Affordable 5G smartphones from Vivo and Oppo drove an 8% YoY growth in India’s smartphone market in Q2 2025.

The rebound came after a sharp dip in Q1, with new launches boosting shipments.

5G phones made up 87% of the market; models priced ₹8,000–₹10,000 surged over 600% YoY.

Affordable 5G smartphones from Chinese brands like Vivo and Oppo helped India’s smartphone market grow by 8% year-on-year (YoY) in the second quarter of 2025, according to market intelligence firm CyberMedia Research (CMR).

The rebound followed a sharp drop in shipments during Q1 and was driven by a wave of new launches. However, analysts say the full-year 2025 outlook remains moderate, with overall shipments expected to grow only in single digits.

CMR reported that 5G smartphone shipments accounted for 87% of the total market in Q2, reflecting a 20% YoY increase. Notably, 5G smartphones priced between ₹8,000 and ₹10,000 saw over 600% YoY growth.

This recovery comes after a slump in Q1 2025, when India’s smartphone market declined 7% YoY due to shifting consumer preferences and rising competition. However, the premium segment grew during the previous quarter on the back of strong demand for 5G and AI-ready devices—a trend that continued into Q2.

“The ₹10,000–₹13,000 5G smartphone segment witnessed over 138% YoY growth in Q2 2025. This surge was primarily driven by rising demand for value-for-money 5G smartphones among first-time upgraders,” said Menka Kumari, Senior Analyst – Industry Intelligence Group, CyberMedia Research (CMR).

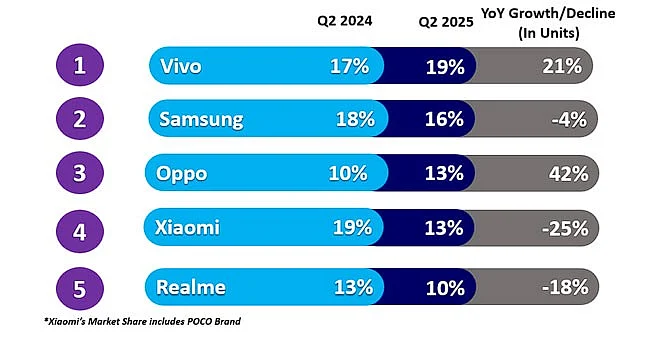

Vivo, Oppo Gain in Q2

Vivo and Oppo, both owned by China’s BBK Electronics Corporation, recorded significant market share gains between April and June. CMR data showed that Vivo retained the top spot with a 19% market share. The Vivo T4X, T4, Y19, and Y39 models accounted for 48% of the brand’s 5G shipments.

Oppo secured third place with a 13% market share, with shipments rising 42% YoY in Q2, led by the Oppo A3X, A5 Pro, and F29 models. The growth was driven by a refreshed portfolio that appealed to both entry-level and mid-premium consumers, CMR noted.

Samsung maintained its second-place position with a 16% overall market share, though this was down by 3 percentage points compared to Q1. CMR reported that Samsung’s "Uber Premium" smartphones saw an impressive 89% YoY increase in shipments in Q2 2025.

Apple, Samsung’s rival in the premium segment, also posted strong double-digit growth, capturing a 7% market share. Demand was driven by the iPhone 16 series, particularly the iPhone 16e.

“In the premium segment (above ₹50,000), Apple’s market share rose 54% YoY,” CMR stated.

OnePlus, Xiaomi Lose Ground

OnePlus recorded a 21% YoY decline in the premium segment (above ₹25,000), amid continued market challenges. The new OnePlus 13 series contributed 17% of total shipments, while the Nord series showed stronger performance, accounting for 83%.

Xiaomi held a 13% market share, but its shipments dropped 25% YoY—the steepest decline among the top five players—due to challenges in both the affordable and value-for-money segments.

“Brands like Xiaomi and Realme helped drive 5G adoption in the value segment through feature-rich smartphones at competitive prices, supported by aggressive online and retail promotions. Meanwhile, the 2G feature phone segment declined 15% YoY, and 4G feature phones dropped sharply by 31%,” said Kumari.

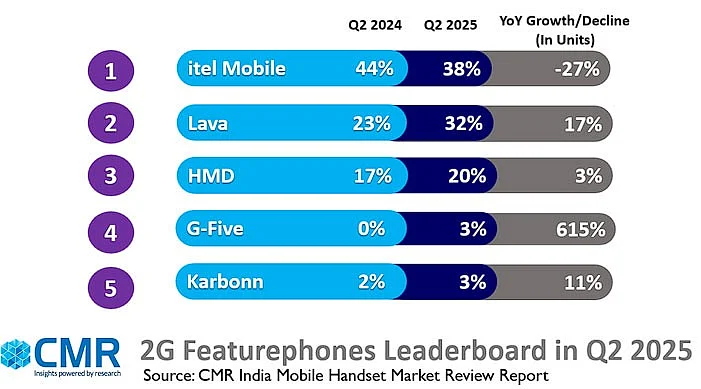

In the 2G feature phone market, Itel led with a 38% share despite a 27% YoY drop. Lava followed with 32%, growing 17% YoY on stable domestic demand, while HMD held a 20% share.

Among other 5G brands, Motorola saw strong 81% YoY growth, marking a comeback driven by focused positioning and wider retail reach. Nothing grew 190% YoY on a small base, led by the CMF Phone 2 Pro, which made up over 37% of its shipments. Transsion Group, which makes TECNO, itel, and Infinix, declined 12% YoY due to weak demand in “Aspirational India” and slow traction in the entry-level 5G segment.

CMR expects India’s smartphone market to grow at a single-digit rate in 2025.

“The second half of the year will be crucial, with new launches aligned with the festive season. Upcoming flagship smartphones are likely to boost consumer interest and accelerate upgrade cycles. While AI-led features are gaining awareness, core smartphone attributes like battery life, camera quality, and performance remain the top priorities for buyers,” said Pankaj Jadli, Analyst – Industry Intelligence Group, CMR.