The GST Council on Wednesday approved GST rates of 5% and 18% for most goods, with a special 40% rate for certain sin and luxury items.

The net revenue impact, based on the 2023–24 consumption base, is estimated at around ₹48,000 crore, though actual outcomes may differ.

The government expects improved revenue buoyancy and stronger consumer spending to help fill the shortfall.

The GST Council, led by Union Finance Minister Nirmala Sitharaman, on Wednesday decided to adopt GST rate slabs of 5% and 18% covering various goods and services, and a special slab of 40% for a small category of sin and luxury goods. Explaining the impact of this GST rationalisation on the government’s tax income, Revenue Secretary Arvind Shrivastava said that, based on the 2023–24 consumption base, the net revenue implication is expected to be around ₹48,000 crore.

But he noted that since “the figure may be mathematically calculated using financial year 2023–24 consumption data, in reality, outcomes will evolve differently.”

The government is hopeful that “buoyancy is expected to play a significant role in enhancing revenue” after the GST rate cuts, which expand from consumer staples to aspirational goods to even insurance policies.

“Consumer behaviour, what they spend on and how much, will also be positively influenced by lower prices resulting from this rationalisation,” Shrivastava told reporters while announcing the rate cuts.

Effective GST Rate to Come Down Marginally

Since GST was introduced in July 2017, via the One Hundred and First Amendment to the Constitution, economists have used the effective tax rate to understand how it actually reduced indirect taxes.

According to data from Bank of America Global Research, the latest round of cuts will bring down the effective GST rate to 10.7% once implemented on September 22, down just 20 basis points from the four-slab structure.

But, compared to FY19, when the effective tax rate was 10.5%, the new rate will still be slightly higher.

An earlier BoFA Global Research report explained this more clearly:

“After a few years of disappointing impact, the GST framework and its efficacy improved post-COVID, when both a surge in inflation, coupled with significantly higher formalisation, meant GST growth has been robust, till recently. Despite efforts to make GST more progressive, effective GST rates have broadly been in the 10–11% range, dipping only to 9.4% in the COVID year of FY21,” said the note dated August 18 by Rahul Bajoria, India & ASEAN Economist, BofAS India, and Smriti Mehra, India Economist, BofAS India.

It added that for the last three fiscal years between FY23–FY25, effective GST rates have averaged 11%, and the estimate for FY26 YTD is at 10.9%.

“Relative to nominal GDP growth, GST has broadly grown in the same range, barring the post-pandemic reopening period, when multipliers shot up materially, despite no major tax increases,” the economists added.

How Much Money the Govt Loses

While the government’s calculation based on FY24 data is ₹48,000 crore, other brokerages and economists suggest a different figure.

First, how did the government reach this number? Radhika Rao of DBS Bank explains:

“The net fiscal implication is expected to be to the tune of ₹48,000 crore (0.13% of GDP), after accounting for ₹93,000 crore revenue loss but ₹45,000 crore is expected to be collected on sin/luxury items,” she said.

But BoFA estimates “the actual revenue loss might be 18–20% larger, accounting for a larger base.”

Meanwhile, Citi Bank puts a figure to it, saying that government estimates ₹48,000 crore net revenue foregone based on FY24 data extrapolated to FY26, while Citi estimates ₹57,600 crore loss (about 0.16% of GDP).

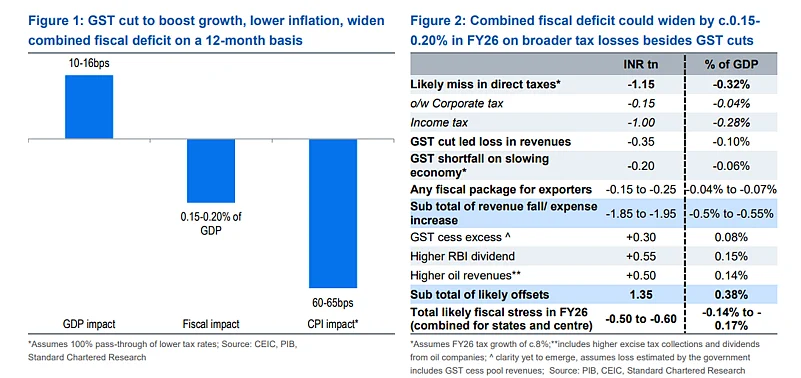

According to Standard Chartered, on a 12-month basis, the GST cut could result in a revenue loss of about ₹60,000 crore (0.16% of FY26 GDP) for the Centre and states combined.

"The impact on the FY26 fiscal deficit would be roughly half of this, easing concerns about fiscal slippage. However, there is still expected pressure on the FY26 combined fiscal deficit of about 0.15–0.20% of GDP, driven by a shortfall in direct taxes and a potential relief package for exporters," the bank said.

It's base case projects the combined fiscal deficit at 6.9% of GDP in FY26 (with 4.4% for the Centre). Broader tax losses include a likely miss in direct taxes of about ₹1.15 lakh crore (0.32% of GDP), of which corporate tax may fall short by ₹15,000 crore (0.04%) and income tax by ₹1 lakh crore (0.28%). GST cuts could lead to a revenue loss of ₹35,000 crore (0.10%), with an additional shortfall of ₹20,000 crore (0.06%) from a slowing economy.

Any fiscal package for exporters (in-light of 50% US tariffs) could cost between ₹15,000–₹25,000 crore (0.04–0.07%). This results in a subtotal revenue fall or expense increase of about ₹1.85–₹1.95 lakh crore (0.50–0.55% of GDP). Potential offsets include an excess GST cess collection of ₹30,000 crore (0.08%), a higher RBI dividend of ₹55,000 crore (0.15%), and higher oil revenues of ₹50,000 crore (0.14%), providing a total offset of about ₹1.35 lakh crore (0.38%). The net likely fiscal stress in FY26, combining Centre and states, is estimated at ₹50,000–₹60,000 crore (0.14–0.17% of GDP).

Phasing Out Compensation Cess

According to BoFA, states would be losing ₹70 for every ₹100 lost on GST, making the net impact on fiscal balances small and manageable.

A key opportunity, according to the brokerage, is the phasing out of compensation cess, which was introduced to ensure states did not sacrifice revenues to implement a centrally administered GST.

“While the compensation cess had been steadily declining as a proportion of overall GST revenues, it is still above 6%. The Council decided to phase out compensation cess but it will remain applicable until the loan and interest payment obligations are completely discharged, which is expected in 2025, especially on tobacco goods,” it said.

According to the Union Budget 2025–26, gross GST receipts are budgeted at ₹11.78 lakh crore, comprising CGST ₹10.11 lakh crore and GST Compensation Cess ₹1.67 lakh crore. For April–August 2025, gross GST mop-up reached ₹10.04 lakh crore, marking 9.9% growth from ₹9.14 lakh crore a year ago. Net revenue collections during the five months stood at ₹8.78 lakh crore, up 8.8% from ₹8.07 lakh crore in the corresponding period last year.

What the Govt Can Do to Close the Shortfall

According to Motilal Oswal Financial Services, the government has a strong track record of fiscal discipline and, most times, its estimates have been conservative, inspiring confidence.

“Moreover, the government has several levers to improve receipts in case the fiscal impact of the approved measures turns out higher than estimated,” it said on August 4.

What are these levers? An earlier Kotak Institutional Equities report explained.

The note dated August 18 said the central government could offset the revenue shortfall by utilising compensation cess collections and the cess fund by amending or repealing the GST (Compensation to States) Act in Parliament, post consultation with the GST Council, or through the Finance Bill. It could also tap surplus marketing margins of OMCs through higher excise duties while keeping retail prices unchanged. Further, it said the government could use funds from select schemes such as those for R&D or AI projects.

Though it added, “States may have limited room to absorb SGST losses unless the Centre shares gains from these measures,” the report said.

All Bets on Consumption-led Growth

While some experts flag the expected impact of revenue shortfall, others are cheering for the consumption boost these cuts could generate.

Axis Securities on Thursday said, “The government has now shifted gears from capex-oriented spending to consumption-led spending, starting from the FY26 Budget onwards.”

According to the brokerage, the past decade was defined by development-focused schemes, with the construction of roads, bridges, metro systems, and other infrastructure projects serving as benchmarks for the ruling party’s success.

“Now, with the February 2025 Budget, more focus has been given to the rural masses and the middle class for spurring consumption via tax relief, indicating a shift in the economic regime. And now, GST 2.0 reforms are further strengthening the agenda of consumption pick-up moving forward. This consumption-led growth will have a cascading effect on the economy and provide a much-needed boost to private capex, which has been sluggish for several years,” the note said.

Adding that, unlike income tax cuts, welfare schemes, and subsidies, the GST rate cut would benefit all sections of households and impact a wider population, especially rural India and lower- to middle-income households.

It was the need of the hour, according to the brokerage, which said, “Consumption patterns were clearly muted over the last 4–6 quarters, subdued due to multiple challenges like higher inflation, slowing urban demand, and slowing credit growth. Now with GST 2.0, a new leg of consumption-led growth opens avenues for the multiplier effect in the economy.”

Though it added that the meaningful impact of GST 2.0 on “the operational performance of Indian corporates is likely to come in H2FY26. Furthermore, the earnings of Indian corporates are likely to revive from the second half onwards.”