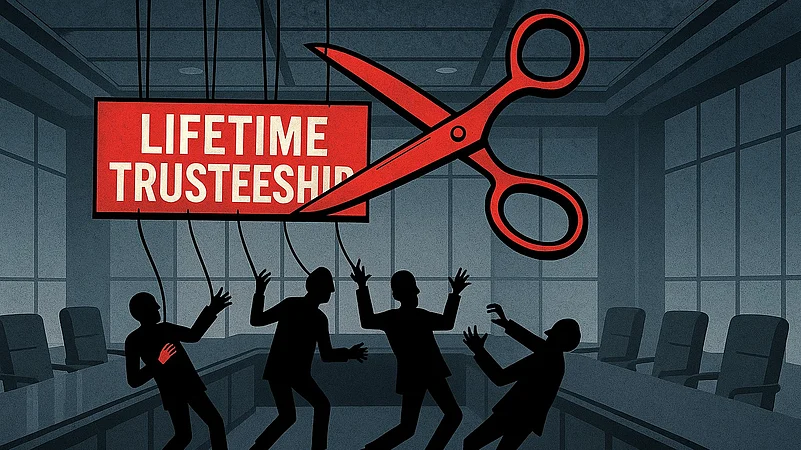

A seemingly routine Maharashtra ordinance has intervened in the embattled Tata Trusts’ key affairs.

It has limited the Trusts’ ability to appoint lifetime trustees, a provision they viewed as essential after the passing of Ratan Tata in 2024.

Experts believe the government’s move may be linked to the ongoing power struggle within the Trusts, one they had anticipated.

On August 30, 2025, Maharashtra Governor C P Radhakrishnan signed the Maharashtra Public Trusts (Amendment) Ordinance, 2025. On the face of it, the amendment seemed to be one of the routine regulatory updates passed to improve governance of charitable trusts. However, legal experts are coming round to the view that it may have had more than just a little to do with the ongoing power struggle over control of Tata Sons, which controls India's largest industrial conglomerate.

Those who see no such designs may point out that the amendment came into force on September 1—weeks before the first public signs of infighting at Tata Trusts emerged in mid-September, and well before the explosive battle over lifetime trusteeships erupted in mid-October.

Yet, its provisions read like a targeted intervention into the very crisis that would soon unfold.

At the heart of the matter: The ordinance limits lifetime tenure to just 25% of board members at any charitable trust. For Tata Trusts—which collectively hold over 65% of Tata Sons and thereby control one of India's most powerful business empires—this restriction has upended plans to grant permanent positions to key trustees, including those at the center of a bitter internal feud.

"It would be naive to assume that the State was oblivious to the governance ramifications of that development," says Tushar Kumar, Advocate at the Supreme Court of India. The ordinance, he notes, bears the unmistakable imprint of anticipatory regulation designed to prevent any charitable trust from insulating itself from periodic oversight and public accountability.

Tata: A House Divided

The tussle at the Trusts came into public view about a year after the death of Ratan Tata on October 9, 2024. Its root lies in the decisions taken by the Trusts soon after the patriarch passed away. Tata Trusts, which hold over 65% of Tata Sons, adopted a resolution to provide stability to the salt-to-software conglomerate at “a moment of transition between two eras.”

The October 17, 2024 resolution said that "on the expiry of tenure of any trustee, that trustee will be re-appointed…without any limit being attached to period of tenure…in accordance with the law.” This meant upon re-appointment current trustees would have lifetime tenure.

On the same day, the trustees made Ratan Tata's half-brother Noel Tata Trusts' chairman and his re-appointment gave him lifetime membership of the board.

Two other such reappointments came up about a year later in 2025. Venu Srinivasan's tenure at Sir Dorabji Tata Trust and Mehli Mistry's membership at Sir Dorabji Tata Trust and Sir Ratan Tata Trust were set to expire in October this year.

The flare up first emerged in the public domain after a meeting on September 17, dividing the Trustees into two sections. On the one side were Chairman Noel Tata, Venu Srinivasan and Vijay Singh, all three part of the Trusts as well as Tata Sons board. They were accused of not being transparent with other Trustees, who include Mehli Mistry, Jehangir HC Jehangir, Darius Khambata and Pramit Jhaveri.

The fight had earlier led to Singh's resignation from Tata Sons' board as a nominee director of the post.

In October this year, while approving Venu Srinivasan's reappointment, Mehli Mistry demanded that going forward all the current trustees be voted in unanimously, giving them lifetime membership.

In his approval Mistry wrote, that "should any trustee elect not to pass this resolution reappointing Mr Venu Srinivasan or an identical unanimous resolution for all other trustees as and when their respective tenures expire, then in such event, I do not provide my formal approval for the reappointment of Mr Venu Srinivasan in terms of Circular No: 87 dated October 18, 2025. Needless to state, I do not expect such a situation to arise."

However, his expectation was met with disappointment on October 27, a day before his term was supposed to expire. As Noel Tata, Venu Srinivasan and Vijay Singh voted against a resolution to appoint him for life. Even with the approval of Khambata, Jhaveri and HC Jehangir, Mistry couldn't get his life membership.

Later, he formally tendered his resignation from SDTT, SRTT as well as other Tata Trusts like Tata Education and Development Trust and Bai Hirabai Jamsetji Tata Navsari Charitable Institution.

It was expected that Mehli Mistry would challenge his removal from the Trusts. Instead the Trusts have been hit by new regulation.

Interestingly, according to a report by the Economic Times (ET), the trusts were not aware of the new law enacted when appointing Venu Srinivasan for life in October. It came up only during the meeting on November 11, when Trustees met to appoint a replacement for Mistry.

So as they appointed Noel Tata's son Neville Tata and former Titan Managing Director Bhaskar Bhat on both Trusts, they also changed Srinivasan's life tenure to just three years.

Interestingly, while Neville and Bhaskar were appointed on Sir Dorabji Tata Trust (SDTT), Srinivasan objected to their appointment on Sir Ratan Tata Trust. He reportedly said that there should be discussion before they become a member. He was not present for the Sir Dorabji Tata Trust meeting since his tenure was part of its agenda that day.

The Critical Amendment

In the six-page ordinance, the Maharashtra government said that they have "noticed" that in various instruments of trusts, there is no clarity about appointment of perpetual or permanent trustees and tenure trustees and their tenure, which leads to multiple litigations before the Charity Commissioner and the court.

"This affects the working of the trusts, welfare of beneficiaries and the public," the statement added.

Hence, it inserted a new section 30A in the Maharashtra Public Trusts Act, amending the existing definition of trustee and clarifying how tenure and perpetual trustees should be appointed and replaced. Perpetual trustees cannot exceed one-fourth of the total trustees unless the trust deed explicitly allows it, and a tenure trustee may be made a perpetual trustee only when a perpetual trustee’s position becomes vacant due to reasons like death, insolvency, incapacity, permanent relocation abroad or conviction for a morally serious offence.

Further, to address the confusion over which authority has jurisdiction, it clarifed that whenever a trust document or court order mentions the Civil Court, Civil Judge, District Court or District Judge, it should now be read as a reference to the Charity Commissioner, giving the Commissioner clear authority to handle such matters.

Implication for Tata Trusts

At their current composition, SDTT and SRTT have six and seven members respectively, meaning they can have only one lifetime trustee. Hence, the new law defeats the purpose of the resolution passed in 2024.

While the state government claims it was to stem litigation stemming from a lack of clarity on Trustees’ tenure, legal experts think otherwise.

"This (Maharashtra Ordinance) impedes Tata Trusts’ recent resolutions aiming for all trustees to have lifetime tenures, forcing a fundamental re-examination of board composition and tenure policy in compliance with the new law," said B. Shravanth Shanker, Advocate-on-Record, Supreme Court of India.

He added that the timing and substance of the amendment suggest "a targeted response to recent changes at Tata Trusts."

"The government likely intended to curtail concentrated governance, promote periodic renewal, and pre-empt internal disputes over succession and control in high-profile public trusts," he added.

According to Tushar Agarwal, Founder & Managing Partner, C.L.A.P. JURIS, Advocates & Solicitors, the timing and the specificity of the rule match closely with the Tata Trusts’ lifetime-trustee plan.

"So it is reasonable to infer that the government anticipated or responded to that situation, even if implicitly," he said.

Vipul Jai, Partner at PSL Advocates and Solicitors, agrees. "The timing of the Ordinance may seem to be a response to Tata Trusts’ decision to make trustees perpetual, which could have a direct bearing on the control and succession planning. However, the Ordinance is a decisive move by the Government toward greater transparency and accountability in public-trust governance," Jai said.

What Can Tata Trusts Do?

Legal experts told Outlook Business that trusts now can either challenge the ordinance in court or increase the members of the trusts.

Enlarging the board of trustees, according to Tushar Kumar, would necessitate "a meticulous amendment of the trust deeds, a reconstitution of the board, and a harmonisation of the existing resolutions to ensure formal legality and institutional continuity."

"The second option is one of constitutional and legal recourse, whereby the trusts could assail the validity or retrospective application of the ordinance on the grounds that it interferes with vested rights and the autonomy of charitable bodies to regulate their own internal affairs," he said.

However, he further added that a challenge of that nature would raise substantial questions of legislative competence and reasonableness under Articles 19 and 300-A of the Constitution.

"Prudence may dictate a calibrated approach, complying in form while reserving the right to question the statute in substance, so as to preserve operational stability and avoid regulatory friction with the office of the Charity Commissioner," Kumar suggested.

The life‐tenure model gave heavy weight to certain individuals; the amendment will force the trust to plan for more systematic succession and term limits, and possibly retirement ages or periodic reviews, notes Agarwal from C.L.A.P. JURIS, Advocates & Solicitors.

"Having too many life trustees can be seen as less transparent; the amendment reflects a regulatory push for greater oversight and periodic renewal," he said, adding that given "Tata Trusts’ prominence and their historically cooperative approach with regulators," the most practical solution will likely involve a mix of modest board expansion, a hybrid structure with both life trustees and renewable fixed-term trustees, and active engagement with regulators to clarify or phase in compliance requirements.

While litigation remains an option, it would likely be a last resort, as it could cause reputational risk and prolong uncertainty, he suggested.