“Minimalist will not survive or remain relevant in its current form in the next 3-5 years” – this single line posted by Bombay Shaving Company founder Shantanu Deshpande has raised questions on the beauty brand’s sustainability. It was not just a passing opinion; it was a pointed critique aimed at Indian’s most-talked about D2C stories, which is now in the hands of FMCG giant Hindustan Unilever.

For context, HUL acquired new-age beauty brand Minimalist for ₹2,706 crore in April 2025. The legacy player now has 90.5% stake in Uprising Science, the brand’s parent company. This may mark the beginning of the end of once founder-driven business, said Deshpande in his LinkedIn post last week.

“A new CEO is at the helm of a struggling giant. There will be a combination of ‘focus on our core’ and ‘innovate and build ourselves for the consumer’ that will further alienate an orphaned brand,” Deshpande wrote. And if the internal shake up was not enough, external pressure is building too.

“Competition is quick to swoop in. Not hard to copy a copycat. Competition will ensure premiumisation – another strategic lever for new CEO – will be tough,” the rival company's founder-CEO warned, saying, he, himself, has seen 10 pitch decks in the beauty space.

While some LinkedIn users echoed Deshpande’s skepticism pointing towards past examples of start-up acquisitions fizzling out under corporate ownership, others defended Minimalist’s growth story as they suggested that HUL’s scale and capital can help the beauty brand thrive.

The post, simply, opened a fault line between those who are sceptical about new-age brands ability to thrive in their niche markets on their, compared to brands that get acquired by FMCG heavyweights such as HUL.

Scale vs Soul: The Identity Risk

Since its inception, Minimalist has been known for its focus on transparency, science-backed formulations, and active ingredients. It emphasises on using a minimal number of ingredients to target specific skin concerns. Before being acquired by HUL, the founders (Mohit Yadav and Rahul Yadav) were focused on #HideNothing for Minimalist.

But it has now become a small part of HUL’s vast portfolio, which includes food & refreshment, home care, beauty & wellbeing, personal care products and more. For now, HUL has placed Minimalist under its Beauty & Wellbeing division, which is led by Harman Dhillon.

However, the current Minimalist team is being led by its original founders, in collaboration with HUL executives. The transition was expected to take place in Q1 FY26, though there is no official word on it yet.

This picture is going to get complicated further when the change will happen at the top. With new CEO Priya Nair set to take charge of HUL from August 1, there’s a concern that corporate strategies like focusing on core products or accelerating mass-market appeal could sideline Minimalist’s original essence.

“HUL’s brand strategy is more about branding than the soul in products,” says Nikita Aggarwal, brand strategist at founder’s office of NxtWave. If the new marketing team tries to change the brand with HUL’s DNA, she believes that there is a risk that the founder's brand positioning won’t survive.

Akshay D’Souza, an independent consumer business consultant, also acknowledges the risk, but disagrees with the doomsday narrative. “HUL may not be known for building brands from scratch, but Minimalist wasn’t a risky bet. It already had product-market fit, scale, and loyalty. Now, HUL’s distribution and supply chain can help it scale profitably,” he says.

Though he believes that with HUL’s distribution and global supply chain, the beauty brand can massively expand the brand's reach and improve margins. That’s the big upside.

Even Minimalist offers HUL access to a consumer segment and product space it hadn’t meaningfully tapped into before, according to Mit Desai of Praxis Global Alliance. “That makes the brand’s product-led identity strategically valuable. But retaining that distinctiveness will depend on how thoughtfully the acquirer manages the integration”.

Outcomes over Optics: The Real Test Begins

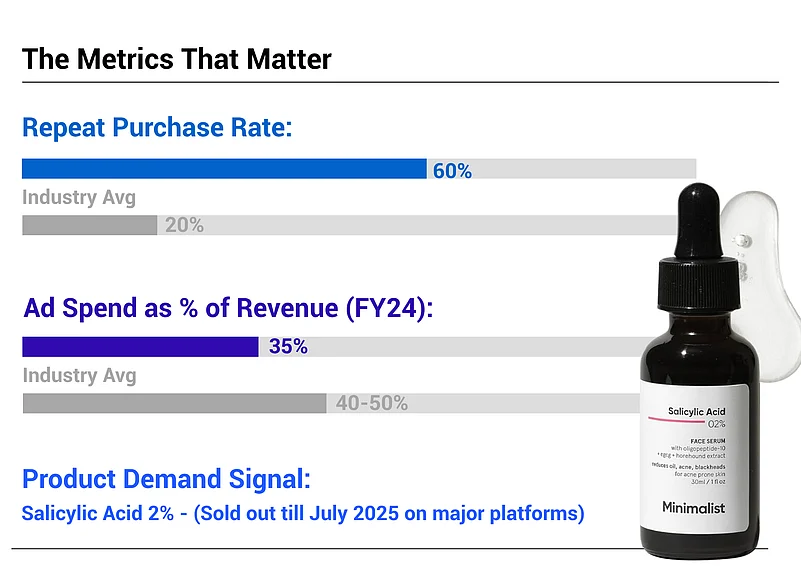

For any skincare brand, the real test lies in one question: do consumers come back to make second purchase? Experts reveal that Miinimalist’s repeat purchase rate stays strong at 60%, which is three times higher than the beauty D2C industry’s average.

Another big signal of its staying ahead in beauty space won’t be Instagram buzz or ad spends; it will be product performance. Minimalist’s advertising and promotional spends jumped to ₹117 crore in FY24, nearly 35% of total costs – up from an earlier benchmark of 20-25%.

In contrast, most D2C beauty brands operate at 40–50% ad spend, but Minimalist stood out by building trust through restraint.

“If impactful product innovation does not accompany this increased ad visibility, users will feel the dissonance. And in beauty, nothing kills a brand faster than looking louder than you perform,” says Deepak Gupta, cofounder, Style Lounge, a beauty tech start-up.

Citing an example, he says that its popular product like Salicylic 2% often sell out on big platforms such as Nykaa and Lifestyle. They were even unavailable till July 2025. “This indicates that people still want them. Brand loyalty isn't falling apart. However, if quality or user experience gets worse, the decline might speed up,” he adds.

Gupta also listed out three signals to be watched out for troubles in such cases. These include reduction in research & development funding, exit of core members from the product team, and slowdown of new product launches.

And Desai warns that even subtle shift in customer acquisition methods, pricing, communication tone, or service experience could gradually impact loyalty if not handled carefully.

“If the product is not the hero but the marketing is. D2C brands are built on reviews on various platforms, if the cult tribe feels that product is no more the hero, they will talk and walk away. Also, there is always a risk of competition. A lot of brands like Deconstruct are in similar space, Ordinary is available in India & hence product innovation becomes important,” says Aggarwal.

Sometimes products outgrow. For example, there was a brand called TAC (The Ayurvedic Company) got popular for gold in their face cream. The start-up has shut down because the trend for their core product is gone now.

Hits & Misses in Beauty M&A: The Scaling Rifts

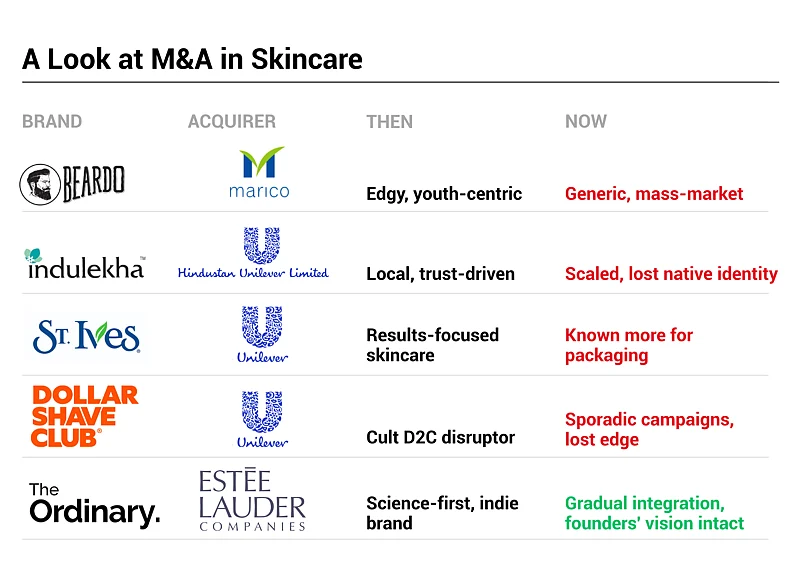

Aggarwal gives some global examples, in which the beauty and personal care industry is littered with cautionary tales of promising brands that lost their edge after being acquired, some of them by Unilever itself. Take Beardo, for instance: once a bold, youth-centric brand in men’s grooming, it now feels like just another mass-market label under Marico.

Similarly, St. Ives, acquired globally by Unilever, has shifted from being seen as a results-driven skincare brand to one better known for its packaging than efficacy. Indulekha, under HUL’s wing, may have gained scale but lost the deeply rooted local narrative that once made it a household name.

Even Dollar Shave Club, once a disruptive force in direct-to-consumer shaving, now struggles to command the same loyalty—reduced to sporadic campaigns rather than a strong consumer connection. These examples highlight the delicate balance required to scale without diluting soul, and serve as a timely reminder of what’s at stake for Minimalist.

However, there are some positive examples too. For instance, The Ordinary (by DECIEM) was acquired by Estée Lauder gradually, while keeping founder vision intact for years.

“EL knew better than to touch the brand tone too early—and it worked. So, there is a risk specially if the founder’s skin in the game reduces, the brand is not one of the top contributing in the portfolio,” she adds.

Brand or Bland: The Future That Awaits Minimalist

Minimalist is at a strategic fork, it can either be a category creator in India (which it already is) and into India’s first Science-backed skincare legacy brand, or risk becoming just another well-advertised label with no substance and shelf life.

It can even get the biggest “distribution” advantage. Under HUL, D’Souza says it can reach far more consumers than the founders ever could—especially through general trade, which is hard to crack. “Online and modern trade can only take you so far. HUL’s general trade muscle is where Minimalist will benefit the most”.

“The second benefit is HUL’s global supply chain. Their sourcing capabilities can help reduce input costs and boost margins. So, I expect strong top-line and bottom-line growth,” he says, adding that HUL is paying the price for innovation through this acquisition—and it could pay off well.

Harish Bijoor, business & brand-strategy expert says that if the soul of Minimalist is to be preserved within the larger, more maximalist structure of HUL, it’s essential that the brand is insulated from HUL’s mass-market machinery.

"Distribution needs to remain distinct and independent. The advertising and marketing approach must also be differentiated. Even the leadership should be uniquely aligned with Minimalist’s original vision," he adds.

For this, HUL is likely to pursue a hybrid path – retaining Minimalist’s niche D2C appeal in digital channels, while selectively scaling through its broader retail distribution network. This would help them unlock growth, and preserve brand equity too.

Unlike Pond’s or Dove, which caters to mass audiences through legacy advertising and price-point positioning, Minimalist operates in a performance-led and ingredient-conscious category. It can even revive HUL’s brand and personal care segment, which saw degrowth last year, says De’Souza. The brand fills a crucial gap in consumer preference.

However, for HUL, the challenge will be to scale responsibly without eroding the brand’s core values or alienating its early adopter base. In short, Minimalist under HUL's umbrella will determine if Deshpande's scepticism of the beauty brand's chances of survival is justified.