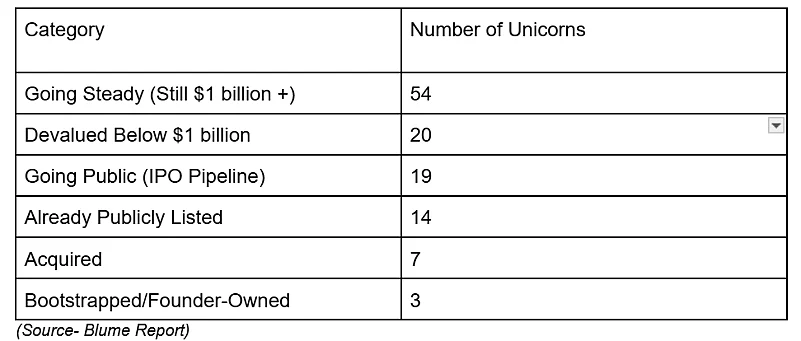

Even though India is the third largest unicorn creators of the world, only 91 out of 117 unicorns in the country are truly worth greater than $1 billion. Some of the unicorns that are now valued under $1 billion includes embattled edtech platform Byju’s, personal care product company Myglamm, social media platform Hike and e-pharmacy company Pharmeasy.

The country’s unicorn creation also reduced significantly from 44 in 2021 to 2 in 2023. However, the number did improve to 6 in 2024, as per a report titled ‘Indus Valley Annual Report 2025’ released by early-stage venture capital firm Blume Ventures.

The prolonged funding winter was one of the reasons for the same. India witnessed a funding winter from 2023 which led to decrease in the overall start-up ecosystem’s funding from $42 billion received in funding in 2021 to $16 billion funding received in 2023 as per data platform Tracxn. The funding winter also led to the closure of more than 35,000 start-ups in 2023 as per a report by Bain & Company in collaboration with the Indian Venture and Alternate Capital Association (IVCA).

To add to it, there where several other concerns such as a weak IPO market and valuation concerns. The poster boy of start-up ecosystem Byju Raveendran’s edtech platform Byju’s got caught up in several regulatory scruinties which includes a rift between the investors and the founders.

Eventually, the company’s valuation was reduced from $22 billion in 2022 to zero in 2024. A spokesperson for one of Byju’s investor companies, Prosus, reportedly said, “We have impaired Byju's down to zero at the end of FY24. We have written down Byju's primarily because we have inadequate information on the company’s financial health, liabilities, and future outlook.”

To add to it, PharmEasy also saw a reduction in its valuation to $456 million in December 2024. This was a 92 per cent reduction from its peak valuation of $5.6 billion in October 2021. As per reports, Janus Henderson, an investor of the company highlighted that his 12.9 million shares of the company, once worth $9.4 million, was valued at just $0.76 million as of December 2024.

Rise of Micro VCs

While painting a broad picture of the Indian start-up ecosystem, the report also indicates that there has been a surge of micro VCs (small-scale venture capital fund that primarily invests in early-stage startups) in the country. Currently the country has more than 100 active micro VCs in India, supporting startups in SaaS, deeptech, fintech, and consumer tech.

One of the reasons for the growth of micro VCs has been the selective approach of multi stage funds who end up choosing elite founders, adds the report. “As Seed / Multistage funds get choosy and prefer to focus on elite founders, a gap is opening up in funding for first-time founders, which is being filled by MicroVCs,” adds the report.

Over the last few years, there has been a decline in early-stage funding for Indian startups. If we look at the data, the number of startups securing seed funding has dropped significantly—from around 2,513 in 2021 to just 1,078 in 2024, as per the report. Additionally, while check sizes at Series A and B stages stayed stable, follow-on funding dropped, with 30% fewer startups raising Series A/B rounds compared to 2022. Some of the examples of micro VCs includes Better Capital, 8i Ventures, iSeed and Sauce.VC.