TCS' layoff announcement of 12,000 employees, signals the decline of India’s traditional IT talent pyramid.

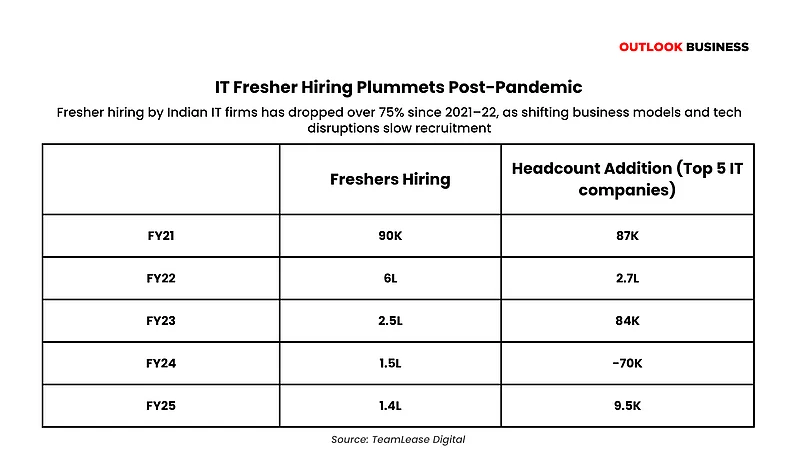

Fresher hiring has plunged sharply since 2021–22, as AI and automation reshape roles.

Bench strength and mid-level layers are also shrinking, with companies prioritising specialised skills over mass intake.

Deal wins are rising but revenue conversion is slow, reflecting cautious client spending and longer project cycles.

For a long time, the Indian IT services sector operated on a pyramid workforce structure—hiring a large number of freshers while maintaining a lean layer of experienced professionals in roles such as team leads, managers, client relations executives and senior management. The industry, which saw a massive bump in hiring and new deals during the Covid-19 pandemic, was hit by a post-Covid macroeconomic slump, high inflation, productivity gains driven by generative AI, and the changing nature of client deals, which have begun to reshape this model.

Over 12,000 job cuts announced by India's largest IT firm, Tata Consultancy Services (TCS), seem to put a final stamp on this transformation of the nation's largest private jobs sector. The layoffs will primarily affect middle and senior-grade workers, accounting for about 2% of the company’s 613,000-plus workforce. “The way we work is changing and the operating model is evolving,” said K Krithivasan, chief executive and managing director of the company, while confirming the layoffs.

“We’ve been highlighting that with the advent of new technologies, particularly AI and along with it this time, the operating models are undergoing significant transformation. Clients are increasingly moving toward a product-aligned approach, bringing more agility into the system,” he added in an interview.

While TCS aims to become “future ready,” technology industry body, Nasscom has said that the wave of white-collar job cuts may continue.

“The tech industry is at an inflection point, as AI and automation move to the very core of business operations. Over the next several months, we anticipate a period of transition as organisations shift toward product-aligned delivery models—driven by rising client expectations around agility, innovation and speed. This shift is likely to reshape traditional service delivery frameworks and in the near term, may lead to some workforce rationalisation as conventional skill sets are reassessed,” Nasscom stated on Monday.

Though the alarm bells are ringing now, the transformation began well before this week.

Hiring Slowdown

Following the surge in digital demand after the Covid-19 pandemic, IT services companies gradually began pulling back on hiring—both freshers and lateral recruits. According to data shared by Neeti Sharma, chief executive of TeamLease Digital, fresher hiring in the IT sector peaked at 6 lakh in 2021–2022, as companies anticipated significant client additions and new deals in an increasingly remote and digitised world. However, just a year later, this number dropped to around 2.5 lakh. Since then, the hiring of new graduates has continued on a downward trajectory.

Experts blamed the slowdown on both overcapacity and macroeconomic headwinds. According to Sharma, over the past two decades, India’s IT sector has relied heavily on entry-level hiring, with 70–75% of revenues driven by global BFSI projects that required large teams for basic tasks such as mapping and documentation, supported by team leaders, project managers and executives. Despite this reliance, entry-level salaries have remained stagnant at around ₹3–3.5 lakh per annum due to an oversupply of talent.

“The pandemic reshaped the traditional onsite model, with only 20–30% of employees now travelling abroad, as remote work replaced many overseas roles—effectively diminishing the 'American dream'. This shift, combined with reduced onsite demand, has pushed the industry to prioritise specialised skills over mass hiring for routine work,” she added.

This trend has been particularly evident among the top five IT services companies—TCS, Infosys, HCL Tech, Tech Mahindra and Wipro. Hiring data over the past five years shows a steep workforce correction. These companies, which added 87,000 employees in FY21, ramped up recruitment to a record 2.7 lakh in FY22. Since then, additions have steadily declined: 84,000 in FY23, a reduction of 70,000 in FY24 and a modest net addition of just 9,500 employees so far in FY25.

At the same time, companies faced allegations of issuing thousands of offer letters to college graduates without onboarding them on time. Later, Wipro was even accused of asking some of these graduates to join at a lower salary.

Earlier this year, Infosys fired hundreds of 2022-batch graduates from its training programme after they failed to clear internal assessments. These candidates later alleged that the company had made the screening process more stringent. An IT workers’ body, the Nascent Information Technology Employees Senate, even filed a complaint over the dismissals.

Shrinking Employee Base

According to Sharma, it’s not just the entry-level workforce that’s shrinking—the middle layer is also being thinned out from the organisational pyramid.

This shift is evident in the reduced bench strength (unassigned employees on payroll) and the shorter duration employees can remain unassigned to projects, commonly referred to as “bench time.”

“In the last two years, bench strength has significantly shrunk. What happened in 2023 and 2024 was that companies avoided new hiring and instead relied on their existing bench. Over time, they gradually exited those employees as well. As a result, this year, they were forced to resume hiring because there was no bench left. Today, most companies have little to no bench strength. And whatever remains is small, limited and composed of employees with very specific skill sets.

Previously, the average bench time used to be around 80–90 days. Then it dropped to about 45–60 days. Now, it’s down to 30–40 days, rarely more than 40–45 days,” she noted.

Last month, TCS formalised this shorter bench period and passed the responsibility to come out of these periods onto employees themselves. In an internal policy change, the company said, "At any given point in time, associates must be allocated for a minimum of 225 business days in the last 12 months. Long periods of remaining unallocated shall adversely impact associate compensation, career growth, avenues for overseas deployment in the future and continuity of employment with the organisation."

Under the new internal policy, it is primarily the associate’s responsibility to actively engage with the Unit or regional resource management group when unallocated and to pursue available opportunities. Associates awaiting new assignments are classified as “unallocated.” TCS now mandates that such employees spend four to six hours daily on upskilling through training resource platforms such as iEvolve, Fresco Play, VLS and LinkedIn. They are also required to complete all mandatory training, attend in-person sessions as advised, utilise tools like the GenAI Interview Coach and incorporate feedback from past interviews to remain job-ready.

To enable quicker deployment, physical presence in the office has also been made mandatory.

While similar announcements have not yet been observed at other major IT firms, several have indicated changes to their hiring strategies following their Q1 results.

HCLTech’s chief people officer, Ram Sundararajan, said the company will focus on hiring fresher based on specialisation rather than volume.

“We are talking about an elite cadre of freshers who will be paid more. These top-tier candidates will receive significantly higher compensation—services freshers, for instance, may be hired at up to three times the standard pay and software freshers at up to four times,” he noted.

As of the end of Q1 2025–26, HCLTech’s total workforce stood at 223,151, reflecting a net reduction of 269 employees during the quarter. However, the company added 1,984 freshers. The last twelve-month attrition rate remained steady at 12.8%, unchanged from the same period last year.

Sundararajan did not specify how many new hires would fall under the “elite cadre,” but indicated that, based on current trends, it could be around 15–20%, with the possibility of a higher share if better-quality talent is found.

“We have, of course, released a fair number of people due to productivity improvements. Not all of them are immediately redeployable, as the demand for some entry-level or lower-end skills is now being met through automation and other solutions,” said HCLTech chief executive C Vijayakumar during the Q1 earnings call.

“The training and the redeployment time is longer. While some will be redeployed, for others it may not be possible. This shift is partly driven by broader changes in the industry,” he added.

At Infosys, the employee count remained flat quarter-on-quarter at 323,788. The company’s utilisation rate improved by 30 basis points QoQ, reaching a peak of 85.2%.

Tech Mahindra, on the other hand, saw a sequential decline in headcount by 622. A company executive acknowledged that they had built up a certain level of bench strength in the previous quarter, which they now expect to reduce in response to rising demand.

“Hiring will really depend on how the overall demand picture evolves for the rest of the year,” said chief financial officer Rohit Anand.

When Deals Deceive

Analysts note a growing disconnect between the revenues reported by companies and the size of their projected deal pipelines. While these deals are expected to eventually materialise into revenue, for now, they remain projections—numbers on paper rather than cash in hand. In an increasingly uncertain macro-economic environment, marked by wars in Europe and West Asia and a fragile trade landscape, such projections are becoming harder to rely on.

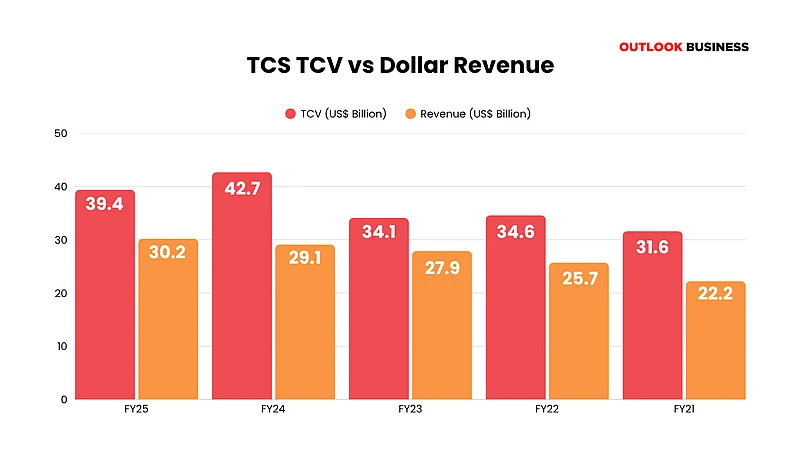

"Q1 FY25 results highlighted a widening gap between revenue growth and total contract value (TCV) expansion. Management attributed this to delays in client decision-making, longer deal conversion cycles and ramp-downs in existing programmes. Discretionary spending continues to remain weak across most verticals and geographies, further pressuring near-term revenue conversion," said Yes Securities in a report earlier this month.

The brokerage further noted that revenue growth now shows the strongest correlation with TCV growth from four quarters earlier—unlike in FY23, when revenue aligned most closely with same-quarter TCV. This shift points to a slower revenue conversion cycle, likely driven by a reduced share of discretionary projects in the current deal mix.

"As a result, we expect this delay in revenue conversion to persist over the coming quarters," the report concluded.

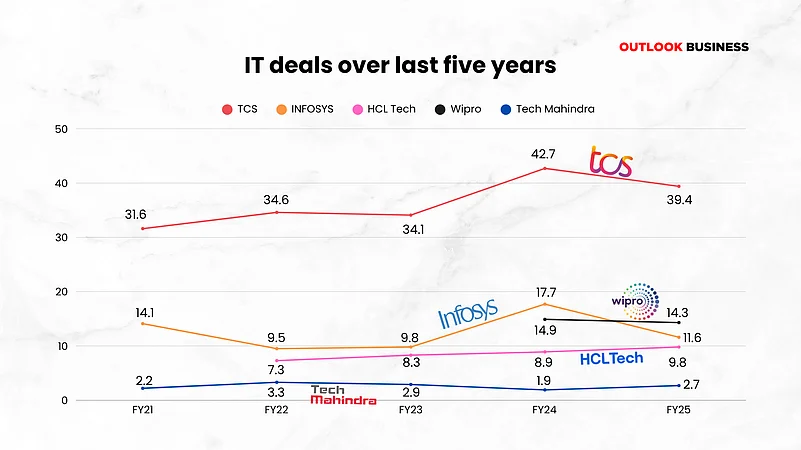

Data shared for the top five IT companies show that TCV has gone through massive volatility in the past five years.

Take TCS as an example. In FY21, its TCV was $31.6bn, which rose to $34.6bn in FY22 during the pandemic-led digital boom. It dipped slightly in FY23 before jumping to a record $42.7bn in FY24, only to decline again to $39.4bn in FY25. However, when we compare this to the company’s revenue, a different story emerges. Despite the surge in TCV, revenue moved more gradually—from $22.2bn in FY21 to $30.2bn in FY25—showing that a large portion of TCV has not yet converted into actual revenue, highlighting the lag between deal wins and revenue realisation.

Pyramid No More

As top IT companies struggle to secure deals in an uncertain macroeconomic environment, they are reconfiguring the composition of their workforce.

Staffing firm Xpheno estimates that the top seven Indian IT services companies, along with 10 mid-tier firms, currently employ around 695,500 professionals in the mid-junior to mid-senior bracket—those with five to thirteen years of experience. In contrast, freshers, entry-level staff and junior engineers number approximately 530,150, indicating a noticeable tapering in the talent pyramid, Business Standard reported in March.

Kamal Karanth, co-founder and chief executive of Xpheno, told the publication that the IT workforce now has a “big, fat middle layer,” shaped by the hyper-hiring phase of FY22. This period created a large pool of junior talent with three to five years of experience, while significantly expanding the five-to-nine and nine-to-thirteen-year bands. These segments also saw the highest churn during the industry’s boom. Meanwhile, the lower rungs have thinned due to reduced intake over the past three hiring cycles.

The sluggish growth environment of the last three years has reinforced this trend, as companies increasingly prefer experienced professionals who can contribute to live projects immediately, rather than investing heavily in training freshers.

However, Nasscom struck a more optimistic note. "Over 1.5mn professionals have been trained in AI and GenAI skills across various levels. In particular, advanced AI skilling initiatives have reached more than 95,000 employees in leading listed firms, covering AI-native cloud, embedded AI and applied intelligence certifications," the industry body said yesterday.

It added that every wave of disruption brings new roles, new value chains and new opportunities. As industries evolve, continuous skilling, upskilling and cross-skilling will be critical to building future-ready, resilient workforces.

"Hiring trends will continue to evolve, with increasing demand for deep, specialised expertise. There is no one-size-fits-all solution—each enterprise will navigate this transition based on its unique strategic needs. What is critical, however, is a shared commitment. Industry, academia and government must collaborate more deeply to bridge the skilling divide and embed talent development as a national and business imperative—central to sustaining India's technology leadership in the AI era," it added.