US markets closed sharply lower on Friday after Iran launched missiles at Israel in retaliation for a series of Israeli strikes targeting Tehran’s suspected nuclear capabilities. Explosions were reported over Tel Aviv and Jerusalem, with air raid sirens sounding across the country as Israeli defence forces confirmed incoming missile fire from Iran.

The Dow Jones Industrial Average dropped 1.79% to 42,197.79, while the S&P 500 declined 1.13% to end at 5,976.97. The Nasdaq closed 1.30% lower at 19,406.83.

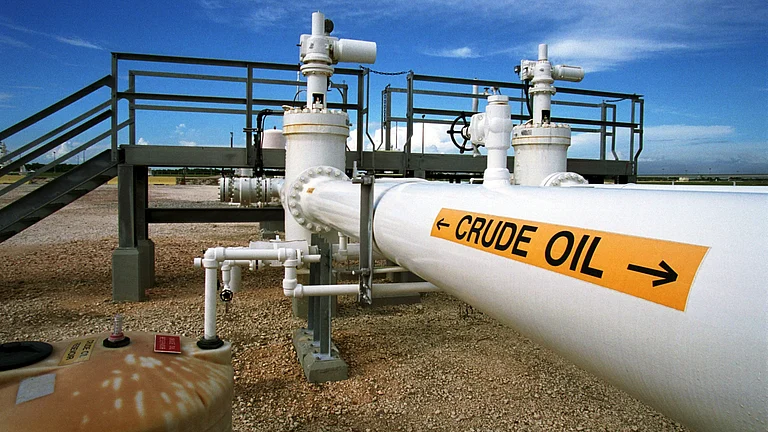

The strongest impact was visible in the oil market, where the price of a barrel of benchmark US crude jumped 7.3% to $72.98. Brent crude, the international standard, rose 7% to $74.23 per barrel, on fears the conflict could disrupt crude supply from the Middle East. Meanwhile, US energy stocks rose in tandem, with Exxon opens new tab up 2.2% and Diamondback Energy opens new tab rallying 3.7%.

Iran remains a key oil producer globally, although Western sanctions have significantly curbed its exports. However, the risk of a broader conflict raises concerns over further supply disruptions. Any escalation could hamper Iran’s oil shipments, tightening global supply and driving up crude and fuel prices worldwide.

The US dollar index rose about 0.5% to 98.16, while US 10-year Treasury yields rose 5.6 basis points to 4.413%, as markets absorbed a sudden shock to commodity and stock prices.

On the other hand, tech and financial stocks witnessed a sell-off. Nvidia shares declined 2.1%, Apple lost 1.4%, while Visa and Mastercard fell more than 4% each. Adobe slid 5.3%, whereas Oracle bucked the trend, surging 7.7% to a record high.

In contrast, U.S. defence stocks rallied amid heightened geopolitical tensions, with Lockheed Martin, RTX Corporation, and Northrop Grumman all gaining over 3%.

Airline stocks declined sharply amid rising fuel costs. Delta Air Lines fell 3.8%, United Airlines dropped 4.4%, and American Airlines slid 4.9%.

Meanwhile, U.S. energy stocks advanced on the back of firming crude prices. ExxonMobil gained 2.2%, while Diamondback Energy rallied 3.7%.