Since the New York-based “activist short-seller” Hindenburg Research targeted the Adani group in January, billionaire Gautam Adani’s family group has unleashed an extensive plan to reclaim the lost glory of his brand. Hindenburg’s allegations of fraud, stock price manipulation and use of tax havens by the group companies led to a massive sell-off of their shares. From giving a 413-page reply to Hindenburg’s allegations to pre-paying liabilities of around $2.1 billion, the Adani group is redefining its priorities for the coming years to win investor confidence again.

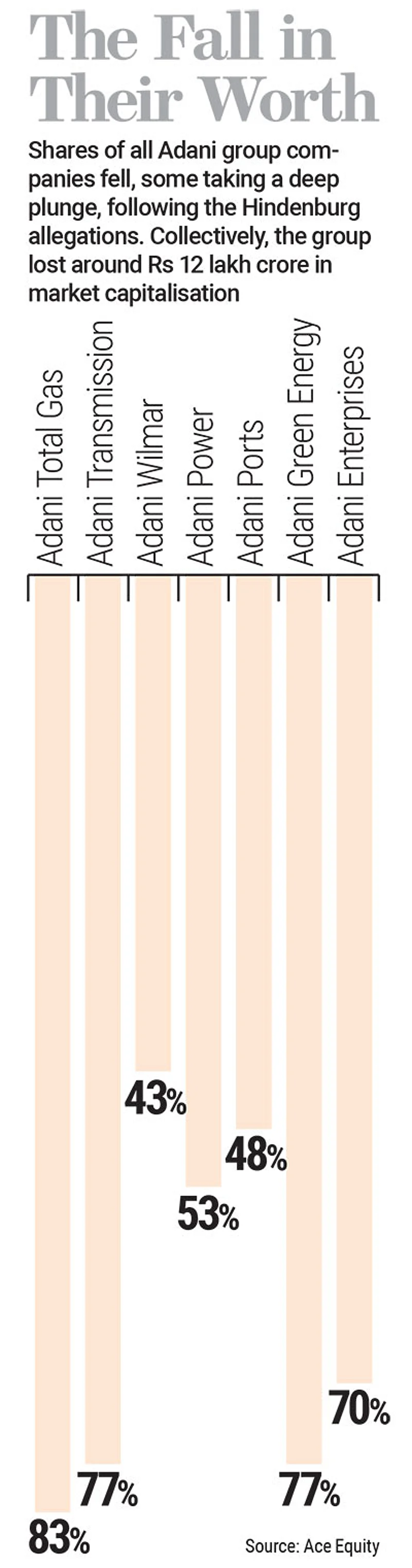

According to estimates, following the Hindenburg allegations, the Adani group lost around Rs 12 lakh crore in market capitalisation collectively before recovering to an extent, with its group companies losing their worth in a varied pattern. For example, Adani Total Gas crashed by 83%, Adani Transmission fell 75%, Adani Wilmar tumbled 27%, Adani Power dropped 41%, Adani Ports declined 19%, Adani Green Energy plunged 77% and Adani Enterprises declined 53%. The shares of the group’s recently acquired cement companies ACC and Ambuja Cements and media firm NDTV also fell by over 20%.

There is concern among industry watchers that with a group as diverse as this, the Adanis may be forced not just to limit their ambition about inviting new investors to the fold but also to rationalise their sectoral offerings as global rating agencies and funds take a cautious approach towards its companies. Given that the rise of the Adani group runs parallel to the consolidation of power in the hands of Prime Minister Narendra Modi, will Gautam Adani take cues from where his friend wants to take the economy or will he go by business decisions made purely on market sentiments? In the times of crisis, the hedging of Adani’s bets can either be a political or business decision, and both are fraught with dangers.

Global Discomfort, Indian Response

The rout in the Adani group’s firms led to ratings downgrades, their removal from international sustainability indices and the Norway government’s sovereign fund Norges Bank Investment Management exiting its entire position to Adani Green Energy, thereby raising aspersions on the company’s ability to raise funds from international capital markets.

Last month, credit-rating agency Moody’s downgraded ratings outlook for some of the group’s companies, while American index MSCI said that it would cut the weightings of some in its stock indices. It announced that it would reduce the free float designations for four Adani group companies in multiple indices. These companies had a combined 0.4% weighting in the MSCI Emerging Markets Index as of January 30. Apart from Adani Enterprises, the MSCI cut the free floats assigned to Adani Total Gas, Adani Transmission and ACC.

TotalEnergies of France put on hold its plan to take 25% equity in the $50 billion green hydrogen project of Adani New Industries, which it had announced last year, as it awaited results of an audit following Hindenburg allegations.

If there is a giveaway on how Gautam Adani will attempt to recover his group’s brand image and re-calibrate his businesses, it lies in the voluminous reply his group issued in response to the Hindenburg charges. It was full of nationalist bluster that seemed more political in nature and targeted at a domestic audience, which businesses tend to stay clear of, especially the ones which need to keep borrowing from global investors.

For the global community, its strategy includes early loan repayment to the tune of $2.1 billion, getting favourable funds to invest in group companies—it raised $1.87 billion investment from Rajiv Jain’s US-based fund GQG Partners—and other investor outreach campaigns. News agency Reuters claims that the Adani group has plans to hold road shows for investors in London, Dubai and many US cities.

Green as Counter-Strategy

Though there is no official word from the group on restructuring of capex plans, the media widely reported in the aftermath of the Hindenburg expose and Adani Enterprises Ltd pulling its follow-on public offer (FPO) of Rs 20,000 crore that the group put on hold its aggressive schemes of further investment. Business Standard reported that Adani Green Energy Ltd put under review capex plans for as much as Rs 10,000 crore for 2022–23. The Press Trust of India reported that the Hindenburg revelations led to the Adani group withholding work on its Rs 34,900 crore petrochemical project in Mundra in Gujarat.

The Adani group always made big plans. Its green business was no exception to this rule and assumed significance since it correlated its ambition to meet the tough goals set by the Modi government for a net-zero future for the economy. In 2021–22, Adani outlined that the company would invest $70 billion in green transition which would lead to creation of solar and wind power plants and setting up giga factories to produce hydrogen among other green initiatives.

In July last year, Adani told his shareholders, “The best recent evidence for our confidence and belief in the future has been the $70 billion investment we announced in facilitating India’s ‘green’ transition. We are already one of the world’s largest developers of solar power. Our strength in renewables will empower us enormously in our effort to make ‘green’ hydrogen, the fuel of the future.”

Adani Green Energy holds India’s biggest renewable energy portfolio and had aims to construct 10% of the country’s targeted renewable energy capacity by 2030. The company had set a target of achieving a capacity of 45 gigawatts of renewable energy by 2030, the same year India plans to have 500 gigawatts of non-fossil fuel energy capacity. It already has the largest single-destination solar-power parks in Gujarat, Rajasthan and Karnataka.

Deven Choksey of KRChoksey, a portfolio management service provider, says that the Hindenburg report is unlikely to have any meaningful impact on the group’s green energy goals. “I do not think that the Hindenburg report is going to come in the way of the Adani group’s green energy goals. At the most, it may affect the pace at which the group raises capital for its green projects. I think as against borrowed money, it will look to bring money through equity. Generally, in infrastructure business, the equity approach is more prudent once the assets are built,” he says, adding that Adani Green Energy is not likely to abort the journey it has committed to undertake.

If push comes to shove, the Adani group can delve into its deep cash pockets. Choksey feels that the cash-rich Adani group of companies is capable of meeting any expansion challenge or hold on to present commitments. “The Adani group has Rs 54,000 crore EBITDA, or operating profit, in the current year, and it is compounding at the rate of 20% annually. In four years’ time, Rs 54,000 crore will become Rs 1 lakh crore. There is a cash generation ability at the group level. I do not think that there is a challenge on this front as money is available. The Adani group was moving fast with its expansion plans. Now, it will have to go ahead in a calibrated manner,” he says, adding that the projects which were to be completed in two years will now happen in three or three-and-a-half years.

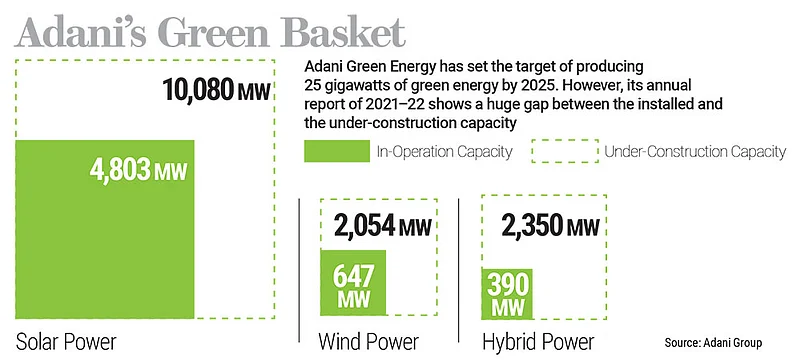

Ravi Singhal, CEO of brokerage firm GCL, however, feels that the Adani group’s green strategy is not shaping up well. “It will be impossible for Adani Green Energy to achieve the target of producing 25 gigawatts of green energy by 2025 because it does not have money and the company is selling shares to service the debt rather than doing it through internal cash accruals,” he says.

Adani Green Energy declared in its 2021–22 annual report that it has 4,803 megawatts of solar power generation capacity in operation and another 10,080 megawatts under construction. Its wind power generation capacity currently stands at 647 megwatts, with another 2,054 megawatts under construction. The company also has hybrid power, mix of solar and wind, generation capacity of 390 megawatts under operation and 2,350 megawatts under construction. Last month, its 700 megawatts wind-solar hybrid plant became fully operational at Jaisalmer, Rajasthan. Its new hybrid power plant consists of a combination of 600 megawatts solar and 510 megawatts wind plants. Adani Green Energy also added a significant portfolio of renewable energy by way of acquiring SB Energy for $3.5 billion in 2021, which had a total portfolio of 5 gigawatts.

Since there is a large gap between the company’s installed capacity and capacity under construction, there will be pressure on the group to finish the projects on time, for which its capacity to impress international funds and other financial bodies becomes important post-Hindenburg expose. “The Adani group has taken a lot of loans from outside India, and the rising interest scenario and an appreciating dollar are making it difficult for the group to service debt,” says Singhal. “Meanwhile, to come clear, Adani Green Energy should share its growth plans publicly, as investments in stocks depend on the future earnings of the company where earlier growth plans stand redundant,” he adds.

A Green Problem

While Gautam Adani wants to be seen as Modi’s co-passenger in India’s journey towards the net-zero target, he cannot ignore the group’s interest in legacy fuels either. His reliance on fossil fuel continues to be high and, in the times when the international opinion is moving in favour of an environmental, social and governance (ESG) regime for businesses, the Adani group faces flak from ESG-aware global funds. Norway-based pension fund KLP sold its entire shareholding in Adani Green Energy after it was found that the Adani group pledged its green stocks as collateral for loans via Adani Enterprises that would eventually finance the Carmichael coal mine in Australia. KLP proactively refuses investments in coal-related businesses in its portfolio.

In 2021, it withdrew from Adani Ports and Special Economic Zone Limited because the company was developing a port in Myanmar on land leased from the country’s military. “Adani’s operations in Myanmar and its business partnership with that country’s armed forces constitutes an unacceptable risk of contributing to the violation of KLP’s guidelines for responsible investment,” KLP told Reuters. Despite dumping Adani Green Energy, KLP continues to stay invested in India, along with Norway’s Climate Investment Fund, in solar power project being developed by Italy’s Enel Green Power in Rajasthan and a transmission project being managed by ReNew Power in Karnataka.

While the Hindenburg revelations mostly deal with the governance issues in the Adani group companies, its bracketing with environmental concerns in an ESG regime and global funds’ reluctance to back a green company whose group siblings are involved in the generation of fossil-based power has hit Adani Green Energy hard. Bloomberg has reported that after the Hindenburg expose hit the Adani group, the number of European ESG funds which are invested directly or through other funds in the group companies has dropped to 480 in the first week of March from 500 in mid-February.

The slow exits of ESG funds from the Adani group companies, Bloomberg notes, could be on account of only 18% of these funds having a direct stake in these companies. However, market expert Avinash Gorakshakar cautions against reading much into the exit of European ESG funds. He says, “US-based Rajeev Jain of GQG Partners investing Rs 15,000 crore in the Adani group shows that there are a lot of funds waiting on the sidelines for clarity to emerge on the group, but, at this juncture, they will not take a contrarian investment bet on Adani and instead wait and watch. Foreign investors are sitting on cash, and investors should not read too much into one ESG fund exiting Adani Green.”

The Short and Long of Adani’s Green Businesses

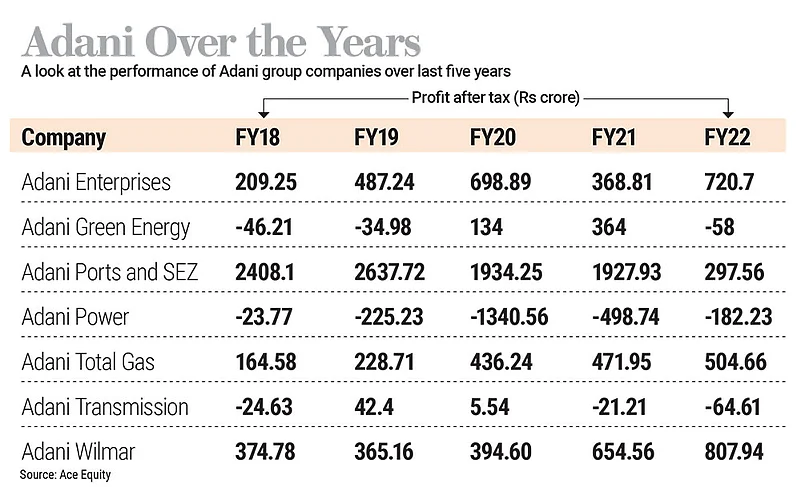

The Adani group earns a sizeable chunk of its revenue from its flagship company Adani Enterprises, which operates coal, infrastructure and airports businesses. It posted net sales of Rs 69,420 crore last financial year, while Adani Green Energy clocked net sales of Rs 5,133 crore during the same time frame, data from market research firm Ace Equities shows.

Recently acquired cement units ACC and Ambuja Cements had net sales of Rs 16,152 crore and Rs 28,965 crore respectively, while its power business Adani Power clocked net sales of Rs 27,711 crore, Adani Ports posted sales of Rs 15,934 crore, Adani Wilmar had sales of Rs 54,213 crore and Adani Total Gas recorded sales of Rs 3,037 crore.

Gautam Adani wanted to up the green energy game within the group portfolio to match it with the Modi government’s goals. But now his plans for $70 billion investment are susceptible to global perceptions about his business.

With clouds hanging over investment in Adani’s green energy space, Gorakshakar says that the Adani group will spend money on capital expenditure on green projects in a controlled way in the next financial year and go aggressive after the Lok Sabha election concludes in May 2024. Market watchers expect Modi to return as prime minister, and that will be music to Adani’s ears. “Green energy requires a lot of investment. In the near term, till elections get over the next year, the Adani group will not get fresh equity investment from big financial institutions. All these projects require incremental debt. If these projects do not get loans, the projects may not materialise. Once the Bharatiya Janata Party comes back to power next year, the company will again start with its expansion plans,” feels Gorakshakar.

Before Adani Enterprises scrapped its FPO, it had hoped to utilise the money to be raised through it for funding capital expenditure requirements of some projects of the green hydrogen ecosystem apart from improvement works of certain existing airport facilities, construction of a greenfield expressway and repayment of debt. With the FPO gone and the group facing ESG concerns, Gautam Adani’s green businesses cannot immediately take pole position in the group portfolio. And, if he indeed needs to wait out the remaining term of the Modi government for giving an aggressive push to his green ambition, as Gorakshakar suggests, the Friend Adani and the Businessman Adani will be a fretful combo for a year.