India’s inflation gauge moves to a 2024 base year from 2012, updating weights to reflect current household consumption patterns.

Reduced food and beverage weighting could smooth headline inflation but increase the influence of core and services prices.

Early prints under the new series will be closely tracked by markets and the RBI for shifts in inflation trends and policy signals.

The revised series of the Consumer Price Index (CPI) will be rolled out tomorrow, with the base year now updated to 2024 from the previous 2012. With the updated base year and a rejig in the basket reflecting changes in household spending, the new series is expected to help gauge inflation more accurately.

The new series, revised by the Ministry of Statistics and Programme Implementation (MoSPI), also updates the base year for other key macroeconomic indicators, including the gross domestic product (GDP), now rebased to 2022–23, and the Index of Industrial Production (IIP), also rebased to 2022–23. These indicators play a crucial role in informing the monetary policy decisions of the Reserve Bank of India.

“To reflect evolving consumption patterns, the base year of the CPI needs to be revised every three to five years,” an Expert Group Report on Comprehensive Updation of the Consumer Price Index said. Such revisions, however, are contingent on the availability of Household Consumption Expenditure Survey data, which provide the updated item basket and weights required for index compilation.

Why CPI Matters to Households

One of the most significant functions of the CPI is that it is an important measure linked to the Public Distribution System (PDS) through the tracking of subsidised or free food grain prices. MoSPI has suggested that the PDS be factored into the CPI by creating a single commodity index that combines PDS prices with open market prices. Free items would be treated as having a zero price, so their impact — including downward pressure when items become free — is captured in inflation estimates.

Beyond setting the stage for monetary policy, the CPI also serves as a proxy for tracking changes in the cost of living and is used for wage indexation, pensions, and welfare schemes.

What the New Series Means for Inflation Volatility

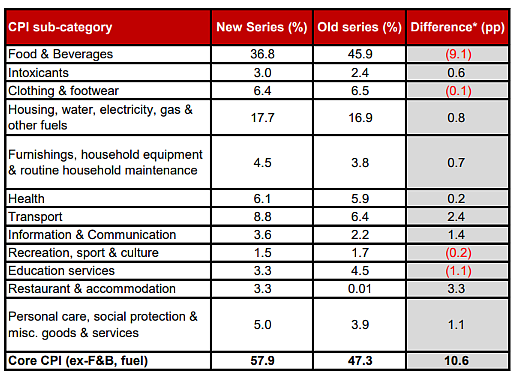

One of the most awaited revamps in the new CPI series is the recalibration of weights in food and beverages. In the new series, the weight of food and beverages has fallen to 36.8% from 45.9%, with food alone dipping to 34.8% from 39.1%.

A key nuance affecting inflation prints is that food prices have been among the most volatile components of the CPI. With the revised weight, headline CPI numbers are likely to change materially, reports said. A lower food weighting is also expected to make the RBI’s inflation-targeting mandate easier amid reduced volatility. The RBI is likely to remain in a “wait and watch” mode to assess technical changes and evolving inflation trends under the new series before making further monetary policy adjustments.

At the February 6 meeting of the Monetary Policy Committee, the rate-setting panel of the RBI held policy rates steady at 5.25%. The RBI also upwardly revised its inflation expectations for April–June (Q1) to 4.0%, followed by an uptick to 4.2% in July–September (Q2).

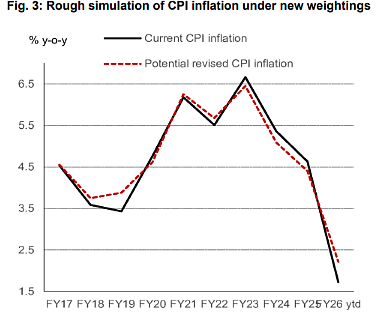

According to a research report by Nomura, headline inflation could rise by as much as 0.5 percentage points (50 basis points) due to changes in the weightings of food and core components (excluding food, beverages, and fuel). “If the new CPI series raises FY26 inflation, it could also lower FY27 inflation, assuming the same momentum,” the report said. “Inflation under the new CPI series depends not only on changes in weightings, but also on methodological changes and new data sources, which imply different index values.”

The Nomura report dated January 30 noted that the lower weighting of food is likely to result in higher spot inflation readings, as the deflationary trend in food prices has kept headline inflation low. Food inflation in December stood at -2.71%, remaining in negative territory for the seventh consecutive month.

“If the new CPI series raises spot inflation, it could also lower the forward inflation trajectory, assuming the same momentum,” the report added.

Inside the Revised CPI Basket

The revised weightage also reflects a shift in consumption patterns, with new categories such as over-the-top (OTT) platforms, digital subscriptions, and digital services gaining prominence. The new series will include more sub-divisions and data sources for items such as air fares and telecom services. It also eliminates obsolete items such as typewriters and cassette players to ensure a more accurate reflection of household expenditure.

The earlier CPI series comprised six groups and 23 sub-groups, while the new series will have 12 divisions, 43 groups, 92 classes, and 162 sub-classes. The revised structure brings India’s inflation basket more in line with global standards.

Rural coverage has also been expanded to 1,465 villages across 686 districts, compared with 1,181 villages across 582 districts earlier. Urban coverage has increased to 1,395 markets in 434 towns, from 1,114 markets in 310 towns previously.

With food weights reduced, the weightage of core items — particularly transport, information and communication, health, and household goods and services — has increased. “Restaurants and Accommodation” will be introduced as a new category in the revised series.

Gaps That Remain in the New CPI Series

According to a report by Mint, a key unaddressed concern in the revision relates to housing inflation. Although the housing index has been expanded across rural and urban areas, it excludes employer-provided accommodation, raising concerns about how well it captures ground realities in metropolitan and large cities. The overall weight of housing has increased to 12% from 9%, including the addition of rural housing — where rental inflation tends to be lower — which could distort the consolidated housing inflation figure, the report said.

Moreover, with an increased weight assigned to healthcare and services, it remains unclear how effectively the health component will capture actual healthcare costs.

While the revised CPI series promises a more accurate reflection of household spending, markets and policymakers are likely to closely watch the initial prints to assess how the changes reshape India’s inflation narrative.