Adani Group reportedly plans to invest $15 billion in a five-year expansion plan to tap India’s rapidly rising air-traffic demand.

The conglomerate aims to scale its airport network’s capacity to 200 million passengers annually.

Investments will span Navi Mumbai, Ahmedabad, Jaipur, Thiruvananthapuram, Lucknow and Guwahati,

Adani Group is preparing to ride India’s expected surge in air traffic with a $15 billion expansion plan over the next five years. The ports-to-power conglomerate reportedly aims to increase the annual passenger-handling capacity of its airports to 200 million.

According to a Bloomberg report citing sources, the group will invest across its airports in Navi Mumbai, Ahmedabad, Jaipur, Thiruvananthapuram, Lucknow and Guwahati. About 70% of the funding is expected to come from debt and the remaining 30% from equity.

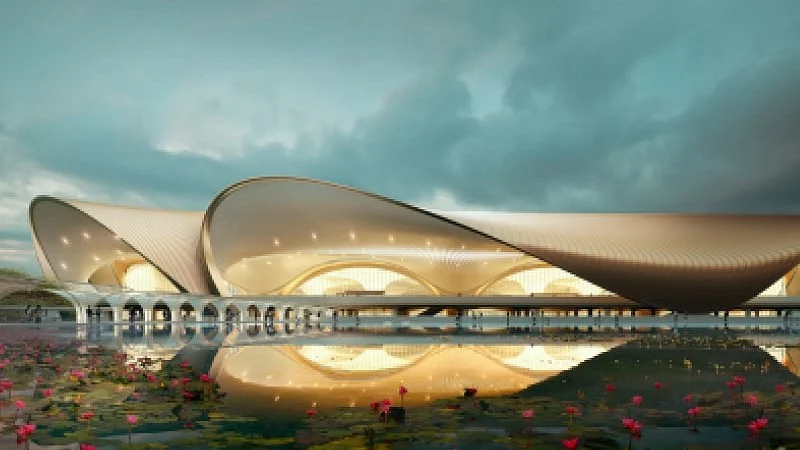

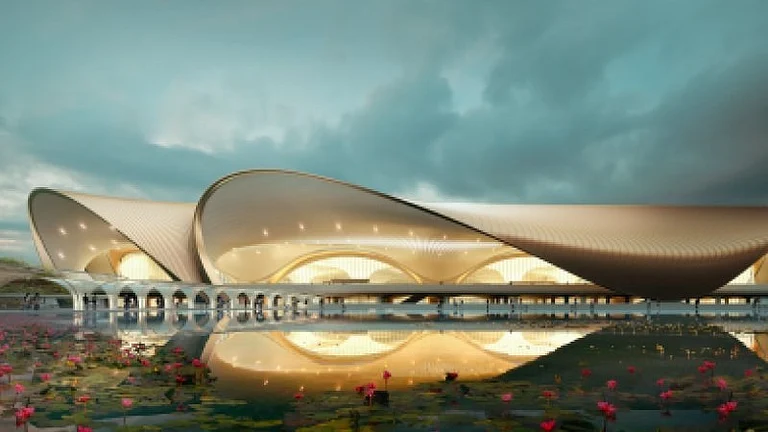

Adani Group’s subsidiary, Adani Airport Holdings Ltd (AAHL), currently operates nine airports across India, including Mumbai’s Chhatrapati Shivaji Maharaj International Airport. The company is set to inaugurate the Navi Mumbai International Airport on December 25.

The expansion blueprint includes new terminals, taxiways, and an additional runway at Navi Mumbai, alongside capacity upgrades at the other five airports.

According to AAHL’s website, the company manages 89 million passengers, 1 million metric tonnes of cargo, 6,14,552 air traffic movements, and works with 65 operating airlines.

What’s Driving the Investment?

India’s fast-growing air travel market is the key driver behind the Adani Group’s renewed push. Annual passenger numbers are expected to surpass 300 million by 2030. By scaling up its capacity to handle nearly two-thirds of that demand, the group is positioning itself at the centre of this growth curve.

The plan will increase AAHL’s overall handling capacity by more than 60%, excluding the 20 million passengers expected at Navi Mumbai and 11 million at Guwahati, which opens this month.

These upgrades focus primarily on the six airports Adani acquired in 2020 during India’s second phase of privatisation, previously operated by the Airports Authority of India.

The government is now preparing another round of airport privatisation involving 11 airports, bundling weaker assets with profitable ones to draw interest. Adani Airport Holdings and Delhi Airport operator GMR Airports are expected to be among the key contenders.

The investment push also comes amid reports that the Gautam Adani-led group is considering listing its airports arm, AAHL, by 2027. The conglomerate is simultaneously exploring entry into the airport ground-handling services space following the exit of Turkey’s Celebi Aviation after its security clearance was revoked.