With trade talks collapsing before the 27 August deadline, US President Donald Trump’s steep 50% tariffs on Indian exports went live this morning, dealing a sharp blow to India’s outward-facing sectors. The move comes on top of a 25% reciprocal levy in force since 7 August, and a further 25% penalty imposed for India’s purchase of Russian crude from today.

The triple whammy has cast a long shadow over Indian exporters, with textiles, shrimp and gems bracing for the heaviest losses. Investors have already priced in some of the pain as shares of textile and shrimp firms have fallen between 6-19% since the tariff announcements.

Textiles Stares At Faltering Competitiveness

Among all, the textile and apparel industry stands most exposed. India is the world’s sixth-largest exporter in the sector, accounting for about 4% of global shipments in 2024. The sector, including handicrafts, contributed $37.7 billion or 8.6% of India’s merchandise exports last year, against an overall market size of $179 billion.

Nearly 29% of those exports, worth $10.3 billion, head to the US. With the new 50% tariffs in place, analysts warn Indian goods could simply be priced out. Competitors such as Bangladesh, Vietnam and China already enjoy lower tariff regimes, leaving Indian exporters on the back foot.

“The textile and garment sector, a traditional stronghold for India, faces fresh pricing pressure as tariffs dent competitiveness in global contracts,” noted Divam Sharma, Co-founder of Green Portfolio PMS.

Apparel shipments to the US stood at $10.8 billion in 2024, underlining India’s heavy reliance on American buyers. For companies such as Gokaldas Exports, Indo Count and Welspun Living, as much as 70% of revenues flow from that single market. Gokaldas chief Sivaramakrishnan Ganapathy, in an interaction with CNBC-TV18, had already flagged the need for government support if Washington pushed ahead with steeper levies.

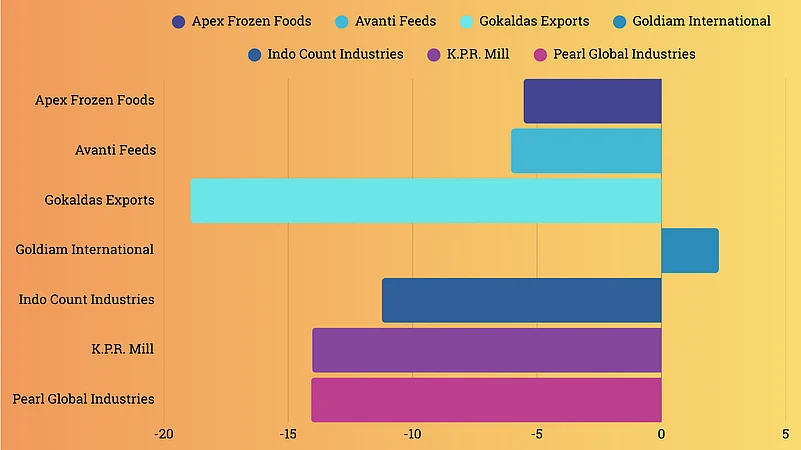

Global banks are equally cautious. JPMorgan estimates that around 1.1% of India’s GDP in value-added exports to the US are now under direct threat, with textiles ranking among the most vulnerable given their high labour intensity. Investors in the stock market also took note of the worsening near-term outlook for textile stocks and moved ahead with dumping their holdings in the segment. On the heels of that, shares of major textile exporters have slumped 11-19% since the tariffs were levied.

Shrimp Exporters Fear a Collapse in Orders

Seafood exporters are also reeling. India ships roughly ₹60,000 crore ($7.4 billion) worth of seafood to the US annually, with shrimp accounting for 40% of the total. In 2023, India exported $1.81 billion of frozen shrimp to the US, dwarfing Vietnam’s $290 million. Analysts warn that the new tariffs could wipe out up to ₹24,000 crore in exports, shifting demand to rival suppliers.

The sector was already battling headwinds, from global oversupply and falling prices to disease outbreaks. The additional 50% levy piles onto existing US duties, which include a 7% countervailing tax and anti-dumping penalties.

Andhra Pradesh, which produces nearly 70% of India’s shrimp, is most at risk. “We are shocked. Orders from US clients have been paused in recent weeks as buyers aren’t willing to absorb the tariff, and neither can exporters, forcing price cuts for farmers,” said Pawan Kumar, head of the Seafood Exporters Association of India.

Shares of companies such as Avanti Feeds and Apex Frozen Foods have already dropped around 6% in the past month. With nearly half of India’s shrimp exports destined for the US, analysts warn volumes could collapse, leaving farmers and exporters staring at a bleak year ahead.