Adani Enterprises plans to spin off and list key subsidiaries, including its airport, metals, roads, and data centre businesses.

The company, valued at ₹2.71 lakh crore, aims to unlock value as several assets near maturity in the next three years.

The move follows a similar roadmap to its 2016–2020 listings of Adani Total Gas, Adani Green Energy, and Adani Wilmar.

Adani Enterprises, the flagship arm of the Adani Group, is reportedly planning to spin off and list several of its key subsidiaries over the next few years. The company, which currently has a market valuation of ₹2,71,036.26 crore, aims to unlock value from its maturing businesses.

According to The Economic Times (ET), subsidiaries likely to be listed include its airport, metals, roads, and data centre businesses. These listings could take place between 2027 and 2031.

The company expects several of its major assets to reach maturity over the next three years, paving the way for new listings, the newspaper reported. The listing roadmap is expected to mirror what the Gautam Adani-led conglomerate achieved between 2016 and 2020, when it listed Adani Total Gas, Adani Green Energy, and Adani Wilmar.

By FY28, Adani anticipates its airport division’s EBITDA will triple from current levels, while its copper and materials units will be fully operational and ready for listing.

The Ganga Expressway and seven additional road projects are also projected to be completed within this timeframe. The roads business reported an EBITDA of ₹930 crore in the first half of this fiscal year, with seven projects operational and another seven under construction.

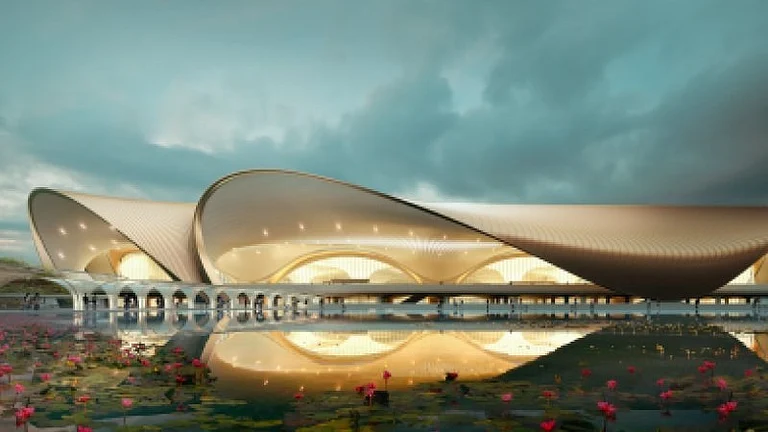

Adani Group, India’s largest private airport operator, manages eight airports through its wholly owned subsidiary, Adani Airport Holdings, which oversees operations in Mumbai, Lucknow, Ahmedabad, Jaipur, Guwahati, Thiruvananthapuram, and Mangalore. The airport business reported an EBITDA of ₹1,062 crore in the September quarter, a 43% year-on-year increase.

The group has also launched the first phase of city-side development across 114 acres at its airports in Mumbai, Ahmedabad, Jaipur, Lucknow, and Guwahati, focusing on the fast-growing non-aero segment.

In metals, Adani Enterprises aims to build the country’s second-largest portfolio after Vedanta in the coming years.

Following the report, Adani Enterprises’ shares were trading 0.87% higher at ₹2,348.35 on the NSE at 10:38 AM.

For the first half of FY26, Adani Enterprises reported a total income of ₹44,281 crore and an EBITDA of ₹7,688 crore. Of this, ₹3,583 crore came from exceptional items, with continuing operations contributing ₹2,281 crore. Notably, incubating businesses now account for over 70% of EBITDA, up from 60% a year earlier.