India’s fab supply chain needs 50–100 local suppliers beyond top equipment players.

Critical gaps: infrastructure, fab-specific talent, packaging, cold storage, and logistics.

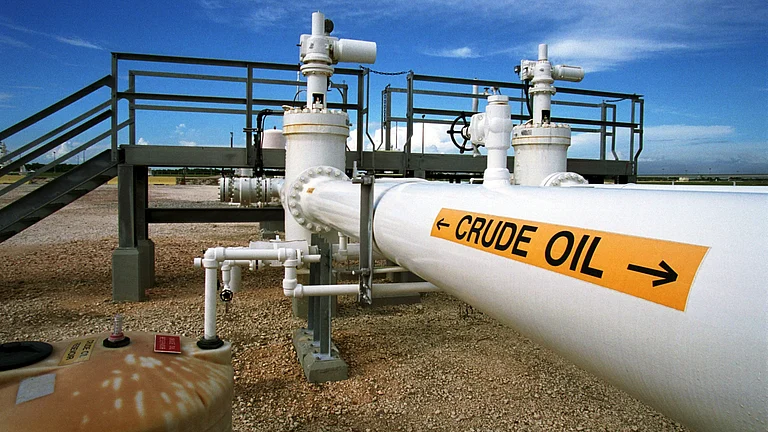

High-end fab gases shortage requires global-local collaborations for rapid solutions.

Suppliers urged to build agility, dual-sourcing and assess tier-1/2 vulnerabilities.

As India makes significant strides in the semiconductor industry, a few challenges remain that need attention as the country aspires to become a global semiconductor powerhouse,” said Srinivas Satya, President, CB and SC, TEPL, during a panel on Fab Supply Chain at Semicon India 2025.

“There are still plenty of challenges in this vertical. These include infrastructure gaps, availability of fab-specific talent, logistics, and the serviceability of precision equipment. These issues are not fully resolved yet, but we’re confident they will be,” he said.

Satya highlighted that India still lacks depth in cost-effective, India-specific fab design capabilities, as well as the highly specialized skill sets required for semiconductor fabs.

“I urge suppliers to take a long-term view. Many more fabs are coming up in the country, and now is the time to invest in local, cost-effective design expertise,” he said.

Touching upon every vertical of the semiconductor ecosystem, Satya said that on the equipment side, it is encouraging to see the presence of several large global players. However, he emphasized that it cannot just be limited to the top 10–12 equipment suppliers, India needs another 50–100 companies across the supply chain.

According to him, high-end, fab-specific gases remain a concern for India’s semiconductor industry. He suggested that collaborations between local companies with strong adjacent expertise and global semiconductor leaders could deliver quick results.

On the logistics front, Satya noted that while significant progress has been made, much still remains to be done.

“Solutions for packaging, cold storage, stocking, and delivery must be tailored to semiconductor requirements, particularly smaller consumption volumes in the early years. This is another area where we’ll need suppliers to collaborate with us closely,” he added.

Satya appreciated the encouraging yet evolving regulatory environment. ‘Whether it’s import duties, environmental norms, or PLI schemes, policies are still in flux. My request to suppliers is to build agility into their operations, stay well-informed and flexible to avoid last-minute disruptions that could prove catastrophic, given the scale of investments involved,’ he said.”

He noted that the semiconductor industry is geopolitically sensitive, and from the outset, risk diversification and dual sourcing must be prioritized.

He urged suppliers to look beyond their primary operations and also assess their tier-1 and tier-2 partners to ensure there are no critical vulnerabilities.

Srinivas Satya, President CB and SC, TEPL, was speaking at a panel during Semicon India 2025, where he was joined by Brian Haas, VP & GM of Semiconductor Equipment at KLA; Mona Khandhar, Principal Secretary, Government of Gujarat; and Haris Osman, Senior Vice President, imec.