No one can deny Ekta Kapoor’s sharp acumen when it comes to spotting or creating content consumption trends in India. She is the brain behind India’s longest running soap operas, Kyunki Saas Bhi Kabhi Bahu Thi, Kasautii Zindagii Kay and Kahani Ghar Ghar Ki. Sure, there was criticism of the content, but the popularity of the saas-bahu saga still provides fodder for discussion almost twenty years later. She was also among the first to rekindle the supernatural genre on Indian television with Naagin. Many followed suit, but few could match her success.

With the same gumption, Kapoor decided to venture into the digital space. Only, this time, she wanted to own the content and the platform — which led to the creation of ALTBalaji. “With ALT, I wanted to create content for the urban mass audience of India and reach out to a large section that had migrated out of television and still craved emotion and entertainment from its content,” says Kapoor, joint managing director, Balaji Telefilms. ALTBalaji is a wholly-owned subsidiary of Balaji Telefilms and was launched in April 2017.

One year since its launch, Kapoor’s bet has proved right again. ALTBalaji has established its might in the highly competitive over-the-top (OTT) streaming industry in India. The app has seen 15 million downloads. The platform has about 150 hours of content and would be adding 100 hours of original programming in the next year. In Q4FY18, revenue of ALTBalaji stood at Rs.37 million vs Rs.11 million in the previous quarter. For FY18 it contributed Rs.68 million to Balaji’s total revenue of Rs.4.16 billion. The FY18 annual report states that ALTBalaji clocked 800 million minutes of video consumption so far with an average watch time of 120 minutes per user. During the Q4FY18 concall, the management stated that ALTBalaji is targeting an FY19 revenue of Rs.900 million.

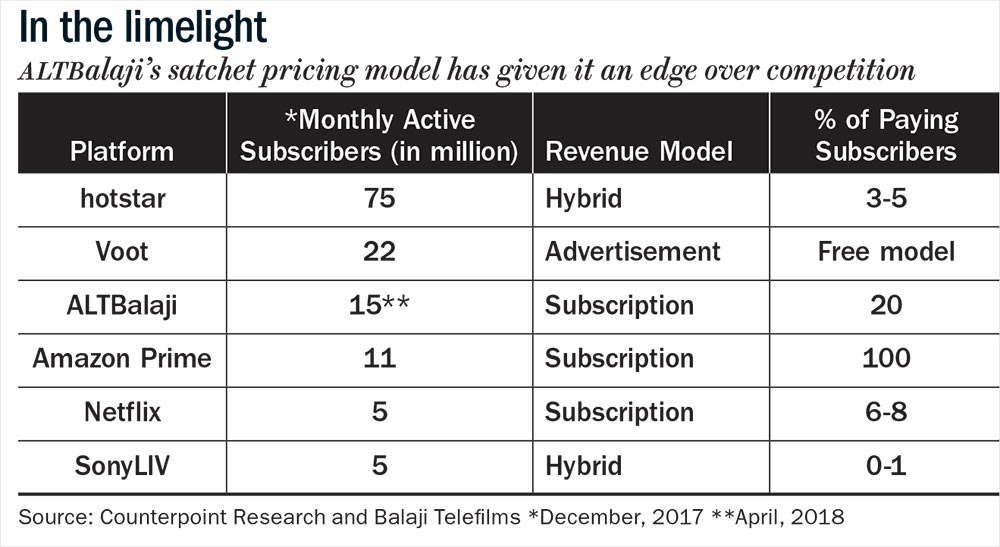

“Being watched globally by over 3 million paying subscribers, we have already broken the notion that India doesn’t pay for content,” says Manav Sethi, chief marketing officer, ALTBalaji (see: In the limelight). 20 original shows, regional stand-up comedy videos and a stellar cast comprising Nimrat Kaur, Rajkumar Rao, Ram Kapoor and Sakshi Tanwar, to name a few, ensured that ALTBalaji got both the quantity and quality right. While it won the Best Platform award at the DIGIXX Awards 2018, Rajkumar Rao won the best actor award and Ekta Kapoor won the Web Person of the Year award. Nagesh Kukunoor, who directed The Test Case, also won the Best Director Award at the Indian Television Academy Awards. “All this has led to the confidence that we can have a subscriber-driven revenue model for OTT platforms in this country. In the next three years and 50 shows, we will have the foundation of a very large and scalable business,” says Nachiket Pantvaidya, CEO, ALTBalaji.

Launch pad

It was in 2015 that the concept of a digital streaming platform was first conceived. “ALT essentially stands for alternate content and consumers,” says Kapoor, when asked the reason behind the name.

Media veteran Sameer Nair, who was then the CEO, Balaji Telefilms, recalls that the plan was to take Balaji — a B2B company — and make it a B2C brand [Nair stepped down from his role in July 2017 and is currently the CEO at Aditya Birla Group’s Applause Entertainment. Sunil Lulla, former chairman and MD of Grey Group India, was appointed the CEO of Balaji Telefilms in May 2018]. “There was a need gap in the audience for premium drama or the world between Naagin and Narcos, and that is what ALTBalaji was targeting. We worked hard at it from 2015 to April 2017, when we launched,” adds Nair.

It wasn’t an easy market that ALTBalaji launched into. From Star India’s hotstar and Viacom18’s Voot, to international competitors like Amazon Prime and Netflix, the streaming war had begun. Additionally, all four had a huge content library to fall back on. In comparison, ALTBalaji had to start building it ground-up.

For a comparatively smaller production house, wasn’t this a Herculean task to take on? Not quite, opines Nair. “In normal cases, a library has great value. But it is different in India because the Indian television network has for the last two decades showcased only daily soap operas. When you talk about a premium drama library, in India it doesn’t exist. So to that extent, ALTBalaji wasn’t disadvantaged,” he says.

It differentiated itself from competitors by relying entirely on original content. Its isn’t a catch-up television model like Voot and hotStar. Nor does it have a sports portfolio like hotstar. Instead, it relies on Balaji’s years of experience as a storyteller on television and simply fits it into more contemporary themes. Pantvaidya uses the metaphor of an Indian thali for its mix of shows and says, “It is all about taking home food and upgrading it to a thali.” This ‘thali’ was launched with six original and four international shows. Today, ALTBalaji has a library of 20 original shows. In contrast, Star India’s hotstar, which launched in February 2015, has about seven original shows, while Viacom18’s Voot, which launched in March 2016, has about 11 original shows. Also, Voot and hotstar both continue to serve acquired international content while ALTBalaji has phased it out.

The budget for each ALTBalaji show is much higher than that for a telly soap episode. “The cost is more because we don’t want to show people ‘sets’. We want to show them real locations. And we want to cast better, both on-screen and off-screen,” says Pantvaidya. He adds that with the budget for 15-20 episodes on ALTBalaji, it’s possible to make around 100 episodes for TV.

Also, while most digital content creators believe that the audience for television and digital is different, Pantvaidya offers a different take. He says that the audience is primarily the same. What changes is what the consumer chooses to watch when he is with family versus when he is watching something alone. Thus, ALTBalaji focuses on creating original content for this individual viewing purpose.

Their content can be categorised into, firstly, tent-pole shows that attract a cinematic audience. Case in point, Bose: Dead/Alive or The Test Case. Secondly, there is an upgraded version of their daily soaps, like Kehne Ko Humsafar Hain and Karle Tu Bhi Mohabbat. Third is the retelling of classics with a modern twist. For instance Romil and Jugal, a gay love story, is a spin-off of Shakespeare’s Romeo and Juliet. Similarly Dev DD is the classic Devdas re-told from a woman’s perspective. “In the last three to four months, we are getting onto a new genre, horror, with shows like Ragini MMS. There is also Gandi Baat, which is about stories of physical intimacy in rural India,” adds Pantvaidya. So while the parent company continues to churn out hits for television, ALTBalaji wants to be perceived as a cool and progressive offering.

“I have always said that the digital platform is an interesting medium for storytelling. It gives me the liberty to create the kind of content I want,” says Kapoor. Nair points out that creating 20 shows in a year is remarkable, and credits Ekta for being the greatest storyteller. “Ekta has a truckload of ideas herself. Most of the stuff you see on ALT is in large part ideas developed by her, which then get executed by others,” he says.

The pricing is also unique for ALTBalaji. While most competitors opt for a premium, subscription or fully ad-based model, ALTBalaji has adopted the satchet pricing model. In simple words, a user can sample the first few episodes by registering himself, and if he likes the content, then he can pay to watch the rest of it. The pricing therefore is much lower compared to Rs.500 per month for Netflix and Rs.999 per year for Amazon Prime. Further, ALTBalaji can be streamed simultaneously on five devices and provides entertainment for the entire family at the cost of a single subscription.

Ashish Pherwani, partner, media & entertainment, EY, says, “We believe that the future of digital subscription is going to be micro payments. People will be willing to pay Rs.5 or Rs.10 to watch a piece of content at their convenience. Balaji’s model is close to that.” Another observation by Pherwani is that the future for 90% of the content will be non-exclusive. Something ALTBalaji has already realised.

“The app is a myth. It is a platform that we need to integrate. But when you have a library of 10, and you say my app is the hero, it is going to cost you a pretty penny to convince the consumers to come on,” says Pantvaidya, adding that perhaps when the company has a library of over 100 shows is when they can think of exclusivity.

Accordingly, in the past year, ALTBalaji has inked partnerships with a diverse set of players from Ola to Airtel to Jio. It has, thus, made its content widely available. Last year, Reliance Industries acquired a 24.92% stake in Balaji Telefilms for Rs.4.13 billion, as a result of which ALTBalaji’s content is also available to Jio users.

These partnerships are struck not just in distribution, but also in creation. “This is the first time that we are commissioning people from outside to make stories for us. Only 30% of content is made by ALTBalaji, the rest is produced by content producers like Big Synergy and SOL Productions. That is teaching us to create instead of manufacture and scale up our creative processes,” explains Pantvaidya.

In FY19, ALTBalaji would be spending close to Rs.1.15 billion in creating 24 original shows that would constitute about 100 hours of original content. The shows would have about 12-16 episodes, averaging 22 minutes each.

Narrowcasting

Scaling up, of course, comes with its own challenge. One is to resist the urge to go in for big splash advertising. Sethi says that the team ensures that 80% of their total marketing budget is spent on digital and not traditional media. Another is to develop a production ecosystem, which is the opposite of the television market where people want to produce at least 250 episodes. “Ekta and the team have worked hard to create an ecosystem where people are willing to produce just 10 episodes,” says Pantvaidya.

Pherwani points out other challenges that still exist for the OTT industry in India. The payments ecosystem has to grow, high-quality broadband penetration has to proliferate and the network has to be strengthened to support large volume video consumption in the future. He, however, reiterates that the future is very bright for the OTT industry, which has as many as 30 players in India.

“There will be huge volume growth. Today there are 250 million mobile video customers and only 3% of all OTT customers pay. We expect that by 2020 it will become 500 million, and 3% will become 9%, so we are talking about a 6x growth in terms of subscription revenue,” says Pherwani. Then, by 2020, India is expected to become the second largest online video viewing market globally, according to a FICCI-EY report 2018 titled Re-imagining India’s M&E sector.

This growth is likely to be pan-India and not just in the Hindi speaking markets. There is already an international player, YuppTV, which offers internet television service in over six regional languages in India. Kolkata-based Shree Venkatesh Films (SVF) launched an OTT platform called Hoichoi as has Sun TV with Sun NXT. Identifying the opportunity, ALTBalaji too launched a Bengali and a Tamil show on their app. “Unlike TV channels, regional content is not geography specific on apps. Our focus on regional will be stepped up in the second year,” says Pantvaidya.

Partho Dasgupta, CEO, BARC India states, “While there is a lot of activity in the OTT space, we will get a precise measure of OTT viewership once we launch EKAM — our third party digital viewership product.” He adds that like in mature global markets, OTT will co-exist and thrive along with TV and in the long run, the lines between pipes and screens will blur.

Having laid the ground-work in terms of content, distribution and monetisation, Pantvaidya says that the goal is now to be the preferred mass internet platform and to breakeven in 36-48 months. This translates to average revenue per user (ARPU) of Rs.20 from 8 million users and a topline of Rs.1.92 billion, which he expects to hit by FY20.

He adds that the last three to four months have been spectacular in terms of growth in viewership, and he expects the growth momentum to be retained thanks to a fresh line-up of shows that ALTBalaji will be launching in the coming months.

“The current focus is binge-worthy content, which comes back season after season. But gradually we might explore original films as a format too; after all, content eventually finds its medium and flourishes if it manages to connect to its audience,” says Kapoor.