Foxconn plans to invest $2–3 billion annually in its AI business.

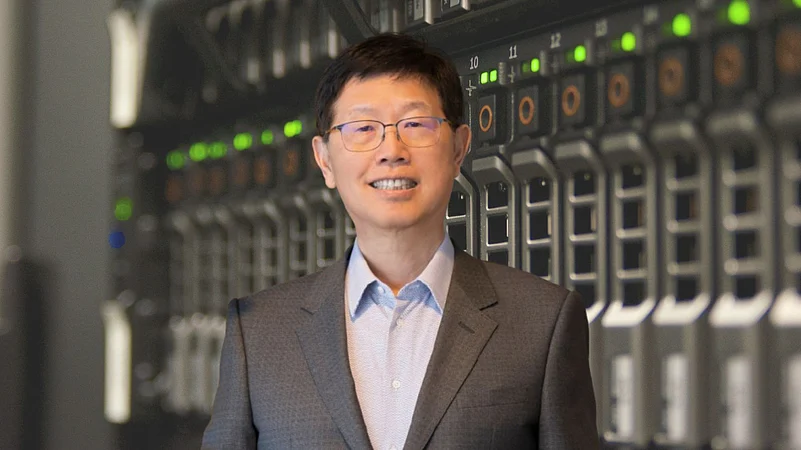

Chairman Young Liu said AI will make up the majority of the company’s investment for now.

The cloud and networking division, including AI servers, has surpassed consumer electronics for two straight quarters.

Apple supplier Foxconn plans to invest $2–3 billion per year in its artificial intelligence (AI) business as revenue from the segment surges. The announcement was made at the Taiwanese firm’s annual Hon Hai Tech Day.

“For now, AI will be the majority of the investment,” Hon Hai Technology Group Chairman Young Liu told Reuters.

Foxconn expects investments in AI infrastructure and related technologies to dominate its spending over the next three to five years, with AI likely to account for more than half of its annual capital expenditure of about $5 billion, Liu said.

He added that Foxconn is in discussions with the Japanese government about potential projects in electric vehicles or AI, noting that domestic production of AI systems will be essential to protect data sovereignty.

The company’s cloud and networking division, which includes AI server production, has outpaced its consumer electronics segment for two consecutive quarters, signalling a rapid shift in its revenue profile.

In the September quarter, Foxconn posted revenue of NT$2.06 trillion, up 11% year-on-year.

The earnings growth was driven by strong demand for data-centre hardware rather than consumer gadgets. Cloud and networking equipment, including AI servers, contributed 42% of total revenue, overtaking smart devices such as iPhones for the second quarter in a row, underscoring a clear shift in the company’s revenue mix as corporate cloud spending rises.

Management expects robust year-on-year growth in the fourth quarter and sees AI-server revenue climbing further, indicating sustained momentum in the AI infrastructure cycle.

On November 12, Liu said he maintains his outlook for significant full-year growth and has revised the full-year forecast for smart consumer electronics to flat, from an earlier expectation of a slight decline. Among its four major product categories, cloud and networking products remain the main growth driver this year.

During the quarter, the firm’s net profit attributable to shareholders rose 17% to NT$57.7 billion.