Epsilon to build 30,000-tonne synthetic graphite plant in India by 2026.

China’s export restrictions push India to diversify battery material supply chains.

Shift from NMC to LFP batteries gaining momentum globally and in India.

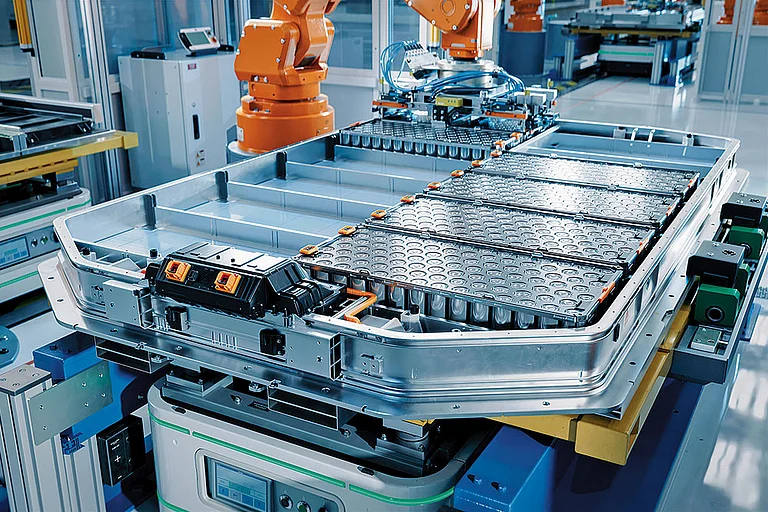

Epsilon Advanced Materials, a Mumbai-based battery material manufacturer, is building a ₹4,000 Cr synthetic graphite anode plant in India in its first phase, producing materials for lithium iron phosphate (LFP) and nickel manganese cobalt (NMC) batteries used in the automobile industry.

Scheduled to start in March next year, the plant is expected to produce 30,000 tonnes of synthetic graphite every year.

Why This Move Matters

The move comes at a time when China imposed restrictions on battery materials to limit the export of certain technologies, machinery and materials essential for making lithium-ion batteries, especially synthetic graphite—a component used in EV battery anodes.

Epsilon is helping to reduce dependence on China by working with suppliers from India and Japan, even though it’s more expensive and slower.

Vikram Handa, Managing Director of Epsilon told Business Standard that India doesn’t yet have government incentives or subsidies for manufacturing battery material, which makes competing with China’s low prices tough.

In addition, Handa warned Business Standard that India’s battery and lithium refinery projects could face problems due to China’s new rules, as companies can’t buy the technology or machines easily anymore.

Citing the example of China which has achieved 50% transition to electric vehicles on LFP, Business Standard reported that the battery technology is shifting from NMC to LFP batteries not just in India but at a global level.

Strategic Supply Shift

Epsilon’s move gains urgency amid China’s new export controls on batteries, graphite, and related machinery, according to a report by Mercom India.

India’s plan could reduce global reliance on Chinese supply chains and strengthen its position in EV battery materials.

China introduced export curbs on synthetic graphite and related technologies, citing “national security and environmental reasons”, starting in 2023 and expanded till 2025.

This means that companies outside China now need governmental approval to buy certain battery-making technologies and machines from Chinese firms. This affects exports of synthetic graphite and its production equipment, lithium extraction and refining technology, and processes for making cathode and anode material.

China currently accounts for a significant portion of the manufacturing of battery materials and more than 90% of the world's production of synthetic graphite. Other nations, such as the US, Japan, and India, find it more difficult and expensive to source materials or establish local production as a result of these export restrictions.