India's textile industry is looking to take advantage of US President Donald Trump's high reciprocal tariffs on competing nations like China, Vietnam, and Bangladesh. While Trump has announced plans to impose a 27% reciprocal tariff on India, its main competitors in the apparel and textile sector—China, Bangladesh, and Vietnam—face levies of 34%, 37%, and 46%, respectively.

"Despite the steep hike in tariffs for India, it prima facie seems to be an advantage for the apparel sector, with our major competing countries like China, Bangladesh, Vietnam, Cambodia, and Sri Lanka facing higher reciprocal tariffs by the US," said Mithileshwar Thakur, Secretary General of the Apparel Export Promotion Council (AEPC).

According to a March report by Emkay Global, the US accounted for about 28% of India’s textile exports in FY24, amounting to $9.6 billion. Within this, a few large commodity groups—knitted apparel, non-knitted apparel, and other made-up textiles—together made up about $7.5 billion of exports to the US.

"But given the intrinsic strength of the Indian apparel sector, with its complete value chain and impressive range of offerings, my initial assessment is that this will work out in India’s favour eventually. We should prepare ourselves to encash this opportunity," Thakur added.

However, he noted that Trump's tariff policy provides a tariff-based edge to Brazil, Turkey, and apparel-exporting EU countries like Italy, Germany, and Spain.

Shares of textile manufacturers and exporters surged on March 3. Garment-exporting companies like Gokaldas Exports and Arvind Ltd. rose as much as 9%. Shares of KPR Mill Ltd. gained 6.69%, Trident Ltd. rose 5.89%, Vardhman Textiles jumped 15%, and Vedant Fashions was up 1.46%.

India's Position in the US Textile Market

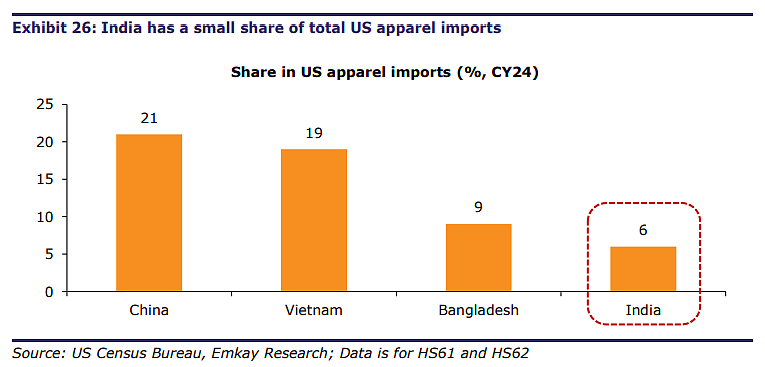

India holds approximately a 9% share in US textile and apparel imports (CY24). However, in the apparel segment (HS61 and HS62), India's share is about 6%, compared to China (21%), Vietnam (19%), and Bangladesh (9%).

"India’s textile and apparel exports would be among the worst hit if reciprocal tariffs are imposed at a broad sectoral level. However, if imposed at the HS2 level, the impact would vary significantly," said Emkay Global in its report.

Despite this, the report added that India would remain competitive against China due to the 40% incremental tariffs now levied on Chinese textile exports by the US.

“Presently, it appears “advantage India” for the Indian textile sector. India competes globally for textile exports with countries like Bangladesh, Vietnam, Cambodia, Sri Lanka, China, Pakistan, etc. Interestingly, as compared to around 27% tariff for Indian imports, these countries have been hit harder by USA tariffs: Bangladesh 37%, Vietnam 46%, Cambodia 49%, Pakistan 29%, China 54%, Sri Lanka 44%, etc. US buys over USD 36bn textiles from India, which is around 30% share for sector India exports, " said Paresh Parekh, Partner and Retail Tax Leader, EY India.

He further added that this situation poses an opportunity for the Indian textile sector to grab and increase its market share in the US.

The Indian textile sector also hopes to secure further strategic advantage by inclusion of textile in potential “zero for zero" India-USA trade deal if it happens, Parekh said.