ValleyNXT launched the ₹400 crore Bharat Breakthrough Fund–I to support early-stage start-ups

The MIB Framework combines mentorship, investment, and business connects to bridge funding gaps

Target sectors include deep-tech, space, defense, robotics, AI, and cybersecurity

ValleyNXT Ventures on Monday launched a SEBI-registered Category I venture capital fund, Bharat Breakthrough Fund–I, in New Delhi. The target corpus of the fund is ₹200 crore along with a greenshoe option of another ₹200 crore, taking the total planned size to ₹400 crore.

The fund aims to address the early-stage start-up “Valley of Death”, the critical phase between validation and scale where start-ups often fail due to fragmented guidance, premature scaling and lack of execution clarity. Bharat Breakthrough Fund–I will adopt a combined VC and accelerator approach based on ValleyNXT’s MIB Framework, Mentorship, Investment and Business Connects, to provide structured support alongside capital.

Event Highlights

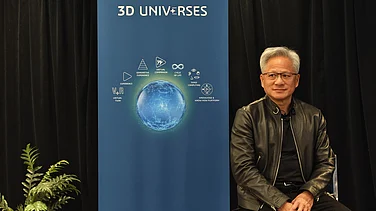

The event began with an address on the “Vision C Philosophy of Bharat Breakthrough Fund” delivered by Nikhil Agarwal, Founder and Advisor at ValleyNXT Ventures. Agarwal said venture alpha is most concentrated at the seed and pre-Series A stages, where start-ups remain highly shapeable and structured mentorship can significantly improve outcomes.

Key highlights of the launch included a series of engaging panel discussions titled “Bridging the Valley of Death,” “How MIB Framework Compounds start-up Growth,” and “Acceleration as a Force Multiplier in Early-Stage Investing.”

Noted speakers Anand Saklecha, SP Singh, Nipun Agarwal, Sandeep Aggarwal, and Ish Babbar shared practical insights on early-stage scaling challenges, investor readiness, and the importance of disciplined execution before capital deployment.

Investment Sectors

The fund will invest in deep-tech and technology-first start-ups across sectors such as space, defence tech, robotics, AI/ML, cybersecurity, biotech, sustainability and consumer innovation. The event also featured panel discussions on bridging early-stage funding gaps and the role of acceleration in scaling start-ups, with speakers emphasising disciplined execution, mentorship and strategic capital access.

While moderating Dr. Madhu Vasepalli, Dr. Apurva Chamaria, and Mr. Suresh Goyal emphasized on how structured mentorship, strategic capital access, and strong business networks can compress years of start-up growth into months.

ValleyNXT Ventures said the new fund builds on its existing track record of evaluating over 5,000 start-ups and investing in more than 10 ventures through its angel network and accelerator-led investment model, as it seeks to strengthen India’s early-stage innovation ecosystem.