Dark patterns like hidden fees, fake urgency cues, and hard-to-find cancellations remain common in Indian apps—79% still use them (ASCI–Parallel HQ)

They can boost short-term revenue but damage trust, increase churn, and hurt brand equity

Regulators are cracking down, with a September 5 self-audit deadline for start-ups

It’s almost impossible to skip “additional charges” on food delivery and quick commerce apps. Even travel platforms often withhold “convenience fees” and “seat costs” until the final payment stage. And sometimes, they also display “sold out” on hotel rooms to create urgency.

The string of dark patterns doesn’t end here! The more you switch from one app to other, the more manipulative tactics you will observe. Pre-ticked “checkboxes for insurance” on fintech apps, “free sign-up” but suddenly hopping to “enter credit card details”, “cancellation options buried under multiple layers, and many more.

Swiggy, Zomato (now Eternal), Zepto, EaseMyTrip, Goibibo, MakeMyTrip, Unacademy, CRED, Ola….Amazon – all are in the same boat!

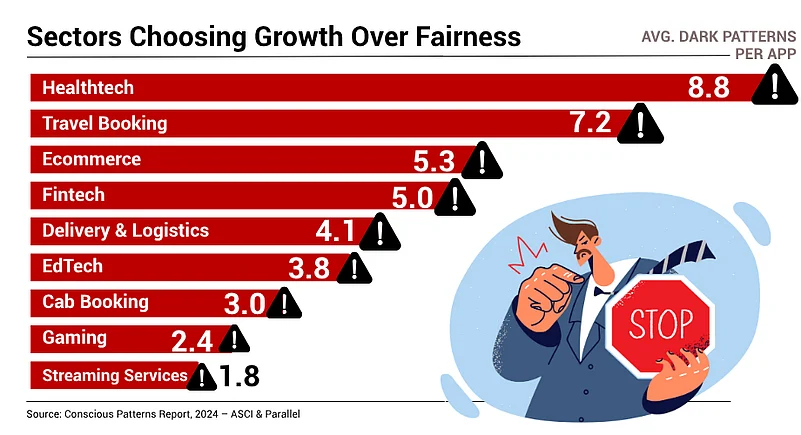

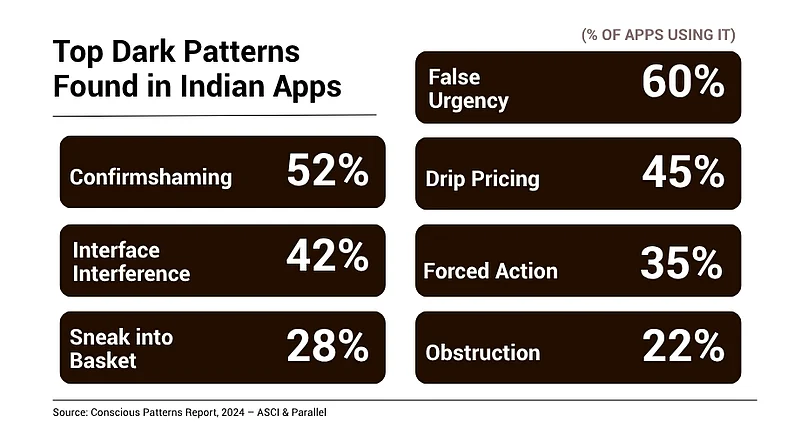

According to a joint study conducted by the Advertising Standards Council of India (ASCI) and UI/UX design company Parallel HQ in 2024, more than 79% of Indian apps trick users into giving away their personal data. While it’s difficult to quantify the precise increase in conversion rates due to dark patterns in India, experts observe significant rise in unintended purchases on online platforms.

“Dark patterns often act as a shortcut as they drive conversions by manipulating users into actions they wouldn’t have taken otherwise. Users who feel manipulated through flash sales, often regret their decisions. Over the time, this practice damages the perception about that brand,” says Robin Dhanwani, founder of Parallel, a product design lab based in Bengaluru.

However, the tide may turn now as the regulators have increased scrutiny on such practices. In May, consumer affairs minister Pralhad Joshi gave online businesses an ultimatum to conduct self-audits to identify and remove dark patterns. The deadline has been set for September 5.

Outlook Business has sent mails to Amazon, Flipkart, Swiggy, and Zomato to take an update on the same. However, these platforms have refused to comment on the story.

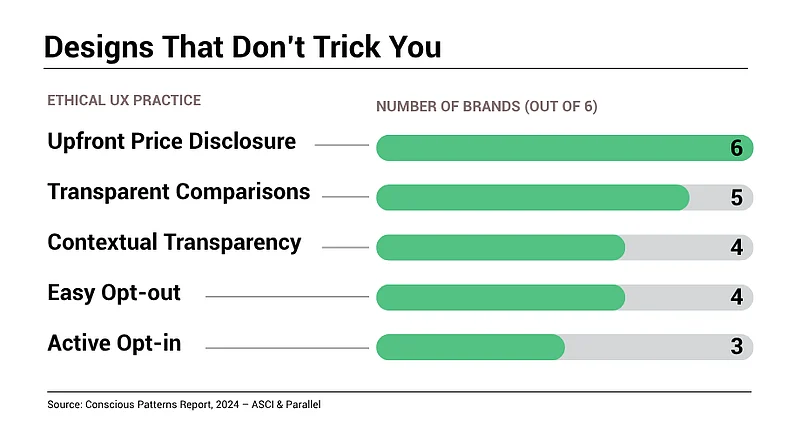

This push for compliance has raised concerns whether Indian start-ups can shift to more transparent and ethical designs. “The alternative is ethical design. But it’s a longer game which helps you build trust and loyalty in the long run,” he notes.

The Ethical Dilemma: Metrics vs Morals

There is a thin line between ethical and unethical designs. One works for “acquire, convert, and retain”, while another focuses on sustainable scaling and building customer trust for the long term. Manisha Kapoor, CEO and secretary of ASCI drew the line between these two marketing tactics clearly.

“The concern arises when these nudges are used deceptively to override user intent or constrain choice, or leading users into actions they did not intend such as making unintended purchases, subscribing unknowingly, or sharing more data then they realise it is deemed deceptive,” says Kapoor.

In contrast, persuasive elements that offer users real choice, clarity, and control remain within ethical bounds. According to Jena, this thin line shifts based on the business’ KRA (key result area). “What looks like manipulation to one person is just Tuesday for a growth team”.

A quick commerce app, for example, offers a monthly subscription by notifying both choices – Pay ₹99/month for free delivery or continue without subscription. Both options should be easily visible, without any countdowns, or hidden links. This way, the app leaves full control with the user to decide the best option suitable for them.

The financial impact is not trivial. Hidden fees or pre-checked upsell options can push checkout totals approximately 10-15% higher than displayed prices, according to Dhanwani.

However, users will tolerate only a few nudges, as long as the product works, the brand connects, and there’s real value. Without these factors, Preetam Jena, CMO of eCommerce Head, warns that the cleanest UI will not save any online business platform. “They’ll churn, rage-tweet, and one-star you into oblivion,” he says.

Due to this growing intolerance, Chirag Taneja, founder of GoKwik, sees the shift toward transparency as “inevitable”.

“Today’s Indian consumer is digitally fluent and increasingly values transparency and control. Sustainable scaling without dark patterns is not only possible—it’s already happening”. He notes that brands making the switch to ethical designs see lower churn and higher lifetime value, even if immediate upsell revenue dips.

Growing Up Without Going Dark

While many start-ups heavily rely on dark patterns for higher conversion rates, Kapoor asserted that not all nudges are unethical. He clarifies that some could be legitimate marketing strategies that help users make informed decisions.

For instance, quick commerce platforms focus majorly on speed as their key selling points. Considering this, some apps mark orders as “delivered” in their system even before the rider physically reaches the customer’s doorstep. This tactic may boost app ratings and user confidence temporarily, however, it ultimately damages the trust when customers realise that the actual delivery time is exceeding the claims.

On the other hand, the platforms which notifies the user with a pop-up reading “delivery personnel will reach 5 minutes late due to traffic” sets realistic expectations and build customer trust for the long-term.

“Dark patterns can spike conversions temporarily. They gradually erode brand perception and customer relationships. When users feel manipulated, it impacts retention and word-of-mouth adversely, which are far more critical for sustained growth,” says Dhanwani.

Taneja believes that sustainable scaling without dark patterns is not only possible, it’s already happening across several digitally native brands. “These companies prioritise clarity in pricing, straightforward user journeys, and transparent communication, resulting in lower churn rates and significantly higher customer lifetime value”.

The most relatable example of businesses growing without using dark patterns is “Zerodha”. The fintech app’s cofounder and CEO, Nithin Kamath has recently criticised the use of manipulative tactics in financial services apps. He even highlighted that Zerodha has consciously avoided these manipulative design practices since its inception.

“One reason Zerodha users trust us with their money is because we have avoided these practices from day one. Doing what’s right for our customers has always been at the heart of our philosophy,” Kamath added.

It’s not an easy game to remove dark patterns and maintain the same momentum of growth. Jena acknowledges the practical challenges start-ups face in balancing quick growth and ethical design but believes the trade-offs are worthwhile.

“Removing manipulative nudges might cause a short-term dip in conversion rates. However, the long-term benefits like loyal customer base, retention rate, brand value, etc., are far more valuable. Growth built on trust is more durable and cost-effective over time,” he notes.

For this, businesses can follow ethical UX practice such as upfront price disclosure, transparent comparisons, contextual transparency, easy opt-out, active opt-in, and more.

Conversion with Conscience: Growth’s Sweep Spot

India’s ecommerce sector saw a massive boom in first-time shoppers over the last few years. These cues helped bridge familiarity gaps, making decision-making easier for those who needed confidence or reassurance to complete a transaction. However, since excess of anything isn’t good, same goes with these offers as well.

These tactics, in some way, have become a default option to advertise the products. And surprisingly, experts believe that advertising effectiveness and transparency must coexist especially in sensitive, high-stakes categories like fintech, gaming, and quick commerce.

“Personalisation is the retention team’s playground. It’s their job to craft smart, relevant nudges that keep the user engaged — not annoyed. Same with CRO: their role is to squeeze every drop of efficiency from the funnel. The key is retention teams should do their jobs but make sure brand love isn’t the collateral damage,” says Jena.

A 2024 Baymard Institute study revealed that eliminating countdown timers and misleading urgency cues led to only a minimal dip in immediate conversions, while repeat purchases soared by 7% over the next six months.

As Taneja further explains how personalisation helps the user by anticipating their needs, recommending genuinely relevant products, or simplifying payment journeys based on past behaviour. For example, surfacing UPI as the default payment method for a user who prefers it is a convenience, not a coercion.

“Another strong trend is the growth of gamified loyalty ecosystems, where brands offer repeat incentives, tiered rewards, and non-monetary perks that deepen engagement over time. Unlike short-term nudges, these models drive higher retention and 2–3x higher LTV (lifetime value) among returning users,” he adds.

In addition, there’s also a renewed focus on content-led commerce. Instead of relying on interface tricks, he highlights that brands are investing in education—through guides, tutorials, and storytelling—which builds trust and drives more confident purchase decisions.

Hence, what’s emerging is a design system rooted in clarity, control, and respect—one that treats the consumer not as a target, but as a collaborator. Since the government has already asked major online platforms to self-audit and eliminate these practices, it would be interesting to see whether India’s top app-based businesses avoid using these patterns or not.