US President Donald Trump said Washington would take control of Venezuela and its oil fields.

Analysts say this move could benefit Indian oil companies.

Venezuela has long been a key crude supplier for India, with ONGC holding major investments that were hit by US sanctions in 2021.

US President Donald Trump on Saturday announced that Washington would run Venezuela and its oil fields after US troops flew into the capital, Caracas and captured long-time leader Nicolas Maduro. A day after Maduro’s removal from power, analysts said Indian oil companies could benefit from the American move.

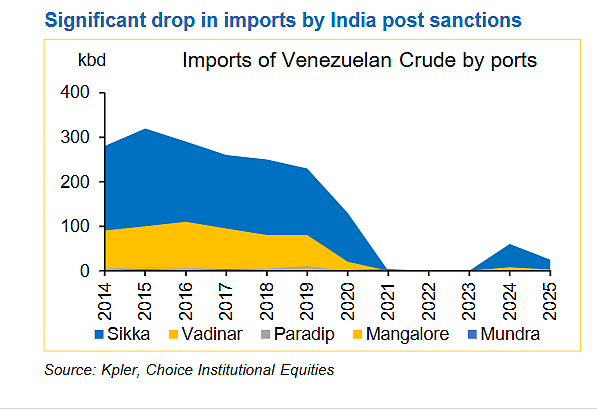

For New Delhi, Caracas has long been a source of crude imports and state-owned Oil and Natural Gas Corporation (ONGC) has made significant investments in Venezuelan oil fields. However, stringent US sanctions curtailed operations in 2021. Analysts now say the US move could revive output from these investments and help Indian refineries shift part of their crude sourcing from Russia to Latin America.

Shares of Indian oil companies opened with gains of up to 2% on Monday. ONGC shares rose 2% in early trade, while Mukesh Ambani-led Reliance Industries gained about 1% to hit a 52-week high of ₹1,611.8 apiece. However, most of these gains were pared later in the session.

On the BSE, Reliance was down 0.78%, Petronet 1.41%, HPCL 1.49%, ONGC 1.57%, BPCL 1.60%, GAIL 1.74%, IOC 1.80%, IGL and ATGL 1.83% each, and Oil India 2.33%. The BSE Oil & Gas index slipped 1.53% around 2:22 pm, while the Nifty Oil & Gas index was down 1.32% in afternoon trade.

“Indian upstream players may benefit as access to equipment and investments could be granted, leading to higher output from the San Cristobal and Carabobo-1 fields, which Indian firms jointly operate with PdVSA,” Choice Institutional Equities said in a note dated January 5. These include ONGC and Oil India.

The brokerage added that refiners such as Reliance Industries, BPCL, HPCL and IOC could also benefit from imports of heavier Venezuelan crude, which is priced at a discount to Brent and enables companies to generate higher gross refining margins.

How It Would Help Indian Refiners

Since June, refiners such as Reliance have significantly reduced purchases of Russian crude. Data from Global real-time data and analytics provider Kpler shows Russian crude imports into India are set to fall to around 1.2 million barrels per day in December, down from 1.84 million barrels per day in November, the lowest level since December 2022.

The decline is due to multiple factors, including US sanctions on Rosneft and Lukoil and EU sanctions on products linked to Russian barrels.

Pressure has also been visible from the US side, with President Trump repeatedly calling on India to stop purchases as part of ongoing trade talks. On Monday, he warned that if imports were not curtailed, the US could raise tariffs on Indian exports from the current 50%.

Amid these threats, Jefferies said Reliance’s key advantage lies in its ability to process cheap Venezuelan crude at its Jamnagar refinery. Venezuelan crude is heavy and difficult to refine, and only a few complex refineries worldwide can handle it. As a result, it typically trades at a discount of about $5–8 per barrel to Brent crude.

"Venezuelan acidic (High TAN) and extra-heavy crude has historically been processed by India’s most complex refineries, including Reliance, Vadinar, IOC’s Paradip, MRPL, and HMEL, and any re-entry would likely be at discounted levels," said Nikhil Dubey, Senior Research Analyst, Refining & Modeling at Kpler.

Adding that as India continues to diversify its crude basket amid ongoing India–U.S. trade discussions, there is a growing emphasis on managing concentration risk, reflecting a broader U.S.-led focus on reducing exposure to Russian barrels.

"At the same time, the EU’s 18th sanctions package has tightened restrictions on refined products derived from Russian crude, affecting export-oriented refiners running those barrels," he added.

Reliance had signed a deal with Venezuela’s state oil company PdVSA in 2012 to meet around 20% of its daily crude needs, but this was halted in 2019 after US sanctions were tightened. With the US now signalling it may allow Venezuelan crude to be sold to global buyers, Jefferies believes Reliance could once again secure long-term supplies at lower prices, boosting refining margins and cash flows despite the stock trading at relatively high valuations.

How ONGC Could Benefit

ONGC’s overseas arm, ONGC Videsh Ltd (OVL), jointly operates the San Cristobal oilfield in eastern Venezuela. Production has fallen sharply as US sanctions cut off access to key technology, equipment and services, leaving commercially viable reserves effectively stranded. Venezuela has failed to pay OVL about $536 million in dividends linked to its 40% stake in the field up to 2014, with a similar amount due for subsequent years. Payments have been frozen as Caracas has not allowed audits for that period.

Jefferies said US-led changes could allow funds to be repatriated to India, enabling ONGC to recover these dues and restart development of the Carabobo project in Venezuela’s Orinoco Belt, where it owns an 11% stake. Indian Oil Corporation and Oil India each own 3.5%. PdVSA is the majority owner in both San Cristobal and Carabobo-1.

Earlier, OVL had sought a sanctions waiver similar to the licence granted by the US Office of Foreign Assets Control to Chevron, which allowed it to operate and export oil from Venezuela.

Analysts expect PdVSA to be restructured following US action. In a worst-case scenario, its stake could be taken over by a US-backed entity. However, OVL and other foreign partners, including Spain’s Repsol, which also owns 11% of Carabobo-1, are expected to remain involved.

President Trump has said major US oil companies would return to Venezuela to repair damaged infrastructure. Analysts note that the US would still need international partners such as OVL for technical expertise and access to key markets. India is expected to be a major buyer of Venezuelan crude once exports resume.

Venezuela Has Largest Oil Reserves

Before 2019, Venezuela exported about 707 million barrels of crude annually, with the US accounting for 32% and China and India together for 35%. By 2025, exports had fallen to 352 million barrels a year, with China taking 45% and the rest going to undisclosed buyers.

Venezuela has the world’s largest oil reserves at 303 billion barrels, followed by Saudi Arabia (267.2 billion barrels), Iran (208.6 billion barrels), Iraq (145 billion barrels) and the United Arab Emirates (113 billion barrels).

However, years of US sanctions on the country’s socialist regime have severely curtailed production. Venezuela produced about 0.9 million barrels per day in November 2025, compared with around 2 million barrels per day in the early 2010s.

Following Operation ‘Absolute Resolve’ in Caracas, under which US troops captured the country’s president and first lady, President Trump said, “We are going to run the country.”

He added that the US would run Venezuela “until such time that we can do a safe, proper and judicious transition”.

“We are going to run the country right. It’s going to make a lot of money. They stole our oil,” Trump said, adding that the US would sell large volumes of oil to other countries.

He also said US oil companies would invest in Venezuela’s oil fields and raise crude output.

“In a best-case scenario, output could increase by 150,000 barrels per day during 2026, requiring only operational expenditure rather than capital expenditure. Any further increase would likely come from the following calendar year, provided there is significant investment by oil companies,” analysts at Choice Institutional Equities said.

“Transitions of governments and investments in less stable economies have proven challenging over the past decade,” they added.

These risks remain significant, particularly after Vice President Delcy Rodríguez denounced Maduro’s detention as a kidnapping and said Venezuela would not become a US colony. She is set to be sworn in as president in Caracas on Tuesday, though President Trump has already threatened action against her.

“If she doesn’t do what’s right, she is going to pay a very big price, probably bigger than Maduro,” he told The Atlantic.

Following these geopolitical developments, oil prices have traded lower. At around 3:00 pm, Brent crude was down 0.58% at about $60.40 per barrel.

Jefferies said easing US sanctions is unlikely to have an immediate impact on global oil prices because Venezuela’s current production is low. However, over the medium term, increased investment by US oil companies could lift output. If OPEC+ does not cut supply to offset this, oil prices could face pressure in 2027–28.