Just like legendary investor Warren Buffett has hordes of disciples who track his every word and investment he makes, there is one investor who is respected by everyone on Dalal Street. In fact, investing legend Rakesh Jhunjhunwala calls him his teacher and for good reason. From dropping out of college to becoming one of the richest men in the country, Radhakishan Damani is now rightly known as ‘The Retail King’. The billionaire owns nearly 75% in Avenue Supermarts. Even the COVID-19 crisis could not break the good run of DMart, the most valued Indian retailer, which trades only about 7% lower from its all-time high of Rs.2,560. This, despite the management warning that profitability might be hit in the current fiscal. Besides the company’s fundamentals and competitive pricing in the space, many investors swear by Damani’s track record.

So, when he invested and upped his stake in India Cements, a company with many troubles, Dalal Street went into frenzy. Since then, India Cements has gained almost 80% in 2020. Currently, along with his brother Gopikishan Damani, he holds almost 20% in the company. This is after Damani entered the stock in September quarter of FY20 with 1.35% stake and increased their combined stake further in December 2019. Given Damani’s ability to pick the right business, wait it out and make very good return, the question is: what has he seen in India Cements?

Wickets down

N Srinivasan is known throughout the country as the man who played a key role in shaping the story of Indian cricket. Besides being the former chairman of ICC and the president of BCCI, he also owns Chennai Super Kings and Vijay CC and has built several useful political connections. That enterprising fibre has helped him keep his father’s legacy afloat through India Cements, which was founded in the ’40s. Today, through promoter entities, the MD and vice chairman of the company holds 34.92% stake in the company.

Over the years, he has ensured growth through acquisitions such as Raasi and Vishnu Cement, expanding the company to an installed capacity of 15.5 million tonnes across seven integrated plants in the South and Rajasthan and two grinding units in Tamil Nadu and Maharashtra. But a few missteps that include venturing into shipping and coal mining have left the cement major to flounder.

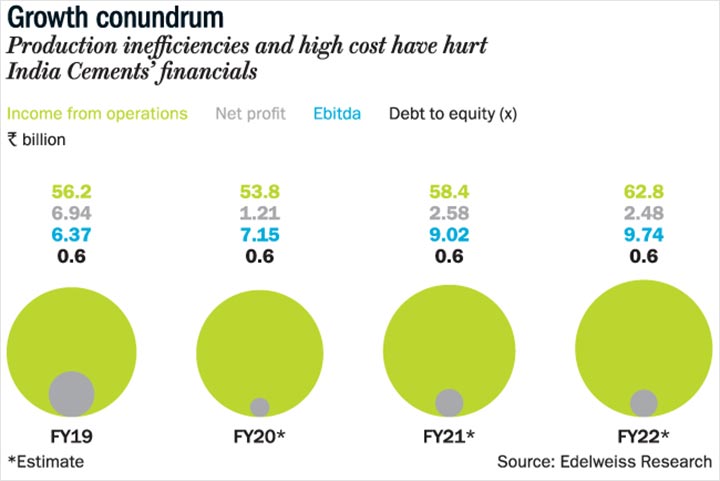

Today, India Cements is confronted with high levels of inefficiency, with the plants suffering on account of obsolescence with no new investments (See: Growth conundrum). A look at the cost of production tells the tale. In FY19, India Cements spent Rs.3,940 per tonne manufactured when the average for its rivals in the South was around Rs.3,450 or an outgo of over 14% due to neglect of plants and high dependence on coal. Due to inadequate investments, the company also reports high waste in heat recovery systems — India Cements has an aggregate capacity of 7.7 MW for its 15.5 million tonne capacity; whereas Shree Cement’s capacity stands at 211 MW for 40 million tonnes.

In fact, for Q3FY20, the company reported a loss of Rs.53.7 million — the first in 19 quarters. Srinivasan attributed it to “the pressures of falling prices combined with poor demand in the southern market.” The management has delayed announcing its results for the fourth quarter, but they expect to register a profit due to a price hike.

Meanwhile, it has seen no Ebitda growth over the past five years. As opposed to industry average core Ebitda growth of 1.60% in FY19, India Cements saw negative growth of 6%. One of its closest peers, Ramco Cements has also seen better growth with Ebitda margin at 20%, while India Cements struggles at 11%. Its debt has also risen from Rs.31.97 billion in FY18 to Rs.34.52 billion in FY19. Despite the debt to equity ratio being manageable at 0.6x, servicing interest costs has not been easy. This was one of the reasons why Care downgraded India Cements’ short- and long-term credit rating in April 2020. They cited “moderate financial performace over the past two years and low profitability indicators” in their report as some of the key factors. “In view of the prevailing industry scenario, demand for cement will continue to remain subdued in the near term and hence profitability is expected to remain moderate,” the report added.

Another disadvantage that it has as compared to its peers is the market mix. Navin Sahadeo, research analyst, Edelweiss Securities, says half of India Cements’ business comes from Andhra Pradesh and Telangana, which together contribute 7.09 million tonne. “Historically, these have been low-priced markets with huge volatility. By contrast, Ramco has over 55% of its sales from Tamil Nadu and Kerala, known to be high on margins.” Ever since the new administration cancelled projects by the former government in Andhra Pradesh, several infra and construction businesses have taken a hit.

Clearly, saying that the company is not in the best shape would be an understatement. Then why is one of the India’s most astute investors interested in the stock?

The underdog

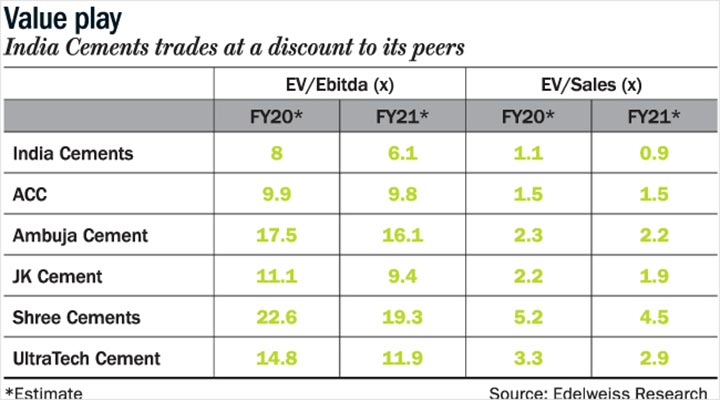

For one, the discount. At a market capitalisation of Rs.40 billion and debt of Rs.30 billion, India Cements’ enterprise value stands at Rs.70 billion. To put things in perspective, one would require a capex of around Rs.7.5 billion to set up a plant with a capacity of one million tonne. After clearances and construction, it takes about two years to kick off production and another year to penetrate the market. Roughly, a 15.5 million tonne plant would need an investment of Rs.115 billion. That means Damani has got a 40% discount since he hiked his stake from September 2019 to March 2020, buying at an average price of Rs.84. The stock is currently trading near Rs.130 still below its book value of Rs.169. Sahadeo points out that India Cements has always traded at a discount due to low profitability and high debt on its books. Over the past three years, its EV/core Ebitda ratio has ranged between 8.8x and 10x. “But that is not unique to India Cements since there are other stocks in the South trading at similar or much lower valuation,” he explains, as he cites the case of Orient Cement, which trades at $40 per tonne against $65 for India Cements (See: Value play).

Meanwhile, for the inefficiency and high cost of production problem, Rashesh Shah, senior research analyst, ICICI Securities believes there are ways that the company could “fix” that. “There is an opportunity to reduce freight, power and fuel, and selling and distribution costs,” he says. For instance, by spending more on trade promotion and cutting back on advertising, the company will not have to cut back on dealer margin. “All this can easily result in cost of production falling by at least 10%,” he adds. This, he believes will boost the company’s Ebitda.

But what’s interesting is that Damani is going big in a space that he has never publicly played before. Other than Simplex Infra, most of his other holdings include VST, Delta Corp, Spencer’s Retail, besides DMart — are all consumer-related companies. India Cements also has a quasi consumer play in Chennai Super Kings which was valued at Rs. 7 billion in 2019 by Duff and Phelps. According to its FY19 annual report, the franchise saw total revenue of Rs.4.18 billion and net profit of Rs.1.11 billion. After its demerger from the parent, CSK’s ownership lies with a shareholders trust.

What has also jogged investor interest is the lack of clarity on the succession plan at India Cements. So far, Srinivasan has been the face of the organisation and his daughter Rupa Gurunath is a whole-time director, but she is not involved on a day-to-day basis. Srinivasan’s son Ashwin has long been estranged from his father, leaving many questioning: Who after Srinivasan?

It is still unknown if he will join the board or appoint someone on his behalf. But despite being a purely financial investor, Damani is also expected to facilitate the process of equity infusion. Those who know the retail king say there is a good chance of the company bringing in money through a private placement, rights issue or even a private equity fund. Damani buying into India Cements is said to have been done with the full knowledge of Srinivasan. It was not a decision taken overnight since Damani had set his eyes on the company for at least a couple of years with the conviction that it was significantly undervalued compared to its peers. When Outlook Business contacted India Cements, they refused to participate in the story and we received no response from Damani's office.

Damani could get the company out of the woods and even set it up for something bigger. Jigar Shah, CEO, Maybank Kim Eng Securities, while agreeing that India Cements has, historically, not been very efficient or profitable, says its large capacity is what needs to be seen. “It is a takeover target and one of the larger companies with a gap in its presence in the south will try to acquire it. That’s the catalyst for the stock.” Possible suitors include LafargeHolcim because of less capacity in the south and perhaps Shree Cement as well. “The last few transactions took place between $100-125 enterprise value per tonne,” reminds Shah. It could well be a long process but Damani is known to be extremely patient with his investments. He has already set himself up for his next multibagger.