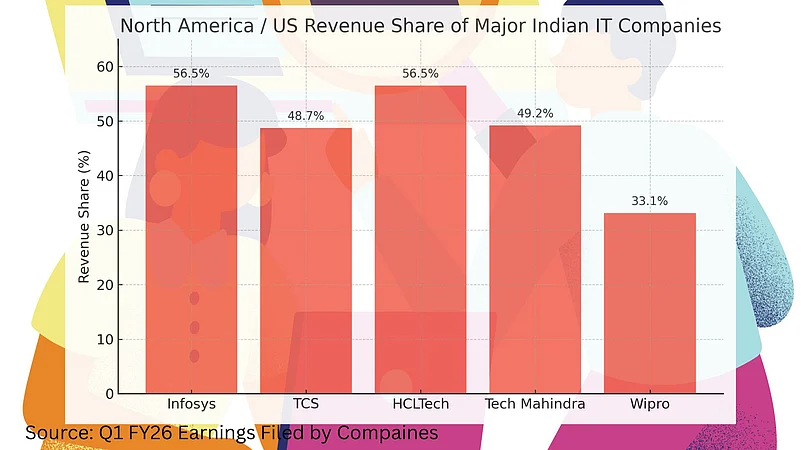

This could be further explained by the heavy dependence Indian IT giants have on the US. As per their latest quarterly results, Infosys derived 56.5% of its revenue from North America, while TCS reported that 48.7% of its revenue came from the region. HCLTech, which discloses its US revenue separately, stated that 56.5% of its Q1 FY26 topline of ₹30,349 crore was generated in the United States. For Tech Mahindra, the Americas accounted for 49.2% of total earnings, while Wipro reported that 33.1% of its revenue came from the region.

The red flags were once again raised in the same quarter. TCS CEO K Krithivasan said last week, on the Q1 results, "We’ve seen delays in decision-making and project starts. This trend, particularly around discretionary investments, has continued and even intensified this quarter. Global businesses have also faced disruptions due to geopolitical conflicts, economic uncertainty, and supply chain issues."

Tech Mahindra CEO Mohit Joshi also said, "I feel that in certain sectors impacted by tariffs and weak demand—like automotive—the sentiment is still not conducive to significant discretionary investments. In some other sectors, like telecom, we have seen stabilisation and growth this quarter, which we expect will continue." He also hoped for a recovery to begin in the second half of the year.

In July, Outlook Business also showed that the deals Indian IT services companies report and the revenue they generate have widened due to "client decision-making, longer deal conversion cycles and ramp-downs in existing programmes."

Jain said that the uncertainty over any expectation of tax on outsourcing will further widen the conversion cycle.

"US companies are signing the multi-year deals with Indian IT firms but they are being delayed in light of the risks," he said, adding that once the client is certain over how the tariffs are going to play out they will decide on execution.

According to Fersht from HFS Research, if tariffs were imposed, the fallout would be significant.

"Delivery costs would surge. Margins would erode. Enterprises would face slower transformation timelines and stalled innovation pipelines at the exact moment when global rivals like China and Europe are accelerating investments in AI. Tariffs would not repatriate jobs to the US, they would simply increase costs, disrupt delivery, and weaken competitiveness," he wrote.

Adding that, "even without formal tariffs, this uncertainty will cause procurement leaders to rethink contracts signed in the last two to three years, knowing they are already out of step with the AI era."

Risks for US Firms

HFS Research's founder further noted that 87% of US technology leaders struggle to fill critical roles in AI, data science, cybersecurity, cloud architecture, and software development, and developer demand is growing 25% faster than the average for other jobs.

"The result is an intensifying skills shortage that US companies cannot solve with domestic hiring alone. The shortage is worsening because universities are not producing enough graduates with advanced digital skills, mid-career professionals often lack retraining opportunities, and the pace of AI-driven change is outstripping domestic workforce readiness," said Fersht.

And at a time when US firms compete with each other and global tech giants for a small pool of elite specialists, India’s vast, scalable talent base is more critical than ever, he added.